Difference in Opening Balances in Tally - Easily Remove with Simple Steps

Summary

TLDRThe video script discusses the common issue of discrepancies in the opening balance of a balance sheet. The researcher explains that these differences arise from an imbalance in the sheet, often due to incorrect entries in the opening balance sheet. The video provides a step-by-step guide on how to identify and correct these errors, emphasizing the importance of accurate accounting practices. It also touches on the basics of accounting, such as ensuring that the asset and liability sides of the balance sheet always match, and offers advice on handling opening stock in tallying systems.

Takeaways

- 📜 The video discusses the concept of opening balance and differences that may arise in the balance sheet, which can be confusing for those not familiar with accounting.

- 🔍 To understand the differences in the balance sheet, one must examine the opening balance and the entries made therein, as discrepancies often stem from incorrect entries.

- 🧐 The difference in the balance sheet usually indicates an imbalance, either on the liability side or the asset side, suggesting that not all balances were entered correctly.

- 📊 The opening balance sheet can be viewed in accounting software like Tally by selecting the period at the start of the financial year, which shows the balance for just that day.

- 🤔 A common mistake is entering incorrect opening balances for accounts, which leads to differences in the balance sheet. It's important to verify each ledger account to ensure accuracy.

- 💻 The video provides an example of altering the opening balance of a capital account and how it affects the overall balance, illustrating how changes in ledgers can create differences.

- 📝 It is emphasized that the balance sheet must always balance, with the total of the debit (asset) side matching the credit (liability) side for the financial records to be considered accurate.

- 🛠️ To resolve differences in the balance sheet, one should review and correct the entries in each account, ensuring that they reflect the true financial position.

- 📈 The video also addresses the common error of entering closing stock in Tally when only opening stock should be entered for the balance sheet to be correctly calculated.

- 🎓 Understanding basic accounting principles is fundamental to using accounting software effectively, as the software is merely a digital format for accounting practices.

- 👍 The video encourages viewers to subscribe to the Tally School channel for more educational content and offers to answer any questions or suggestions posted in the comments section.

Q & A

What is the main topic discussed in the video?

-The main topic discussed in the video is the opening balance and the differences that may arise in the balance sheet, and how to address these differences.

Why do people often have differences in their balance sheets?

-People often have differences in their balance sheets because there may be an imbalance, or the balance sheet has not been entered correctly, leading to discrepancies on either the liability or asset side.

How can one view the opening balance sheet in Tally?

-To view the opening balance sheet in Tally, you need to go to 'Period' and select the first day of the financial year, which will show the balance sheet for that exact day, representing the opening balances.

What is a common mistake people make while entering the opening balance in Tally?

-A common mistake people make is entering the closing stock instead of the opening stock. In Tally, only the opening stock needs to be entered, as the software automatically calculates the closing stock from the remaining unsold items.

What should the balance sheet always reflect?

-The balance sheet should always reflect a balance, with the total of the liability side (credit) matching the total of the asset side (debit). If there is a difference, it indicates an error in the entries.

How can one correct the differences in the opening balances?

-To correct differences in the opening balances, one should go through each ledger account, check the amounts, and alter them if necessary to match the intended values. This involves identifying any incorrectly entered amounts and making the appropriate corrections.

What is the importance of understanding basic accounting concepts when using Tally?

-Understanding basic accounting concepts is crucial when using Tally because it is essentially accounting in a digital format. Knowing these concepts helps in correctly entering data and avoiding discrepancies in the balance sheet.

How does the speaker demonstrate the creation of a balanced sheet?

-The speaker demonstrates the creation of a balanced sheet by explaining that for every investment made (e.g., cash or fixed assets like computers), the capital account (liability side) should be increased accordingly, and the asset side should reflect the corresponding assets.

What should one do if they still encounter differences in the balance sheet after correcting the ledgers?

-If differences still persist after correcting the ledgers, one should thoroughly check if all capital accounts have been entered correctly, as遗漏资本账户 is a common cause of such discrepancies.

What is the speaker's advice for viewers who want to learn Tally effectively?

-The speaker advises viewers to have a good understanding of basic accounting principles, as this knowledge will greatly facilitate the learning process of Tally, which is essentially a digital format of accounting.

How does the speaker engage with the audience for feedback and suggestions?

-The speaker encourages the audience to subscribe to the Tally School channel, ask questions, make suggestions, and even express gratitude in the comments section, promising to respond to each and every one of them.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The BALANCE SHEET for BEGINNERS (Full Example)

PART 8 PEMBUATAN APLIKASI EXCEL AKUNTANSI 2023 | NERACA - POSISI KEUANGAN

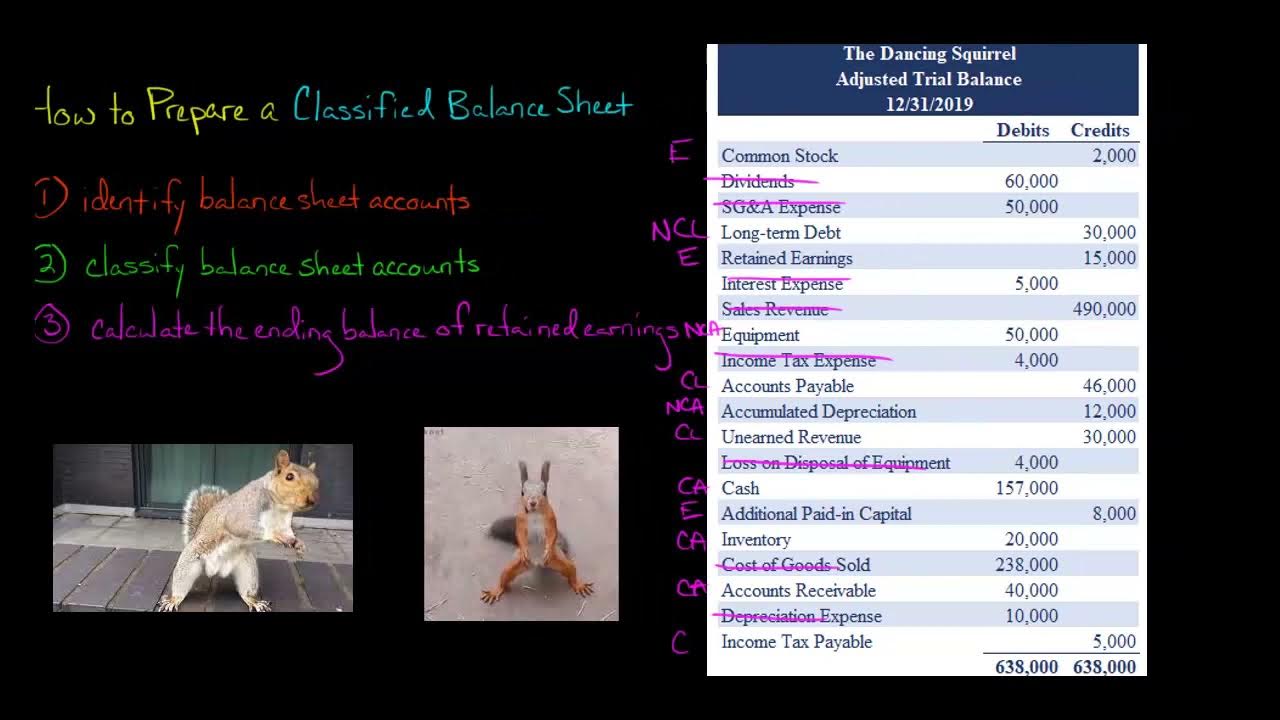

How to Prepare a Classified Balance Sheet

The KEY to Understanding Financial Statements

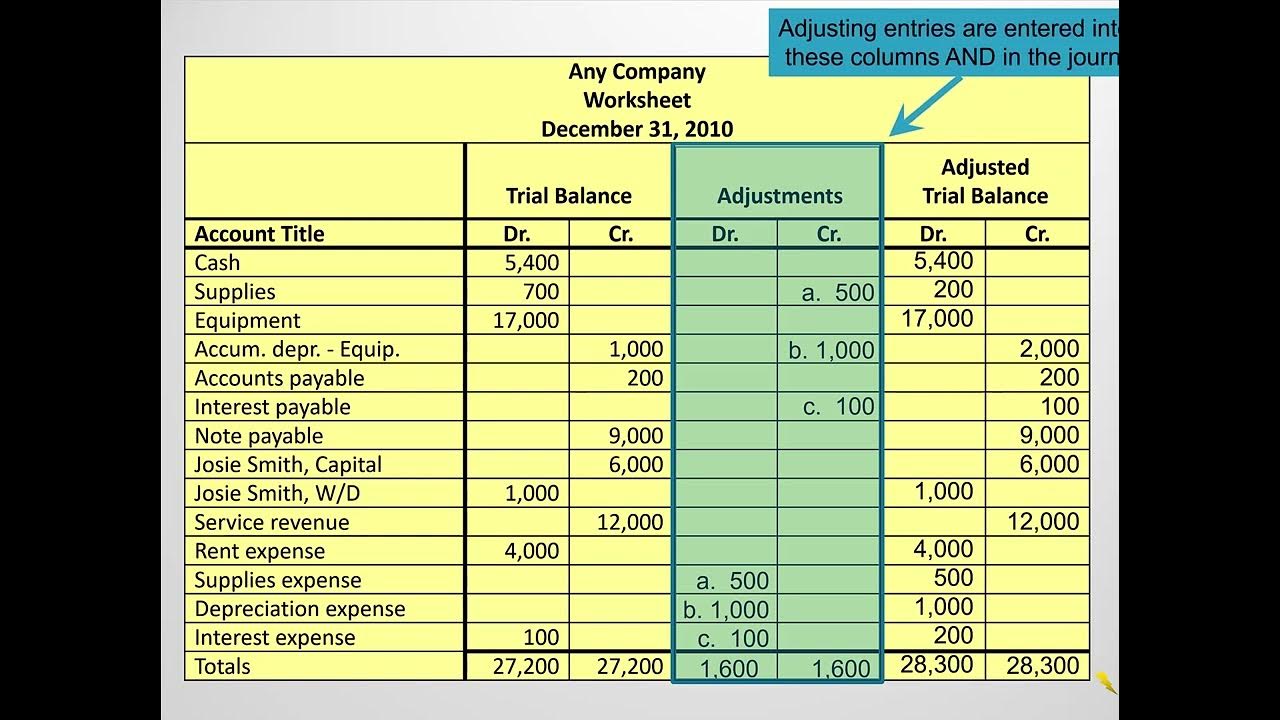

What is the Adjusted Trial Balance and How is it Created?

Financial Analysis: A Guided Tour through the Balance Sheet

5.0 / 5 (0 votes)