Q1FY26 Result Analysis: Where is the buying opportunity? Sahil Bhadviya SEBI Research Analyst

Summary

TLDRIn this video, the host highlights standout performers from Q1 of FY26 across various sectors, including power, pharma, IT, recycling, and more. Despite market volatility, companies like Trans Rail Lighting, Army Organics, Netweb, and others have posted exceptional results, surpassing expectations and giving strong future guidance. The video discusses each company's business model, growth potential, and market positioning, providing insights into their investment opportunities. It emphasizes the importance of close market monitoring for long-term success, while also encouraging viewers to stay informed and selective when considering investments.

Takeaways

- 😀 Companies delivering strong Q1 FY26 results despite market volatility and uncertainty.

- 😀 Trans Rail Lighting from the Indian power sector showed an impressive 81% YoY revenue jump and a 105% rise in net profits.

- 😀 Army Organics (now Chemical) has seen strong growth with 17% revenue increase, 72% EBITDA rise, and a 215% jump in PAT.

- 😀 Netweb Technologies, a leader in high-performance computing and AI solutions, grew its revenue by 102%, with a 127% increase in EBITDA.

- 😀 Pondi Oxide, specializing in recycling lead, zinc, and non-ferrous metals, saw a 36% revenue growth and 83% EBITDA jump.

- 😀 IT companies like CoForge and Persistent Systems are seeing strong demand in digital services, particularly in BFSI, healthcare, and transportation.

- 😀 Affordable housing finance companies, Home First Finance and India Shelter, are growing rapidly, with Home First's AUM growing at 28.6% and India Shelter's at 34%.

- 😀 Radico Khaitan is benefiting from the growing demand for premium whiskey in India, with strong revenue and profit growth.

- 😀 Loris Labs has bounced back strongly from a previous slump, with 31% revenue growth and a remarkable 1,192% PAT growth.

- 😀 Indian electronics sector companies like Dixon, Case, Ember, and Avalon are showing substantial growth, driven by demand and reduced dependence on China.

- 😀 The cables and wire sector, led by Polycap and KEI, is benefiting from India's investment in power transmission and renewable energy projects.

Q & A

What factors are driving the strong performance of Trans Rail Lighting?

-Trans Rail Lighting's performance is driven by its significant involvement in power transmission and distribution, railway electrification, and EPC projects. Additionally, India's push for power transmission infrastructure is benefiting Trans Rail, which has led to an 81% revenue growth and a 105% increase in net profits. The company also expects a 20-25% growth in topline for the upcoming quarters.

Why is Army Organics (now known as Kami Organics) seeing such impressive growth?

-Army Organics (Kami Organics) has seen a massive 215% growth in profit after tax (PAT) thanks to its strong presence in regulated markets like the US and Europe. The company manufactures key pharma intermediates and advanced chemicals used in APIs. The management is optimistic about a 25% topline growth, with the added boost of a joint venture in South Korea for semiconductor chemicals.

What is the key to Netweb's exceptional growth in the AI and computing sector?

-Netweb's revenue growth of 102% and a 127% jump in EBITDA highlight the company's successful positioning in the high-performance computing and AI solutions space. As a major player in designing and manufacturing supercomputing systems and private cloud setups, Netweb’s expansion into AI infrastructure and computing technology has driven its growth, with the management projecting a 35-40% CAGR in revenue.

How does Pondi Oxide stand out in the recycling sector?

-Pondi Oxide's 36% revenue growth and 83% EBITDA increase highlight its success in recycling lead, zinc, and other non-ferrous metals, especially from industrial scrap and waste batteries. These metals are used in key sectors like electric vehicles and chemicals. The growing focus on sustainability and import substitution in India is working in Pondi Oxide's favor, providing strong tailwinds for its business.

Why are companies like CoForge and Persistent Systems poised for long-term success?

-Both CoForge and Persistent Systems have demonstrated strong growth in digital services, focusing on key sectors like BFSI, healthcare, and cloud-based solutions. CoForge's 56% revenue growth and Persistent's 22% revenue growth are indicative of their robust market positioning. Both companies are expanding their digital transformation capabilities and investing in AI, which positions them well for long-term growth, despite some short-term challenges in the IT sector.

What makes the affordable housing finance sector attractive for investors?

-The affordable housing finance sector, represented by companies like Home First Finance and India Shelter, is benefiting from India's growing urbanization and underpenetration of housing finance. Both companies have strong AUM (assets under management) growth, with Home First Finance projecting 25% AUM growth in the coming years and India Shelter targeting 30-35% growth until 2030. However, asset quality needs to be closely monitored to ensure sustained growth.

What drives Radico Khaitan’s strong performance in the alcohol sector?

-Radico Khaitan's exceptional growth, driven by its flagship brand Rampur Indian Single Malt Whiskey and its strong presence in the whiskey sector, highlights the company's strategic focus on premium spirits. The company’s strong distribution network, rural penetration, and expanding global presence contribute to its growth, with demand for whiskey in India continuing to rise. Radico's focus on its own manufacturing plant ensures better margins and quality control.

What were the key reasons behind Loris Lab's massive turnaround in performance?

-Loris Lab's incredible 1,192% PAT growth came after a challenging period of heavy capex investments, which were expected to pay off once completed. The company specializes in cancer treatment technologies, and its recent financial performance reflects the success of its strategic investments. Despite negative sentiment and rumors around the company in the past, Loris Lab has turned around, proving the importance of conviction in long-term investments.

What role does India's infrastructure development play in the success of companies like Interarch Building?

-Interarch Building’s 25% revenue growth and 40% PAT growth reflect its strategic positioning in the growing pre-engineered building and steel construction space. With India's infrastructure and industrial sectors expanding, companies like Interarch are poised to benefit. Their ability to deliver high-quality, cost-effective construction solutions aligns well with the growing demand for industrial and commercial infrastructure.

How are companies in the Indian electronics sector positioned for future growth?

-Indian electronics companies like Dixon, Case, Ember, and Avalon are showing strong growth, driven by both domestic demand and a focus on reducing reliance on China. The growing electronics demand in India, combined with government support in the form of the PLI scheme, provides immense opportunities. However, these companies face high valuations, and any slip in performance could lead to significant market corrections.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

DIWALI PICKS !!

15 Stocks BlockBuster Results - Good Time to Buy? Investment Works

Mankind Pharma Business Outlook | कंपनी के नतीजों पर मैनेजमेंट से बातचीत, FY26 के लिए क्या Plan?

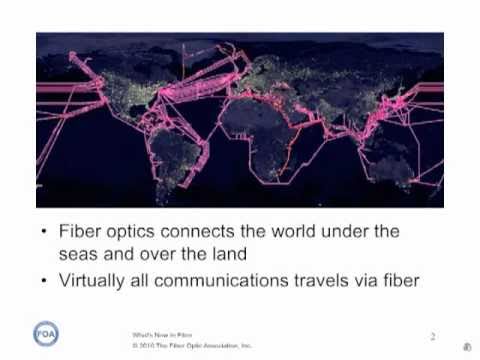

FOA Lecture 1: Fiber Optics & Communications

Expect EBITDA & Margin To Be Better By The End Of This Year: Mankind Pharma | CNBC TV18

Gelombang PHK Pekerja, Aktivis Buruh: Tanggung Jawab Pemeritah | Indonesia Business Forum tvOne

5.0 / 5 (0 votes)