Internal Controls

Summary

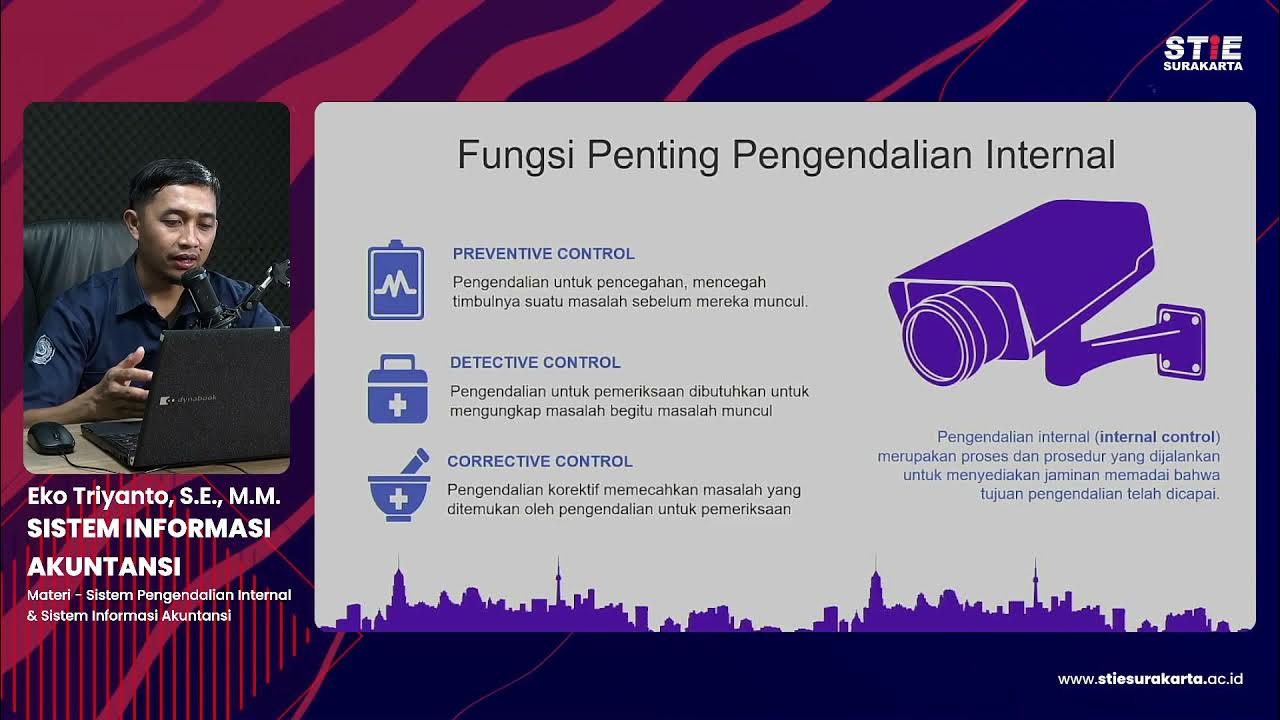

TLDRThis video delves into the concept of internal controls, focusing on their role in safeguarding assets, ensuring accurate financial records, and aligning with company policies. It highlights how internal controls are customized for different organizations, with smaller companies requiring fewer controls compared to larger ones. The video also explores key internal control principles like assigning responsibilities, maintaining records, separating duties, leveraging technology, and conducting reviews. Additionally, it discusses the potential for fraud and how internal controls can mitigate risks by addressing opportunity, pressure, and rationalization factors. Overall, it emphasizes the importance of effective internal control systems for organizational integrity and efficiency.

Takeaways

- 😀 Internal controls are policies within an organization to achieve objectives like safeguarding assets, maintaining reliable records, efficient operations, and aligning with company policies.

- 😀 The internal control system varies by company size and industry, with smaller companies requiring fewer controls due to direct management involvement and fewer employees.

- 😀 Separation of duties is a critical principle of internal controls, especially in large organizations, to reduce the risk of fraud and ensure responsibilities are properly assigned.

- 😀 Safeguarding assets, such as cash, is a major objective of internal controls, involving measures like restricting access to key individuals.

- 😀 Reliable accounting records are essential for performance evaluation, and internal controls must be designed to ensure these records are accurate and trustworthy.

- 😀 Technology can enhance internal controls by reducing errors and increasing accessibility, but it can also change how records are maintained, such as offering audit trails.

- 😀 Reviews and audits are necessary to assess the effectiveness of internal controls and ensure compliance with established processes.

- 😀 Internal controls must be designed to prevent fraud by addressing three components: opportunity, pressure, and rationalization.

- 😀 Financial pressure on employees can increase the likelihood of fraud, making it important for organizations to understand the pressures their employees may face.

- 😀 Rationalization allows individuals to justify unethical behavior after the fact, which is why catching fraud early can prevent it from escalating into a bigger issue.

Q & A

What are the primary goals of internal controls?

-The primary goals of internal controls are to safeguard assets, maintain reliable accounting records, ensure efficient operations, and align with company policies.

Why do internal controls differ between small and large companies?

-Internal controls differ due to the size and complexity of the organization. Small companies have fewer employees and simpler processes, allowing more direct oversight. In contrast, larger companies require more decentralized operations and formalized controls to manage a larger volume of transactions and reduce the risk of fraud.

What are some internal controls that are important for both small and large companies?

-Some common internal controls for both small and large companies include signing checks, ensuring the bookkeeper is not signing the checks, and reconciling bank accounts to reduce the likelihood of fraud.

What is the importance of 'separation of duties' in internal controls?

-Separation of duties is crucial in internal controls because it prevents one individual from having control over both the custody and recording of assets, thereby reducing the risk of fraud. For example, separating cash handling and cash recording duties ensures that fraud is more easily detected.

How does the size of a company affect its internal control structure?

-As a company grows, it becomes more decentralized, which means authority and responsibilities need to be delegated to other managers. Larger companies also need more formal policies to safeguard against fraud, as individuals may rationalize unethical actions more easily in a larger organization.

What role do technology controls play in internal controls?

-Technology controls enhance internal controls by automating processes, reducing human error, and enabling easier separation of duties within software systems. Technology also allows for more efficient record-keeping and provides an audit trail to track activities.

Why is it important to have clearly defined responsibilities in an internal control system?

-Clearly defined responsibilities ensure accountability. If responsibilities are not assigned, it becomes difficult to hold individuals accountable for outcomes. This can lead to confusion and inefficiencies, as well as a lack of motivation to address problems when performance falls short.

What challenges exist with internal controls in relation to e-commerce businesses?

-E-commerce businesses face unique challenges with internal controls due to the online nature of transactions, which increases the potential for fraud. Ensuring the proper implementation of technology controls and safeguarding digital transactions becomes crucial to reduce fraud risks in e-commerce.

What is the relationship between internal controls and fraud prevention?

-Internal controls help prevent fraud by reducing opportunities for fraud, especially when duties are separated, and by increasing the likelihood that fraudulent activities will be detected. By safeguarding assets, enforcing policies, and reviewing processes, internal controls minimize the chances of fraud occurring.

How do companies address the 'rationalization' aspect of fraud?

-Companies can address rationalization by implementing strong internal controls that detect fraud early. By catching fraud early and showing the consequences, organizations prevent the rationalization of fraudulent actions, which could escalate over time if left unchecked.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Revenue Cycle Exaplined CPA Exam

Understand Financial Assets in Less than 13 Minutes!

What are Internal Controls

Internal Control Basics | Principles of Accounting

The 3 Types Of Security Controls (Expert Explains) | PurpleSec

Sistem Informasi Akuntansi #8 Sistem pengendalian internal & Sistem Informasi Akuntansi-Eko Triyanto

5.0 / 5 (0 votes)