Why are Cars so expensive? | Truth about Indian Car Prices

Summary

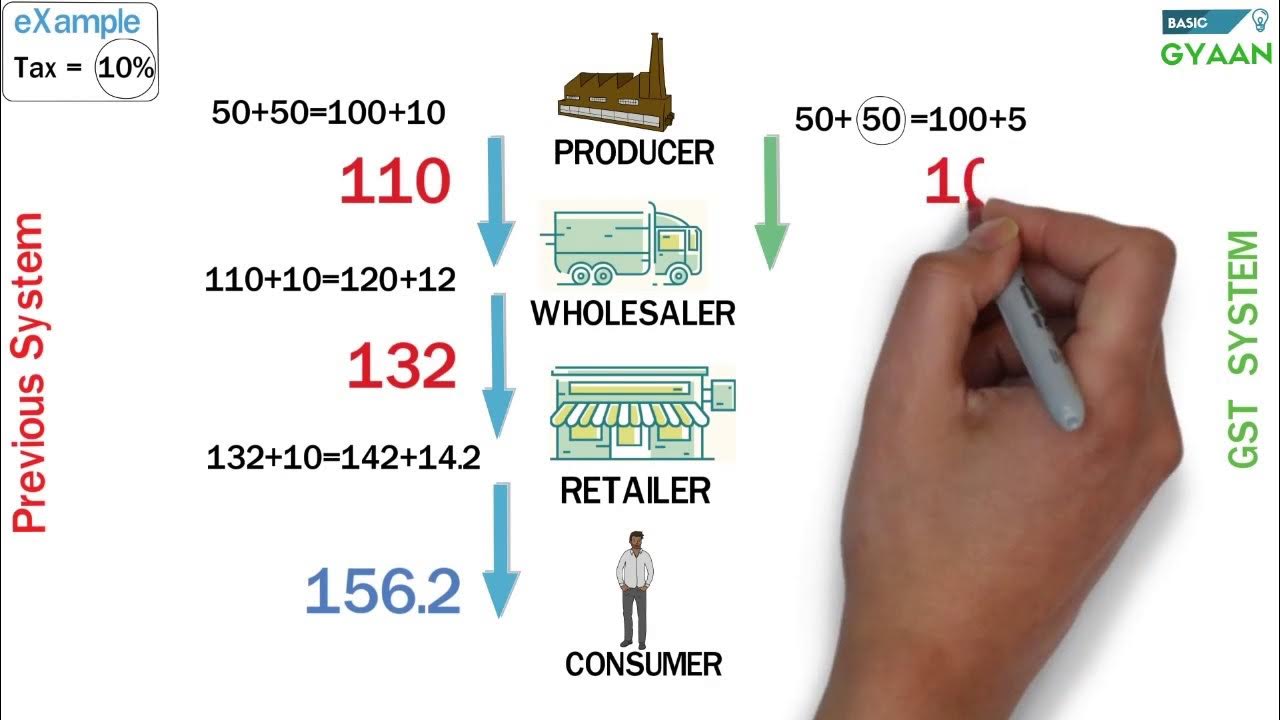

TLDRThis video delves into the complex taxation system on cars in India, particularly focusing on the impact of GST (Goods and Services Tax) on car prices. It explains the breakdown of taxes, including GST, cess, and road tax, and how these contribute to the high cost of owning a car. The script also compares the tax implications for different types of vehicles, such as SUVs and luxury cars, and discusses how these taxes affect the affordability of cars and road maintenance. The video highlights the financial burden on consumers and explores the wider impact of taxes on the car industry.

Takeaways

- 😀 The introduction of GST in India on July 1, 2017, replaced multiple taxes with a single Goods and Services Tax, simplifying the tax system for most goods and services.

- 😀 Cars in India are taxed with a 28% GST, which is the highest rate, along with an additional cess ranging from 1% to 22%, depending on the car's size and features.

- 😀 The total tax burden on some cars can reach up to 50% of their ex-showroom price due to both GST and the additional cess, making cars significantly more expensive.

- 😀 For large cars, especially SUVs, the tax burden is higher due to their size, and this affects the overall pricing for consumers.

- 😀 Road taxes are also added on top of the ex-showroom price, including the GST and cess, leading to compounded taxes, making the total cost even higher.

- 😀 Luxury cars that are imported face an additional 100% import duty, making them much more expensive compared to international markets.

- 😀 For a ₹16 lakh car, consumers end up paying more than ₹22 lakh after taxes, highlighting the impact of compounded taxes and other duties.

- 😀 Car companies in India often import car parts from abroad, which are subject to import duties, further inflating the final cost for consumers.

- 😀 Smaller cars, particularly those under 4 meters in length, can be taxed less, giving customers a price benefit, as seen with certain Hyundai models.

- 😀 The high taxes on petrol (₹10 per liter) further increase the cost of owning a car in India, as most cars are powered by petrol.

- 😀 The video reflects on the impact of taxes on car affordability, emphasizing that lower taxes could make safer, international-standard vehicles more accessible for Indian consumers.

Q & A

What is the significance of GST in India?

-GST (Goods and Services Tax) was launched in India on July 1, 2017, to simplify the tax system by replacing multiple taxes like excise duty, VAT, and infrastructure cess with a single unified tax.

How does GST impact car prices in India?

-GST on cars in India is 28%, which is the highest tax slab. Additionally, a cess is levied depending on the car's size and specifications, further increasing the tax burden on vehicles, especially larger SUVs.

What role does the cess play in vehicle taxation?

-The cess, which ranges from 1% to 22%, is an additional tax added to the GST. The government uses this cess to fund specific purposes, like improving road infrastructure. Larger cars incur a higher cess.

What is the 4-meter rule regarding vehicle taxation?

-According to this rule, cars under 4 meters in length attract a lower cess rate (up to 1%), while cars over 4 meters incur a higher cess (up to 22%). This rule affects the overall tax burden on different vehicle sizes.

Why are luxury cars in India more expensive compared to other countries?

-Luxury cars that are imported into India attract a 100% import duty, which significantly raises their prices. This makes luxury cars much more expensive in India than in markets like the US or Europe.

How does the road tax affect the total cost of a car?

-Road tax is applied on the ex-showroom price of the car, further adding to the total tax burden. The road tax amount is based on the car's price and engine capacity, contributing significantly to the final cost of ownership.

What is the total tax burden on a car purchased in India?

-The total tax burden can be up to 50% of the ex-showroom price of the car, including GST, cess, road tax, and other charges. This makes the final on-road price much higher than the car's base price.

How do taxes affect the affordability of cars in India?

-High taxes make cars more expensive and less affordable for average consumers. This also limits the availability of safer, international-standard cars in lower price ranges, as most affordable cars do not meet global safety standards.

What are the additional costs involved in car ownership beyond the purchase price?

-Apart from the purchase price, car owners in India must also pay for maintenance, insurance, and fuel, all of which are subject to taxes, including an 18% GST on maintenance and insurance services.

How does fuel taxation contribute to the cost of owning a car in India?

-Fuel, specifically petrol, is heavily taxed in India. A significant portion of the price consumers pay for petrol is a tax paid to the government, which adds to the ongoing cost of operating a vehicle.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Understand GST in 10 minutes

1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

POR QUE A FORD SAIU DO BRASIL? (Sergio Habib explica) | PrimoCast 330

GST Easy Explanation (Hindi)

Nirmala Seetharaman Point By Potluri నిర్మలమ్మ నిజంగా వేధిస్తోందా

GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

5.0 / 5 (0 votes)