Nirmala Seetharaman Point By Potluri నిర్మలమ్మ నిజంగా వేధిస్తోందా

Summary

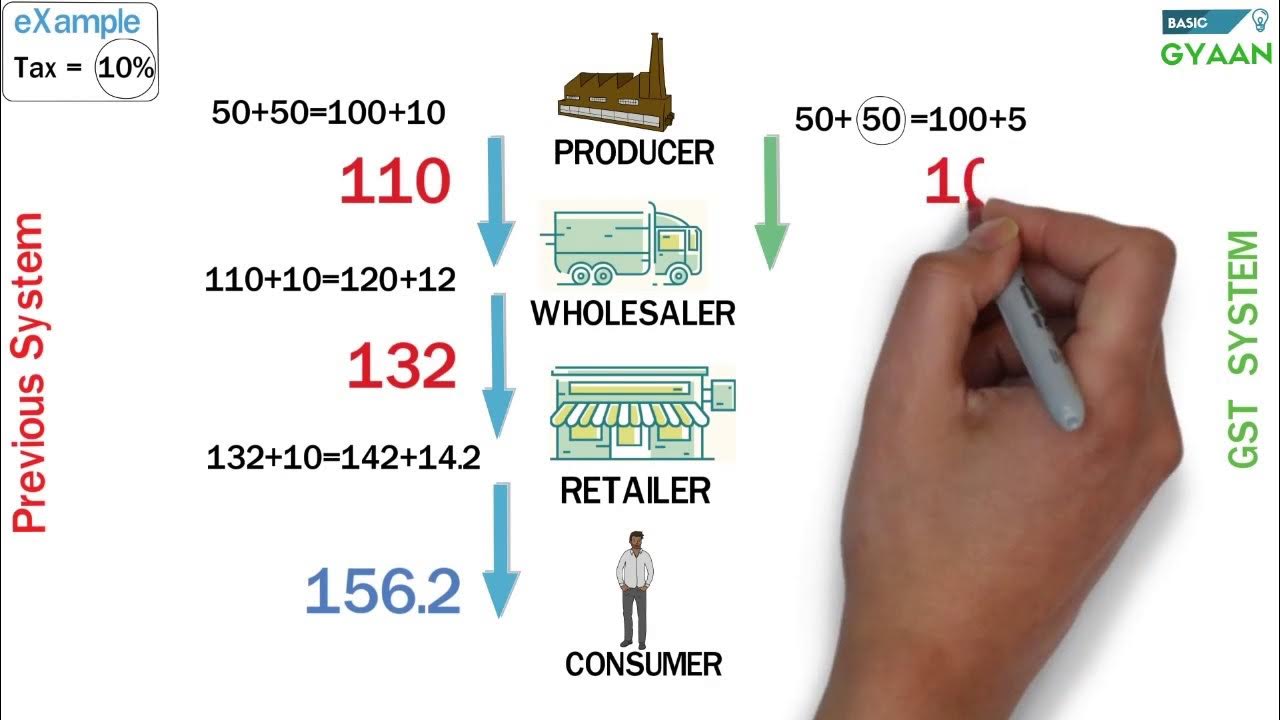

TLDRThis video script sheds light on the complexities and misconceptions surrounding the Goods and Services Tax (GST) in India. It clarifies the decision-making process of the GST Council, emphasizing that both the central and state governments play crucial roles in shaping GST policies. The script addresses common misunderstandings, such as the GST on second-hand cars, popcorn, and fuel, and critiques the media's portrayal of the tax system. It also highlights the significant role states have in the GST framework and the distribution of tax revenues, aiming to dispel confusion and promote better public understanding.

Takeaways

- 😀 GST decisions are made by the **GST Council**, not just the central government or Finance Minister.

- 😀 The **GST Council** consists of **33 members**: 2 from the central government and 31 from states, ensuring a collective decision-making process.

- 😀 For any changes in GST rates or policies, **consensus** is required among all states.

- 😀 GST on **petrol and diesel** cannot be implemented without unanimous approval from all states, which has not been achieved yet.

- 😀 **Popcorn** at movie theaters is taxed at **18% GST**, but this rate applies to all cinemas, not just specific ones.

- 😀 **Second-hand car sales** are not subject to GST when sold privately, but GST applies on the profit margin when sold by a dealer.

- 😀 Social media and **misinformation** play a significant role in spreading confusion about GST policies.

- 😀 The **Finance Minister** does not unilaterally decide on GST matters; it requires approval from the **GST Council**.

- 😀 GST revenue is divided between the central government (50%) and states (50%), with the states receiving over 70% of the revenue from GST-sharing.

- 😀 Public criticism often targets the **Finance Minister** without recognizing the **collective nature** of GST decision-making and the complexities involved.

Q & A

What is the role of the GST Council in decision-making?

-The GST Council, consisting of 33 members, including the finance ministers of all states and the central government, is responsible for making decisions related to GST rates and the inclusion of goods and services under GST. Decisions require consensus among states and not just the central finance minister.

Why are some people confused about the GST on popcorn?

-Some individuals mistakenly believe that popcorn is taxed at 18% GST. However, the confusion arises from the fact that the rate applies primarily to snacks sold in multiplexes or cinemas, where the business model differs from roadside vendors, who may not charge the same tax.

Does GST apply when selling a second-hand car?

-GST does not apply when an individual sells their used car privately. However, if the car is sold through a registered dealership, the dealership must charge GST on the difference between the purchase price and the sale price, which is considered the profit margin.

Why are petrol and diesel not included in the GST system?

-Petrol and diesel are not part of the GST system due to ongoing discussions among states. Any decision to bring these fuels under GST would require unanimous approval from all states, which has not yet occurred.

What is the division of GST revenue between the center and states?

-GST revenue is divided between the central government and the states. Approximately 50% of the Integrated Goods and Services Tax (IGST) goes to the states, while the central government receives 50%. Additionally, 21% of Central GST (CGST) is devolved to the states.

What is the GST rate on electric vehicles?

-Electric vehicles are taxed at a reduced rate of 12% GST, compared to the 18% rate applied to conventional petrol and diesel vehicles.

How does the GST system affect second-hand car sales in India?

-Second-hand cars sold through dealerships are subject to GST on the profit margin, not on the total sale price. However, private sales between individuals do not attract GST.

Why is the central finance minister often criticized on social media regarding GST?

-The central finance minister, Nirmala Sitharaman, is often unfairly blamed for decisions related to GST, even though these decisions are made by the GST Council. Many people spread misinformation on social media, attributing GST issues solely to her.

How does the GST Council handle disagreements among states?

-If states do not reach a consensus on a particular GST issue, voting is used to make decisions. The majority opinion among states determines the outcome, and only in rare cases does the matter go to a vote after failed consensus.

What are some common misconceptions about GST that are being spread online?

-Common misconceptions include claims that GST on everyday goods like popcorn and second-hand cars is excessively high. Other myths include misinformation about the central government's sole role in deciding GST rates and the inclusion of products like petrol and diesel under GST.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Real Estate में GST कितना लगता है | Real Estate में GST कैसे लगता है | GST on Real Estate Business |

Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

Massive GST Fraud unveiled in Delhi | Know all about it | UPSC

GST Easy Explanation (Hindi)

Session 5 - 08 What is a BAS

GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

5.0 / 5 (0 votes)