PPh Pasal 25: Pengertian, Kategori Perhitungan, Perhitungan, Batas Waktu Pembayaran, dan Sanksi

Summary

TLDRThis video explains the concept of PPh Pasal 25, a tax in Indonesia paid in monthly installments. It covers how the tax is calculated for both individual taxpayers (WP) and businesses (Wajib Pajak Badan), with specific rules for entrepreneurs and employees. The tax calculation is based on taxable income, with progressive rates for individuals and a fixed percentage for businesses. The video also provides an example case, demonstrating how to compute monthly installments based on tax credits and obligations. Additionally, it outlines the due dates for payments and penalties for late submissions.

Takeaways

- 😀 PPh Pasal 25 is an income tax paid monthly by individual and corporate taxpayers in Indonesia, based on the previous year's tax liability.

- 😀 This tax aims to ease the burden of taxpayers by allowing them to pay in installments throughout the year.

- 😀 Individual taxpayers are divided into two categories: WP OPPT (specific entrepreneurs) and WP selain OPPT (non-entrepreneurs or employees).

- 😀 WP OPPT includes individuals engaged in wholesale, retail, or multiple businesses and calculates tax at 75% of monthly turnover.

- 😀 WP selain OPPT are employees or freelancers and calculate tax based on their annual taxable income, with rates ranging from 5% to 30%.

- 😀 Corporate taxpayers are taxed at 25% of their taxable income, which applies to businesses with permanent establishments in Indonesia.

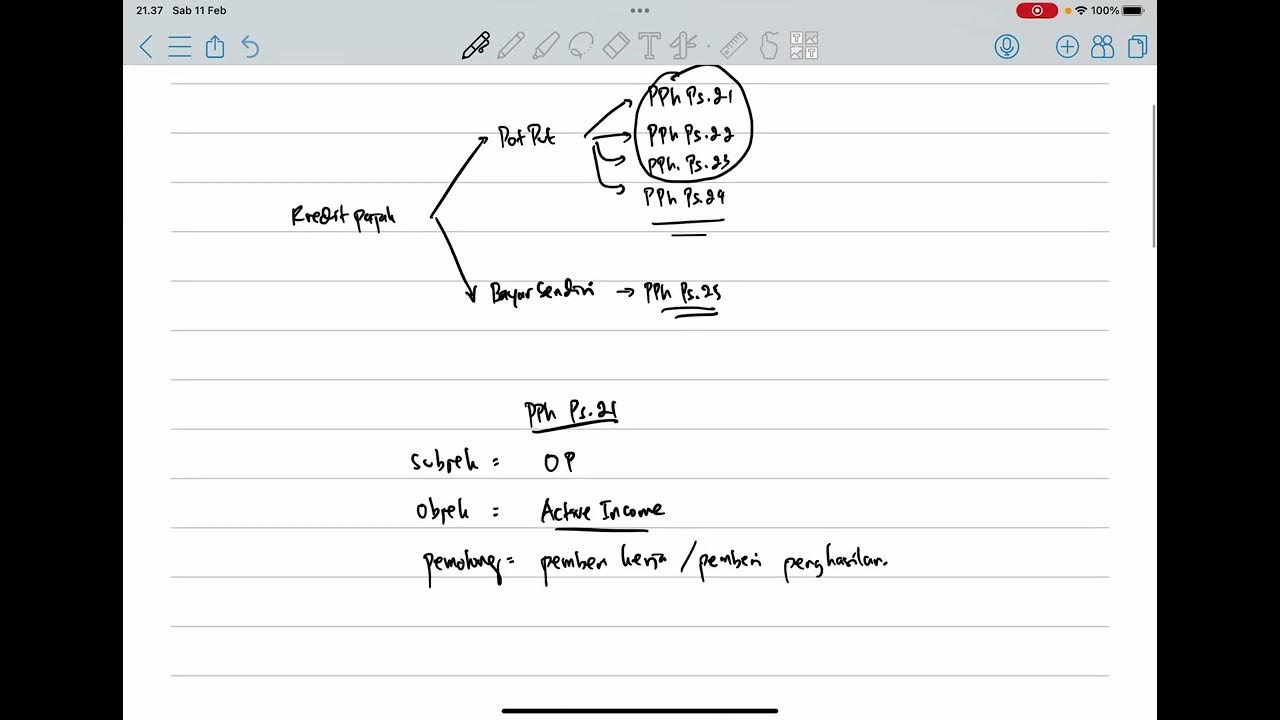

- 😀 The monthly installment amount for PPh Pasal 25 is calculated by taking the tax from the previous year, subtracting certain credits (PPh 21, PPh 22, PPh 23, PPh 24), and dividing by 12.

- 😀 The tax credits deducted from the annual tax include salary tax (PPh 21), withholding tax (PPh 22), and foreign tax credits (PPh 24).

- 😀 The deadline for payment is the 15th of each month, and the tax return must be filed by the 20th of the following month.

- 😀 A penalty of 2% per month is imposed for any late payment, calculated from the due date until the payment is made.

Q & A

What is the primary purpose of PPh Pasal 25?

-The primary purpose of PPh Pasal 25 is to allow taxpayers to pay their income tax in monthly installments throughout the year, easing their tax burden.

Who are the two main categories of individual taxpayers under PPh Pasal 25?

-The two main categories of individual taxpayers under PPh Pasal 25 are: 1) Wajib Pajak Orang Pribadi Pengusaha Tertentu (WP OPPT), who are business owners, and 2) Wajib Pajak Orang Pribadi selain Pengusaha Tertentu (WPOP), who are employees or freelancers.

How is the tax rate for Wajib Pajak Orang Pribadi Pengusaha Tertentu (WP OPPT) determined?

-For WP OPPT, the tax rate is calculated as 75% of the monthly turnover (omzet) at each business location.

What is the tax rate for individuals who are not business owners (WPOP)?

-For WPOP, the tax rate is based on their taxable income, with a progressive rate: 5% for income up to IDR 50 million, 15% for income between IDR 50 million and IDR 250 million, 25% for income between IDR 250 million and IDR 500 million, and 30% for income above IDR 500 million.

How is the income tax for corporate taxpayers (Wajib Pajak Badan) calculated?

-For corporate taxpayers, the income tax is calculated as 25% of their taxable income (PKP), as outlined in PPh Pasal 17, Ayat 1.

How is the monthly installment amount for PPh Pasal 25 calculated?

-The monthly installment amount is calculated by subtracting any taxes already paid (PPh 21, 22, 23, 24) from the total income tax due from the previous year, and dividing the result by 12 months.

What is the deadline for payment and reporting for PPh Pasal 25?

-The deadline for payment is the 15th of each month, and the reporting deadline is the 20th of the following month.

What happens if a taxpayer misses the payment deadline for PPh Pasal 25?

-If a taxpayer misses the payment deadline, they will be subject to a penalty of 0.25% per month, calculated from the due date until the actual payment date.

Can taxes paid abroad be used to reduce the amount of PPh Pasal 25 due?

-Yes, taxes paid abroad that are eligible for a credit (PPh 24) can be used to reduce the amount of PPh Pasal 25 that needs to be paid.

In the example provided, what is the total monthly installment for Raditya's PPh Pasal 25?

-In the example, Raditya's total annual installment is IDR 60 million, which results in a monthly installment of IDR 5 million (IDR 60 million divided by 12 months).

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Angsuran PPh Pasal 25: Cara Menghitung dan Melaporkannya

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

PPh Pasal 25: Pengertian, Perhitungan, Penyetoran dan Pelaporan

Tips memahami apa saja jenis pajak perusahaan yang harus Anda laporkan

PPh Orang Pribadi (Update 2023) - 7. PPh Pasal 25

PPh Pasal 24: Pengertian, Subjek dan Objek, Cara Pelaksanaan Kredit, dan Studi Kasus

5.0 / 5 (0 votes)