Bunga Tunggal dan Bunga Majemuk

Summary

TLDRThis video lesson, presented by Ikhvan, explores the concept of interest (bunga) in Aceh. It explains the difference between simple interest (bunga tunggal) and compound interest (bunga majemuk), providing formulas and calculations for each. The video offers several examples, such as calculating interest for a given period and determining the total amount after a specified time. Emphasizing the importance of consistent time periods, the lesson demonstrates how to convert annual interest rates into monthly rates. The video aims to help viewers understand and calculate interest effectively.

Takeaways

- 🌸 Interest (Bunga) refers to the additional amount given by banks to customers, calculated as a percentage of the principal amount and time period.

- 📊 There are two main types of interest: simple interest (Bunga Tunggal) and compound interest (Bunga Majemuk).

- 💰 Simple interest is calculated only on the initial principal, and the interest does not compound over time.

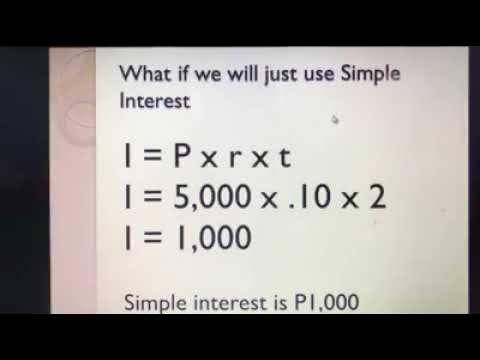

- 🧮 The formula for calculating simple interest is B = P * r * t, where P is the principal, r is the interest rate, and t is the time period.

- 💵 The formula for calculating the final amount (A) with simple interest is A = P + B, where P is the principal and B is the interest.

- 🔄 Compound interest grows both on the principal and the accumulated interest over time, leading to more substantial growth compared to simple interest.

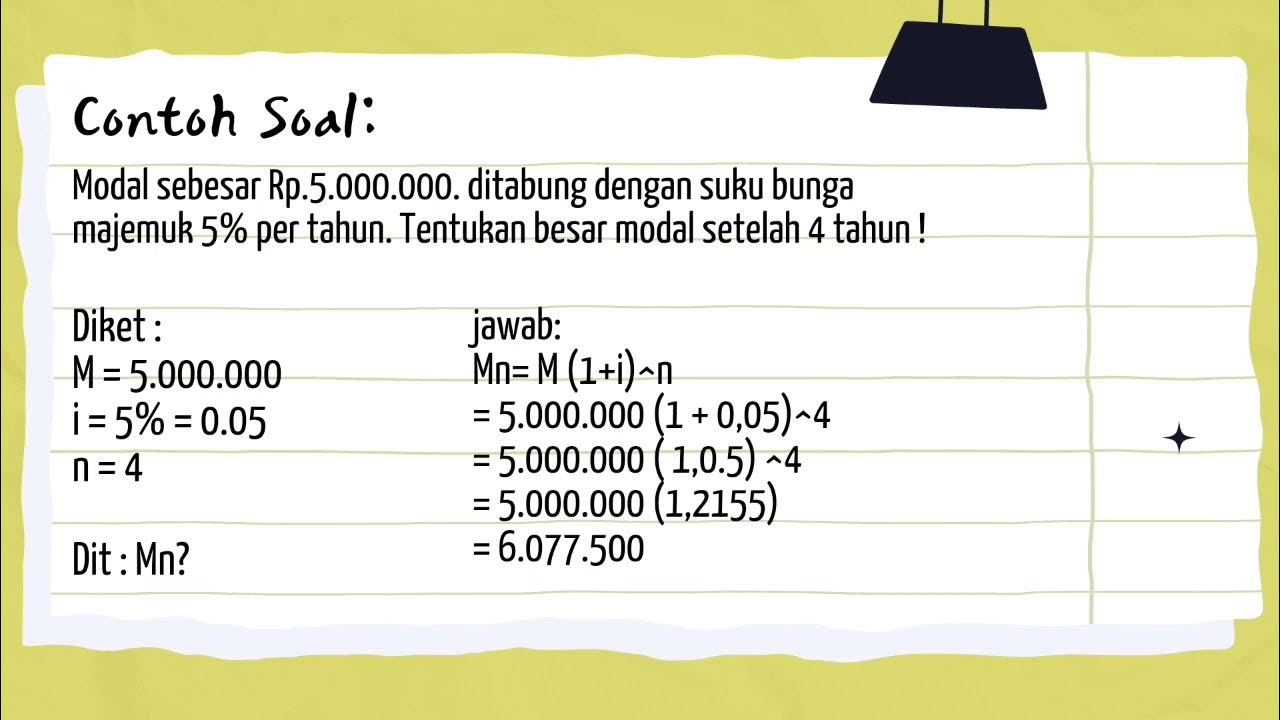

- 📈 The formula for compound interest is A = P * (1 + r)^t, where A is the amount after t periods, P is the principal, r is the rate, and t is the time.

- 📅 When time periods differ (e.g., interest calculated annually but requested for months), you must adjust the formula to align the units.

- 🔢 To convert a percentage to a decimal in interest calculations, divide by 100 (e.g., 5% becomes 0.05).

- 📝 Always calculate within the parentheses first in compound interest formulas before applying the exponentiation to avoid mistakes.

Q & A

What is the general definition of interest mentioned in the video?

-Interest, also known as 'bunga' or 'bank interest,' refers to the additional amount given by the bank to depositors based on the percentage of their deposited funds and the length of time they save. Interest can also apply to loans.

What is simple interest, and how is it different from compound interest?

-Simple interest is calculated only on the principal amount deposited or borrowed, without considering accumulated interest. Unlike compound interest, it does not generate interest on previously earned interest.

What is the formula for calculating simple interest?

-The formula for calculating simple interest is: Interest (I) = Principal (P) × Rate (R) × Time (T).

How is the final amount calculated in simple interest?

-The final amount (A) in simple interest is calculated using the formula: A = Principal (P) + Interest (I). This gives the total amount after adding the interest to the principal.

What is compound interest, and how does it differ from simple interest?

-Compound interest is calculated on both the principal and the accumulated interest from previous periods. Unlike simple interest, it generates interest on interest, resulting in faster growth over time.

What is the formula to calculate compound interest?

-The formula for compound interest is: A = P × (1 + R)^T, where A is the final amount, P is the principal, R is the interest rate, and T is the time period.

What is a key condition when calculating simple interest?

-A key condition for calculating simple interest is that the time periods for the interest rate and the time period must be the same, such as annual interest rate with annual periods.

How do you adjust for different time periods when calculating interest?

-When the time period for the interest rate differs from the period given (e.g., annual interest rate but the interest is calculated monthly), you need to convert one of them to match the other, either by converting the rate to monthly or the time to years.

How is interest calculated for partial periods, such as months, when the rate is annual?

-For partial periods like months, you divide the annual interest rate by 12 to convert it into a monthly rate, then use it in the formula.

What is an example of simple interest calculation provided in the video?

-An example given is Agus depositing 1,000,000 IDR at 5% simple interest annually. The interest after 3 years is calculated as 30,000 IDR using the simple interest formula.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)