Formula for continuously compounding interest | Finance & Capital Markets | Khan Academy

Summary

TLDRThis educational video script explores the concept of compound interest, focusing on how the amount owed grows when borrowing money. It explains the calculation with a principal of $50, an interest rate of 10%, and a borrowing period of 3 years, compounded quarterly. The script challenges viewers to calculate the total repayment amount and introduces the formula for continuous compounding, using the mathematical constant e. It concludes with a concrete example of continuous compounding, illustrating the repayment amount with infinite compounding periods.

Takeaways

- 💼 The principal amount for the loan is $50.

- ⏳ The loan is taken for a period of 3 years.

- 🔄 The interest is compounded 4 times a year, not annually.

- 📊 The annual interest rate is 10%, which is divided by 4 for each compounding period.

- 🧮 The formula for calculating the amount to be paid back is P(1 + R/N)^(N*T), where P is the principal, R is the annual interest rate, N is the number of times interest is compounded per year, and T is the time in years.

- 🔢 The number of compounding periods is 12 (3 years * 4 periods per year).

- 📈 Each compounding period increases the amount by 2.5% (10% / 4).

- 🌐 The concept of continuous compounding is introduced where the number of compounding periods approaches infinity.

- 💡 The formula for continuous compounding interest is P * e^(RT), where e is the base of the natural logarithm.

- 📚 The video demonstrates the transition from finite to continuous compounding, highlighting the practical application in finance and exponential growth.

Q & A

What is the principal amount mentioned in the script?

-The principal amount mentioned in the script is $50.

For how many years is the principal borrowed?

-The principal is borrowed for 3 years.

How many times a year is the interest compounded in the example?

-In the example, the interest is compounded 4 times a year.

What is the annual interest rate if compounded once per year?

-The annual interest rate, if compounded once per year, is 10%.

How is the interest rate adjusted for compounding four times a year?

-The interest rate is adjusted by dividing the annual rate of 10% by 4, resulting in a rate of 2.5% per compounding period.

How many compounding periods are there in total over the 3 years?

-There are 12 compounding periods in total over the 3 years, calculated as 3 years times 4 periods per year.

What is the formula for calculating the amount to be paid back with compound interest?

-The formula for calculating the amount to be paid back with compound interest is P(1 + R/N)^(N x T), where P is the principal, R is the annual interest rate, N is the number of times the interest is compounded per year, and T is the time in years.

What does the script suggest about the limit as N approaches infinity?

-The script suggests that as N approaches infinity, the compounding becomes continuous, which is a concept used in continuous compound interest.

What is the expression used to represent continuous compound interest?

-The expression used to represent continuous compound interest is P * e^(RT), where P is the principal, e is the base of the natural logarithm, R is the annual interest rate, and T is the time in years.

What is the amount to be paid back if the principal is $50, the time is 3 years, and the interest is compounded continuously at a rate of 10%?

-If the principal is $50, the time is 3 years, and the interest is compounded continuously at a rate of 10%, the amount to be paid back is approximately $67.49.

How does the script explain the transition from compounding to continuous compounding?

-The script explains the transition from compounding to continuous compounding by dividing the year into more and more chunks, eventually approaching an infinite number of chunks, which is conceptualized as continuous compounding.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

Zins & Zinsrechnung (ohne Zinseszins)

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.1

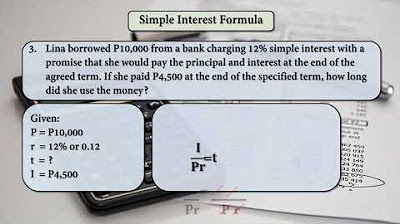

Mathematics of Investment - Simple Interest - Simple Interest Formula (Topic 1)

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

Nilai Waktu Uang (Time Value of Money)

5.0 / 5 (0 votes)