Zins & Zinsrechnung (ohne Zinseszins)

Summary

TLDRThis video explains the concept of interest, using relatable examples to break down how banks pay interest on deposited money. It covers the importance of the initial deposit and the interest rate, explaining how percentages work in calculations. The example of Jan depositing 300€ at a 2% annual interest rate is used to demonstrate how the money grows over 4.5 years. The video also touches on compound interest and invites viewers to think about how they manage their own money.

Takeaways

- 😀 Interest is the amount a bank pays you when you deposit money with them.

- 😀 The more money you deposit, the more interest you will earn.

- 😀 The interest you earn depends on the initial deposit, also known as the principal.

- 😀 Different banks offer different interest rates, meaning some pay more than others.

- 😀 Interest rates are always expressed as percentages, for example, 5% interest means 5% of your principal.

- 😀 To calculate interest, you multiply the interest rate by your principal. For example, 7% of 200 is 14.

- 😀 Interest is usually calculated annually, so a 5% interest rate means you get 5% more money each year.

- 😀 Zinsen (interest) are often calculated yearly, but shorter time periods like half a year will yield less.

- 😀 A practical example shows that a person who deposits €300 at a 2% interest rate for 4.5 years will earn €27 in interest, totaling €327.

- 😀 It's important to note that in real life, there are also interest rates on interest earned (compound interest).

Q & A

What is interest in banking?

-Interest is the amount a bank pays you for depositing money with them. It's calculated based on the amount you deposit and the interest rate provided by the bank.

How does the amount of money deposited affect the interest you receive?

-The more money you deposit, the more interest you will earn. This is because interest is calculated as a percentage of your initial deposit, or principal.

What determines the interest rate provided by different banks?

-The interest rate depends on the bank itself. Different banks offer varying rates depending on their policies and the financial environment.

What does 'percentage' mean in terms of interest?

-A percentage is a way to express a number as a fraction of 100. For example, 1% means 1 out of every 100, and this is used to calculate interest rates.

How do you calculate 7% of 200?

-To calculate 7% of 200, you multiply 200 by 7 and divide by 100. The result is 14.

How does interest work when it's given annually?

-If you earn 5% interest annually, you get 5% of your principal (initial deposit) at the end of each year. This means your money grows by 5% each year.

What would happen if you earned interest every 6 months instead of annually?

-If interest is calculated every 6 months, the total amount of interest you earn will be less after the same period compared to annual interest, because you're earning interest over shorter periods.

How much money will Jan have after 4.5 years with an annual interest rate of 2%?

-Jan starts with 300€. With a 2% annual interest rate, he will earn 6€ per year. Over 4.5 years, he will earn a total of 27€ in interest. So, after 4.5 years, Jan will have 327€.

How do you calculate the total interest earned over a period of time?

-To calculate the total interest, multiply the interest per year by the number of years. For example, if you earn 6€ per year, over 4.5 years, you will earn 6€ x 4.5 = 27€.

What is meant by 'interest on interest' and how does it differ from the calculations above?

-Interest on interest refers to compound interest, where you not only earn interest on your initial deposit but also on the interest that has already been added to your balance. This is different from simple interest, which only considers the initial deposit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Use Infinite Banking to Buy a Car | Infinite Banking with Chris Naugle

Simple interest (Mathematics)

JUROS SIMPLES: Teoria e Exemplos | Matemática Básica - Aula 30

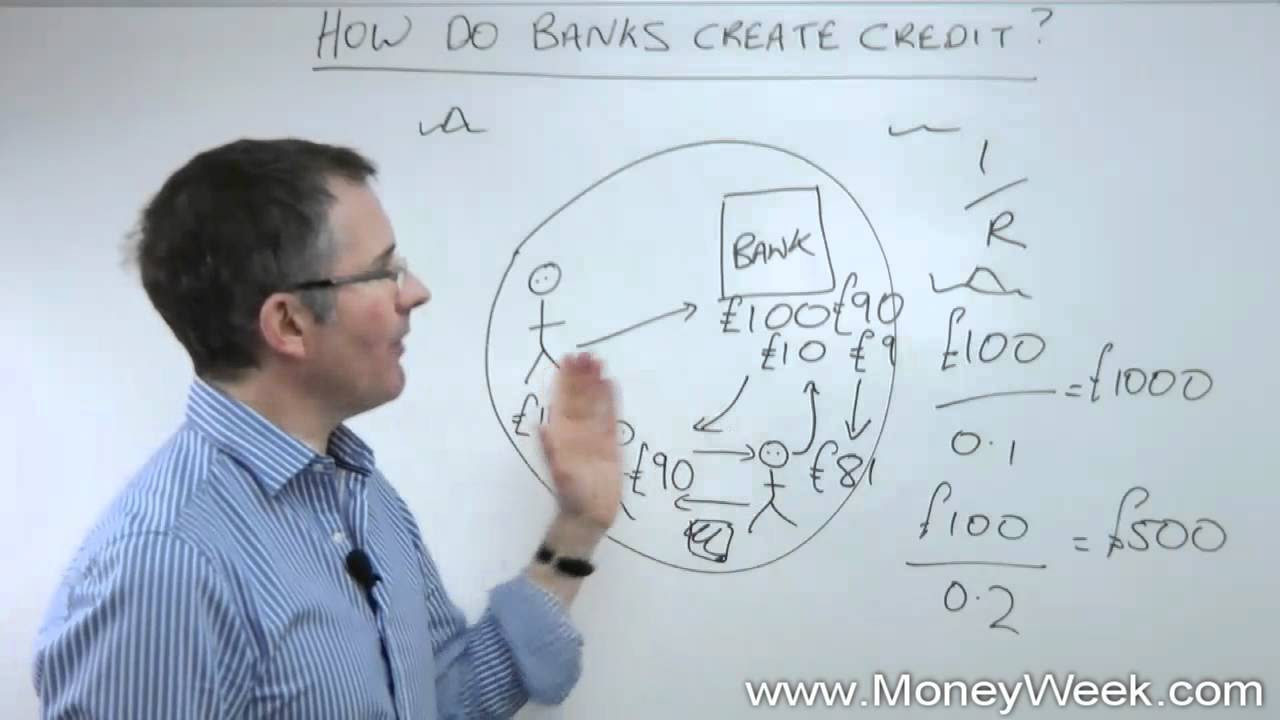

How banks create credit - MoneyWeek Investment Tutorials

"How To Turn $500 Into $400,000 With COMPOUND INTEREST"

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.1

5.0 / 5 (0 votes)