Candle Range Theory | CRT | The NEW Silver Bullet For Struggling Traders

Summary

TLDRThis video script delves into the concept of candle range theory in trading, emphasizing the importance of understanding each candle's range, from one-minute to four-hour intervals. It highlights three key aspects of an A+ range: inside candles, price action resting above or below, and specific time-based ranges. The script uses examples to illustrate how to identify market liquidity, opening prices, and the narrative behind each algorithmically printed candle. It encourages viewers to apply these insights to their own trading charts for a more strategic approach.

Takeaways

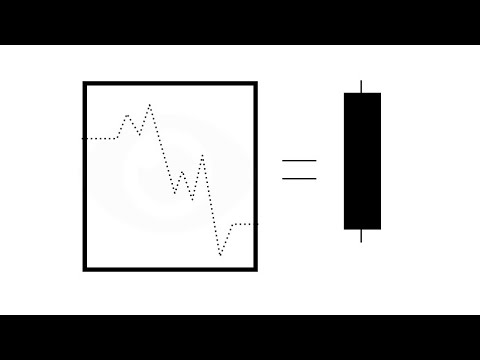

- 📊 Candle Range Theory is about understanding the range of each candlestick chart, including the highs and lows within specific time frames.

- 🔍 Key aspects of an A+ range include inside candles, price action (PDA) resting above or below, and the specific time frame of the range.

- ⏱ Time frames can vary, such as Asia range, daily range, or 4-hour range, and are crucial for identifying liquidity and market movements.

- 📈 Each candlestick represents a range with an opening price, high, low, and closing price, indicating the market's sentiment during that period.

- 💡 Candlesticks are not random; they are algorithmically printed with a narrative, suggesting that patterns can be analyzed and understood.

- 🔑 Inside bars are significant as they indicate accumulation and potential market reversals or continuations.

- 📉 An order block can be created by identifying the range low and high, which can be used for entry and exit points in trading.

- 🚀 Observing the opening, low, high, and closing prices of candles can provide insights into potential market direction and bias.

- 📌 Each candlestick has a 'power of three', which may refer to the importance of the opening, high, low, and closing prices in analysis.

- 📉 The concept of 'time-based premium and discount' is introduced, suggesting that the value of a candlestick can change based on its position within its time frame.

- 📚 The presenter encourages viewers to apply these concepts to their own charts for a deeper understanding and practical application.

Q & A

What is the core concept of candle range theory?

-The core concept of candle range theory is that each candle, regardless of its time frame (1 hour, 4 hours, etc.), represents a range with a high and a low, and it's essential to understand where liquidity is resting and the opening price.

What are the three key aspects of an A+ range according to the script?

-The three key aspects of an A+ range are: inside candles specifically in a higher time frame, PDA (Price Discovery Area) resting above or below, and the specific time the range is occurring (e.g., Asia range, daily range, or 4-hour range).

What does 'PDA resting above or below' refer to in the context of candle range theory?

-In the context of candle range theory, 'PDA resting above or below' refers to the Price Discovery Area being positioned either above or below the range, indicating where the market is finding value and potential support or resistance levels.

How does the speaker describe the formation of each candle in the market?

-The speaker describes each candle as being algorithmically printed with a narrative behind it, implying that there is no randomness in the formation of candles and that each one carries specific information about market sentiment and activity.

What does the term 'inside bar' signify in the context of the script?

-In the context of the script, an 'inside bar' signifies a candle that is completely contained within the previous candle's range, which can indicate accumulation or a period of consolidation in the market.

What is the significance of understanding the 'opening price' in relation to candle range theory?

-Understanding the 'opening price' is significant because it helps in identifying potential entry and exit points for trades. It's used to determine if a market is opening at a premium or discount and can influence trading strategies.

What is the concept of 'sweeping the range low or high' mentioned in the script?

-The concept of 'sweeping the range low or high' refers to the market price moving past the previous low or high of a candle's range, which can indicate a potential shift in market sentiment and may present trading opportunities.

How does the speaker suggest using the daily candle range in trading?

-The speaker suggests using the daily candle range to identify key support and resistance levels, and to look for patterns such as inside bars or accumulation areas that could indicate potential market movements.

What is the importance of recognizing 'fair value gaps' in candle range theory?

-Recognizing 'fair value gaps' is important as they can indicate significant shifts in market sentiment or the presence of large orders. These gaps can provide insight into potential market direction and areas of interest for traders.

How does the speaker define the 'power of three' in the context of each candle?

-The 'power of three' in the context of each candle is not explicitly defined in the script, but it could refer to the three key elements that give each candle its significance: the opening price, the high, and the low.

What is the role of 'narrative' in the formation of each candle according to the speaker?

-According to the speaker, the 'narrative' behind each candle refers to the underlying reasons and market conditions that lead to its formation. It suggests that each candle's creation is not random but is a result of specific market dynamics.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Candle Range Theory Explained

**NEW** CRT Trading Strategy! The 2026 Game Changer

CRT secrets 4: Candle anatomy

Simple 1 Minute Scalping Strategy To Make $300/Day (Backtesting REAL Results)

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

How to journal the Daily Candle using ICT Concepts

5.0 / 5 (0 votes)