Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

Summary

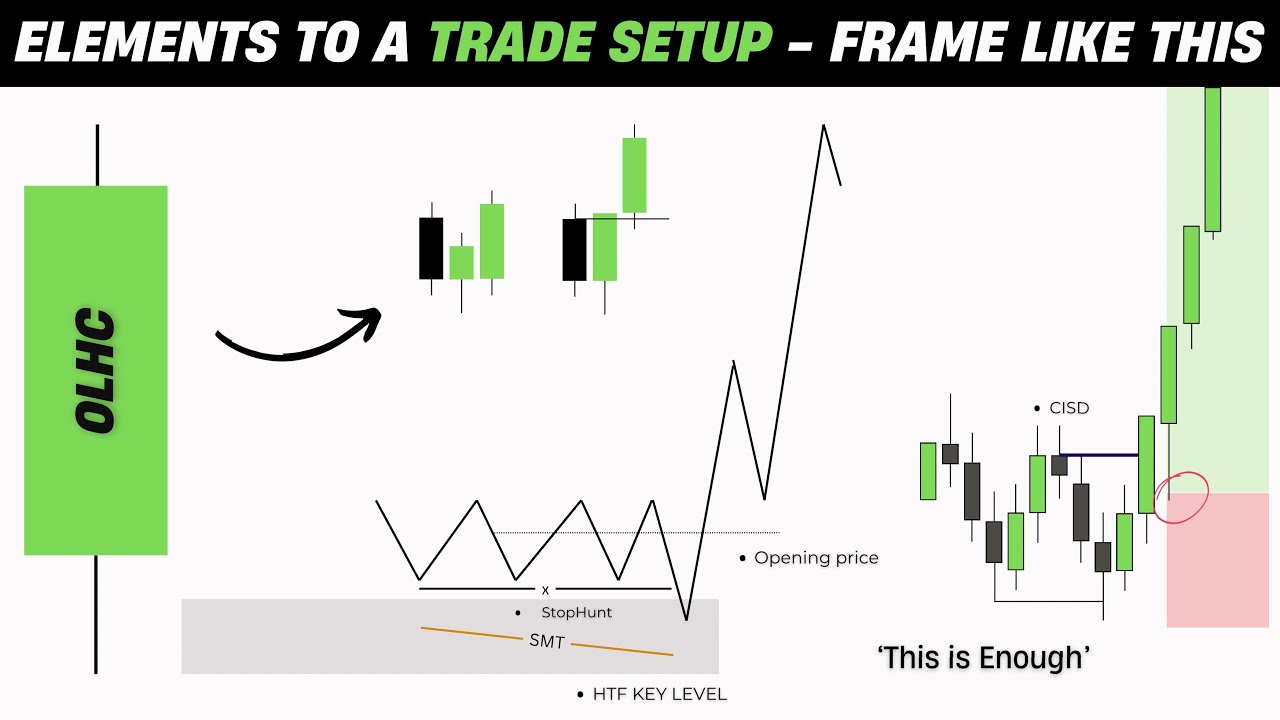

TLDRThis video delves into the concept of order blocks in CRT (Candlestick Reversal Trading), explaining their formation, importance, and how to use them for low time frame entries. It emphasizes the need for a logical framework in trading and provides a refined definition of order blocks as candles that purge or fill liquidity. The video illustrates how to identify valid order blocks and offers practical examples to demonstrate their role in generating high-probability trading entries. It also discusses the decision-making process for using the body or wick of a candle as an order block, advocating for a logical approach rather than pattern trading.

Takeaways

- 📊 Order blocks are crucial in trading as they can provide low time frame entries and are identified by their ability to purge or fill liquidity.

- 🔍 The definition of an order block according to the video is a candle or sequence of candles that purges liquidity by taking out a previous higher low or fills liquidity when price closes above or below it.

- 🛑 Two core concepts of order blocks are purging liquidity, which involves taking out highs or lows, and filling liquidity by testing or reacting to previous order blocks.

- 📈 Order blocks can be identified by observing if the price closes above or below the entire candle, including the wick, or just the body of the candle.

- 📝 It's important to use a refined, objective, and logical definition of order blocks to increase the probability of successful trades.

- 🤔 The choice between using the body or the wick of a candle as an order block depends on the price action and how it closes in relation to the candle's open, high, and low.

- 📉 Purging liquidity involves the price moving past a previous low or high, effectively taking out the liquidity at those levels.

- 💧 Filling liquidity is demonstrated when a candle tests or reacts to an existing order block, indicating a key level of support or resistance.

- 📌 Valid order blocks are characterized by either purging or filling liquidity, but not necessarily both.

- 📝 The video emphasizes the importance of pattern trading and using sound logic to increase the effectiveness of trading strategies.

- 🎓 The speaker credits Romeo and Sham for their influence on the understanding and teaching of order blocks within the CRT (Candlestick and Reaction Trading) methodology.

Q & A

What is the main focus of the video script provided?

-The video script focuses on explaining the concept of order blocks in the context of CRT (Candlestick Reversal Trading) and how they can be used for trading entries, particularly on lower time frames.

What is an order block according to the refined definition provided in the script?

-An order block is defined as a candle or sequence of consecutive candles that purges liquidity in the form of a previous higher low or fills liquidity. It forms when the price closes above or below these candles.

Why is it important to correctly identify an order block in trading?

-Correctly identifying an order block is important because it helps traders to find high-probability trading entries and can increase profitability by providing a logical framework for trading decisions.

What are the two core concepts of an order block as per the script?

-The two core concepts of an order block are that it must either purge liquidity by taking out above the highs or below the lows, and it must fill liquidity in the form of filling or testing previous order blocks.

How can an order block be identified on a price chart?

-An order block can be identified by looking for a candle or sequence of candles that purges or fills liquidity, and then observing if the price closes above or below these candles, which would confirm the order block.

What is a model one entry in the context of the script?

-A model one entry refers to a trading entry that occurs when the price retests and reacts off a valid order block, providing a potential entry point for a trade.

Why is it not always necessary for an order block to both purge and fill liquidity to be considered valid?

-An order block does not need to perform both functions of purging and filling liquidity to be valid. It only needs to fulfill one of these aspects to be considered a valid key level for trading decisions.

What is the significance of the price closing above or below an order block?

-When the price closes above or below an order block, it signifies that the order block has been validated and can be used as a reference key level for future price reactions.

How does the script differentiate between using the body or the wick of a candle for an order block?

-The script suggests using the body of the candle as the order block if the price closes just above or below the open of the candle, and using the whole candle including the wick if the price closes beyond the open, high, or low of the candle.

What is the advice given in the script for choosing between using the body or the wick of a candle for an order block?

-The advice given is to use proper objective logic and reasoning based on the price action. If the wick is significantly smaller than the body, use the body; if the wick is significantly larger, use the wick as the order block.

How can traders apply the knowledge of order blocks to their trading strategy in lower time frames?

-Traders can apply the knowledge of order blocks to identify high-probability entry points in lower time frames, which can lead to more accurate and profitable trades.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

5.0 / 5 (0 votes)