Session 2 - 03 Balance Sheet Accurate informations Supplier Cards Tax & Credit notes

Summary

TLDRThis script offers an in-depth explanation of a balance sheet, contrasting it with a profit and loss statement, and discusses the importance of reconciliation and validation of financial figures. It highlights the risk associated with incorrect bank account details and the potential for fraud, emphasizing the need for diligent processes in managing supplier relationships and payments. The speaker also touches on different business structures, the role of ASIC in regulating companies, and the significance of maintaining good rapport with suppliers for business success.

Takeaways

- 📊 A balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time, while a profit and loss statement reflects the financial performance over a period.

- 🏦 The balance sheet includes all the money in the bank, assets owned, and debts owed by a company, which are not necessarily spent to generate revenue.

- 🔍 Reconciling a balance sheet involves verifying each item listed, such as fixed assets, to ensure the reported figures are accurate and can be substantiated.

- 💼 Payroll obligations are reflected in the balance sheet, and it's crucial to verify these amounts against actual payroll records to ensure accuracy.

- 🔑 Understanding and following proper procedures is vital, especially when dealing with high-risk items like bank account details and supplier information, to prevent errors and fraud.

- 💻 The importance of using secondary source documents for verification cannot be overstated, as relying solely on ledger transactions can lead to confirmation bias and inaccuracies.

- 📝 General journals can be prone to errors if not handled carefully, emphasizing the need for meticulous accounting practices.

- 🏢 Pty limited companies offer a level of protection for directors and shareholders, limiting personal liability for company debts, except in cases of director misconduct.

- 🏦 ASIC (Australian Securities and Investments Commission) is the regulatory body overseeing companies, setting rules, and ensuring compliance with financial reporting and director duties.

- 📈 Subscriptions are regular payments made for services or products, and managing these can be critical for a company's cash flow.

- 🏘 Strata management in Australia involves a system of levies paid by property owners for the maintenance of common areas in multi-unit buildings, which is different from other regions.

Q & A

What is the primary purpose of a balance sheet?

-A balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time, showing what the company owns, owes, and the value of the owner's equity.

How does a balance sheet differ from a profit and loss statement?

-A balance sheet captures the financial position at a single point in time, while a profit and loss statement summarizes the revenues, expenses, and net income over a period of time.

What are some examples of items that might be listed as fixed assets on a balance sheet?

-Examples of fixed assets include computers, xerox machines, and land, which are items that are not typically used up or consumed in the regular operations of generating revenue.

What is the process of reconciling a balance sheet?

-Reconciliation involves verifying the balance sheet figures against individual items and external documents to ensure accuracy and validate the total amounts.

Why is it important to verify the balance sheet figures against payroll records?

-Verification against payroll records is important to ensure that the amounts listed for obligations, such as wages and pensions, are correct and to prevent discrepancies that could lead to financial inaccuracies.

What is a general journal, and why is it important to review it carefully?

-A general journal is a record of financial transactions, including the movement of money between accounts. Reviewing it carefully helps prevent errors such as incorrect account entries, which can lead to financial discrepancies.

What are the risks associated with entering new supplier bank account details?

-Risks include human error in entering incorrect details and the potential for fraud, such as cybercriminals posing as suppliers to request changes in bank details to divert payments.

What is the significance of maintaining a good relationship with suppliers?

-A good relationship with suppliers can be considered an asset as it may lead to better service, such as expedited delivery, and can help ensure the business has reliable access to necessary goods and services.

What is the difference between a Pty Limited company and a public company in Australia?

-A Pty Limited company is a privately owned company with limited liability for its directors, while a public company is listed on the stock exchange, has different reporting requirements, and may be subject to additional compliance and auditing.

What is ASIC, and what role does it play in regulating companies in Australia?

-ASIC is the Australian Securities and Investments Commission, which is the regulatory body responsible for setting rules around directors' duties, company obligations, and overseeing the stock exchange and financial markets.

What is a strata levy, and why is it important for businesses that rent office space?

-A strata levy is a payment made by businesses to cover the maintenance and repair of common areas in a building they rent from a landlord. It is important because it ensures that shared spaces are well-maintained and any necessary repairs are funded.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Profit & Loss Account, Preparation of Final Accounts, Format of Profit and Loss Account, Accounting

Video Pembelajaran Jenis Laporan keuangan

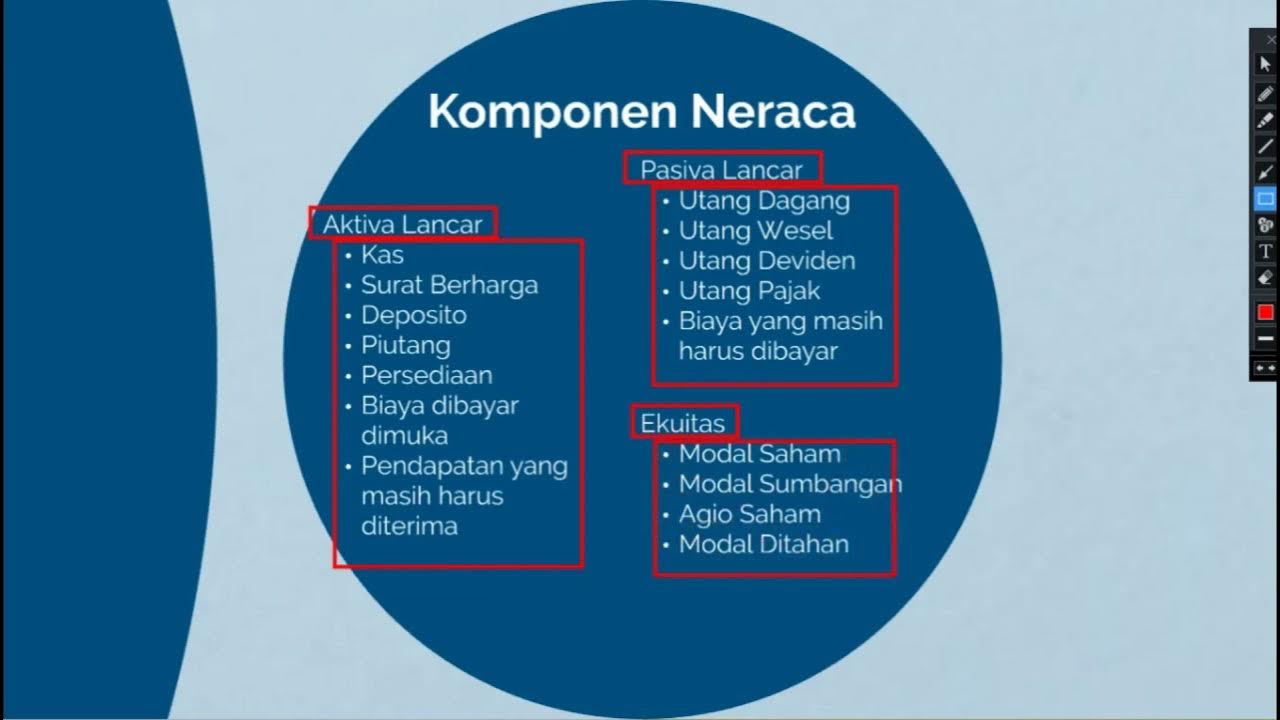

Statement of Financial Position (SOFP) | Laporan Posisi Keuangan | Akuntansi Keuangan Menengah

final accounts introduction in telugu part 1 #RSACADEMY|#degree #accountancy #finalaccounts #inter

Accounting for IGCSE - Video 36 - Limited companies (Part 2) - Financial statments

Projected income statement Grade 11 PART 1

5.0 / 5 (0 votes)