Answering the Copycats on Dubai's New 9% Tax

Summary

TLDRIn this video, Andrew Henderson, founder of Nomad Capitalist, addresses the misconceptions about the UAE's tax system, clarifying that a 9% tax now applies to most businesses, contrary to the widely believed 0% corporate tax rate. He discusses his personal experience with the UAE, the reasons behind his decision not to move there, and the importance of being informed about all options. Andrew also criticizes those who mislead with 'smoke and mirrors' about the tax situation, emphasizing the need for transparency and accurate information when considering relocation for tax purposes.

Takeaways

- 😀 The speaker, Andrew Henderson, clarifies that the 0% corporate tax rate in Dubai is no longer applicable for most businesses, contrary to popular belief.

- 📢 There is a new 9% tax on most companies in the UAE, which has led to some confusion and misinformation among people.

- 🏢 The 9% tax does not apply to personal income from jobs or Bitcoin, but rather to business activities, such as royalties and dividends.

- 👤 Andrew Henderson expresses his view that the UAE government is forward-looking and has smart people in key positions, including the Finance Minister.

- 🏠 He shares his personal reasons for not moving to Dubai, including his wife's discomfort and the ethical concerns he has with some practices in the citizenship industry there.

- 🌐 The speaker emphasizes the importance of being informed about all options when considering a move to a new country for tax purposes.

- 💡 There is a small business relief in the UAE for companies with revenue not exceeding 3 million dirhams (about $816,000 USD) until the end of 2026.

- 🚫 After 2026, the small business relief will no longer be available, and companies will be subject to the 9% tax rate unless they fall under specific exemptions.

- 🤔 The speaker criticizes those who sell UAE companies without being transparent about the new tax regulations, suggesting that they may be resorting to 'smoke and mirrors'.

- 🌍 Andrew Henderson offers services to help clients move to various tax-friendly countries, not just the UAE, and stresses the importance of making informed decisions.

- 💬 The script includes various comments and reactions from people who have strong opinions about living in the UAE, with some defending the 9% tax rate and others expressing concerns.

Q & A

What is the current corporate tax situation in Dubai?

-There is a new 9% tax on most companies in Dubai, unless they meet certain conditions for exemption. Previously, Dubai was known for having a 0% corporate tax rate.

Why did Andrew Henderson not move to Dubai despite its attractive tax policies?

-Andrew Henderson and his wife visited Dubai and decided it wasn't the right fit for them personally. They felt that the networking aspect for their industry in Dubai wasn't attractive and there were ethical concerns with some practices in the citizenship industry there.

What does Andrew think about the UAE government's approach to taxation and business?

-Andrew believes that the UAE government is forward-looking, hiring smart people, and adapting successful ideas from other places. However, he criticizes some individuals who sell companies in the UAE for not being transparent about the new tax regulations.

What is the 'small business relief' in the UAE, and what are its conditions?

-The 'small business relief' in the UAE allows companies with revenue not exceeding 3 million dirhams (about $816,000 USD) to be exempt from the 9% tax until December 31, 2026, subject to certain conditions.

Why does Andrew believe some people react negatively to his comments about Dubai's tax situation?

-Andrew suggests that people who have built their businesses around selling companies in the UAE may feel threatened by his comments because it could disrupt their sales if potential clients become aware of the new tax rates.

What does Andrew suggest is a common misconception about the tax situation in the UAE?

-A common misconception is that the UAE is still a 0% tax jurisdiction for all types of income and businesses. In reality, there is now a 9% tax on most companies, with some exceptions for small businesses and specific conditions.

How does Andrew describe the English proficiency in banks in the UAE?

-Andrew criticizes the English proficiency in banks in the UAE as 'horrific,' suggesting that it is not on par with other countries like Singapore or Malaysia.

What is Andrew's view on the importance of being informed about all options before choosing a tax jurisdiction?

-Andrew emphasizes the importance of being fully informed about all options, including different jurisdictions, before making a decision about where to base a business or reside, to avoid being misled by misinformation.

What are some of the other jurisdictions Andrew mentions as alternatives to the UAE for tax efficiency?

-Andrew mentions Malta, Cyprus, Ireland, Bulgaria, Malaysia, Panama, and Italy as some of the jurisdictions that offer tax efficiency and in some cases, the possibility of citizenship.

Why does Andrew criticize the herd mentality of some people moving to Dubai?

-Andrew criticizes the herd mentality because he believes it leads to a lack of critical evaluation of other options. He suggests that people should make informed decisions based on their individual circumstances rather than following trends.

What does Andrew offer in terms of services to people considering moving their businesses or residence?

-Andrew offers services through Nomad Capitalist to help people move to 31 different tax-friendly countries, providing information and support to make informed decisions about relocation and tax optimization.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Top Countries for Starting Your Business

7 Reasons to Consider Malta Citizenship

Best Countries for Americans to Escape to NOW

How To Pay Low / No Tax in South Africa (Not a meme)

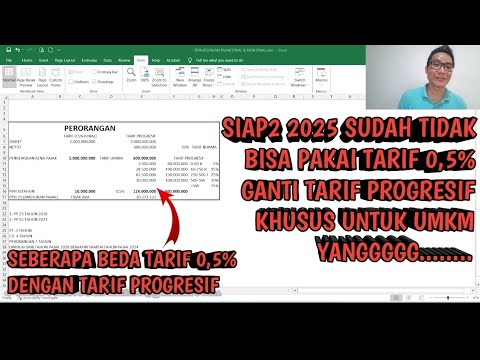

Tarif UMKM 0,5% berakhir di 2024, 2025 Pakai Pajak Progresif lagi !! || Solusi,Bayar Pajak Kecil

शामली:कांधला नगर पालिका के द्वारा टैक्स लगाने, व ब्याज वसूलने पर इंटरव्यू#DM Shamli

5.0 / 5 (0 votes)