Breaking Down ICT Macros From This Week

Summary

TLDRIn this detailed trading breakdown, the trader highlights six macro setups from the past week, focusing on key concepts like fair value gaps (FVGs), liquidity pools, and market manipulation. By analyzing time windows such as the 9:30 a.m. open and London kill zone, the trader discusses how to spot high-probability reversals and trend shifts. Patience and discipline are emphasized, along with the importance of understanding order flow and waiting for confirmation before entering trades. The video provides a comprehensive guide on how to identify strong setups and manage risk in real-time trading.

Takeaways

- 😀 Time-based macro windows (e.g., 9:30 a.m., 1:50 p.m.) are crucial for identifying key trade setups and price levels.

- 😀 Liquidity analysis, including trendline liquidity and buy-side liquidity, helps to determine your trading bias and informs decisions.

- 😀 Fair value gaps (FVGs) such as the 9:30 and midnight FVGs are critical areas to watch for potential price retracements or reversals.

- 😀 Engineered highs are price levels where the market pushes up to a point, often to trigger liquidity, before reversing.

- 😀 Cibbies (a pattern or indicator) play a significant role in recognizing bearish or bullish reversals based on price interaction with key levels.

- 😀 Inversion patterns are high probability setups for reversals, especially when they align with liquidity zones and market sentiment.

- 😀 Patience is key — waiting for the ideal entry confirmation avoids unnecessary losses from chasing the market.

- 😀 Session highs and lows (e.g., AM session high, London high) are strong liquidity magnets that attract price action and help identify trade setups.

- 😀 Risk management through proper trade setups and position sizing is essential to avoid overleveraging, especially in complex setups.

- 😀 Reviewing past price delivery and identifying significant price levels (e.g., session opens, new day gaps) can help identify market direction and improve trade accuracy.

Q & A

What is the main focus of the video analysis?

-The main focus of the video is breaking down and analyzing key macro setups from the trading week, focusing on liquidity analysis, identifying high-probability trade entries, and understanding the logic behind market movements during specific time windows, such as the 9:30 a.m. and 1:30 p.m. macro windows.

What is the significance of the 'midnight fair value gap' mentioned in the video?

-The midnight fair value gap refers to the first significant fair value gap that forms after midnight (12:00 a.m. Eastern time) and is used as an indicator for potential price movement. It is treated similarly to other key fair value gaps, such as the 9:30 fair value gap, helping traders identify areas of potential price reversal or continuation.

How does the trader distinguish between a protected high and an engineered high?

-A protected high is considered unlikely to be revisited, while an engineered high is one where price retraces to the same level before continuing in the original direction. The trader uses price behavior, such as equal highs aligning with previous session highs, to assess whether the high is likely to hold or be revisited.

Why is it important to recognize the presence of 'clear liquidity' in the market?

-Clear liquidity is essential because it helps frame the trader's bias for the market direction. In the video, clear liquidity (either buy-side or sell-side) is used to guide whether the trader should focus on long or short setups. It provides a clear indication of where price is likely to move, given the availability of orders at certain levels.

What role does the 'macro power 3 entry criteria' play in the trader's strategy?

-The 'macro power 3 entry criteria' are key conditions that help confirm the right time to enter a trade. These criteria include factors like liquidity analysis, price behavior around important market levels, and timing within specific market windows. Meeting these criteria increases the probability of a successful trade setup.

How does the trader interpret 'manipulation' in the market?

-In the context of the video, manipulation refers to price movement designed to shake out weaker traders or to create false signals before a larger price move. The trader looks for signs of manipulation, such as price breaking key levels and then returning, to assess whether a reversal or continuation is more likely.

What is the significance of the 'new day opening gap' and how is it used?

-The new day opening gap represents the price difference between the previous day’s close and the current day’s open. It is used by the trader as a key level to watch for price reactions. A close above or below this gap can signal a shift in order flow, potentially marking the start of a new price trend or reversal.

What does 'SMT' stand for and why is it important?

-SMT stands for 'Smart Money Technique.' It refers to a situation where price action in different markets, such as the S&P 500 (ES) and the NASDAQ (NQ), diverges. In the video, an SMT is used as a key signal to identify potential reversals or continuation in the market, particularly when one market leads or lags the other.

How does the trader use the concept of 'engineered sell-side liquidity pools'?

-Engineered sell-side liquidity pools are areas where stop-losses are likely to be triggered, often beneath key lows or previous session lows. The trader looks for signs of manipulation around these levels and uses them as targets for trades, either by waiting for price to revisit these levels after manipulation or by identifying a reversal pattern.

Why does the trader emphasize the importance of patience in trading?

-Patience is emphasized because many traders struggle to wait for the right setup and often chase trades that may lead to unnecessary losses. The trader advocates for waiting for clear entry confirmation and not rushing into trades, as jumping into the market too soon often results in taking losses or entering at suboptimal points.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Why FVGs Are All You Need to Become Profitable in 2024

Day Trading New York Continuation Or Reversal - ICT Concepts

How to KNOW where price will ALWAYS go - DOL simplified!

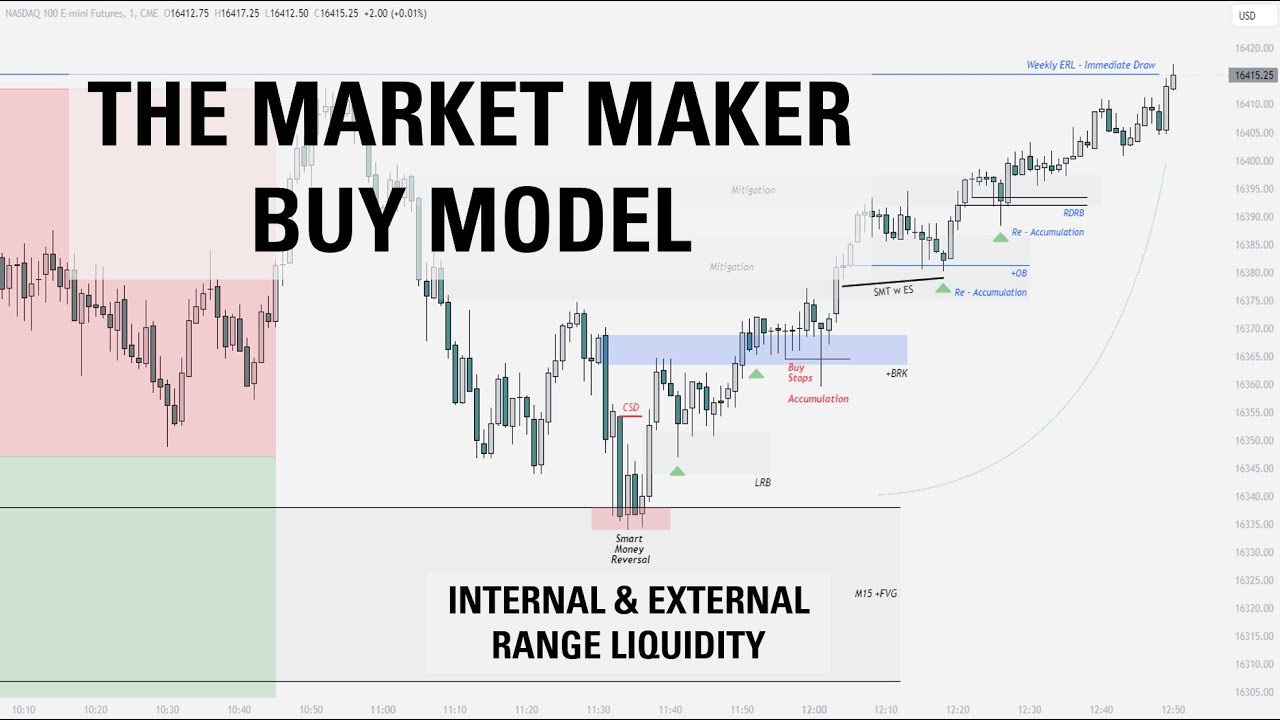

The Market Maker Buy Model | Full Trade Breakdown $NQ

ICT Daily Bias Was Hard, Until I Understood This

My Secret High Probability Liquidity Sweep Strategy [Full In-Depth Guide]

5.0 / 5 (0 votes)