How to Conquer Overtrading | Trading Psychology | FundingYourTrades.Com

Summary

TLDRIn this episode of 'Funding Your Trades,' Emily addresses the mental challenges traders face, particularly overthinking and overtrading. She explains how overthinking can lead to hesitation and missed opportunities, and suggests managing it by staying productive and focusing on self-improvement. Emily emphasizes the importance of quality over quantity in trades and shares her personal routine to maintain discipline and balance, ultimately leading to more confident and consistent trading.

Takeaways

- 🤔 Overthinking in trading can lead to hesitation and missed opportunities due to our brain's natural tendency to overanalyze and predict outcomes.

- 🧠 The survival mechanism of overanalyzing can work against traders, causing doubt and fear, which may lead to second-guessing strategies and taking unplanned trades.

- 🕳 The trap of overthinking often involves staring at trading screens for hours, which can amplify doubt and lead to suboptimal decisions.

- 🛠️ To manage overthinking, one should stay busy and productive, focusing less on charts and more on self-improvement, embracing the principle of 'less is more'.

- 💡 Overtrading, often stemming from the fear of missing out, exposes traders to unnecessary risks and can compound losses instead of recovering them.

- 📉 Consistency in trading comes from focusing on quality trades rather than quantity, with high-probability setups being more effective than high-frequency trades.

- 🚫 Avoiding overtrading involves staying busy with productive activities, such as reading, backtesting strategies, or exercising, to distract from the temptation to trade excessively.

- 📝 Keeping a trading journal and tracking emotions and thoughts is important, but it's crucial not to stay on the charts when tempted to take another trade.

- 🗓️ Implementing a structured routine with specific times for backtesting, research, exercise, and relaxation can create a balanced approach to trading.

- 🏋️♀️ Personal examples of productive activities include working out, pre-market analysis, trading, backtesting, and journaling, which contribute to a disciplined trading routine.

- 🔑 Holding oneself accountable and taking responsibility for actions are key to maintaining discipline and avoiding the pitfalls of overthinking and overtrading.

- 🏁 Trading is a marathon, not a sprint, and staying disciplined and busy with productive activities will yield results over time.

Q & A

What is the main topic discussed in the video by Emily?

-The main topic discussed in the video is overthinking and overtrading in trading, and how to manage these mental challenges to improve trading performance.

Why does overthinking occur in trading according to the transcript?

-Overthinking occurs in trading because our brains are wired to overanalyze and predict outcomes as a survival mechanism, which can work against us in trading by causing doubt and fear.

What are the negative consequences of overthinking in trading mentioned in the script?

-The negative consequences of overthinking in trading include hesitation, missing opportunities, making mistakes, and second-guessing one's strategy.

How does overtrading stem from the fear of missing out, as described in the video?

-Overtrading stems from the fear of missing out when traders think that taking one more trade can recover losses or take advantage of a win, leading to unnecessary risks and potential losses.

What is the key to consistent trading according to Emily's experience?

-The key to consistent trading is quality over quantity, focusing less on the charts and more on high-probability setups, and reducing the frequency of trades.

What is the simplest way suggested to manage overthinking in trading?

-The simplest way to manage overthinking is to keep oneself busy and productive, spending less time on the charts and more time on self-improvement.

How can traders avoid overtrading according to the video?

-Traders can avoid overtrading by staying busy with other productive activities, such as reading, backtesting strategies, exercising, or any activity that takes their mind off the charts.

What is the importance of having a trading routine as suggested in the video?

-Having a trading routine is important as it helps create a balanced approach to trading, ensuring that traders are actively improving their skills and not just staring at screens all day.

What is the role of self-discipline in managing overthinking and overtrading?

-Self-discipline is crucial in managing overthinking and overtrading as it helps traders hold themselves accountable, take responsibility for their actions, and avoid second-guessing their strategies.

How does the video suggest traders should spend their downtime to improve their trading?

-The video suggests that traders should use their downtime to set goals, make a detailed trading plan, journal and track their trades, thoughts, and emotions, and engage in activities that improve their state of mind.

What is the final advice given in the video regarding trading and productivity?

-The final advice given is to stay disciplined, stay busy with productive activities, and implement a structured routine to combat overthinking and overtrading, which will ultimately lead to enjoying trading more and seeing results over time.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

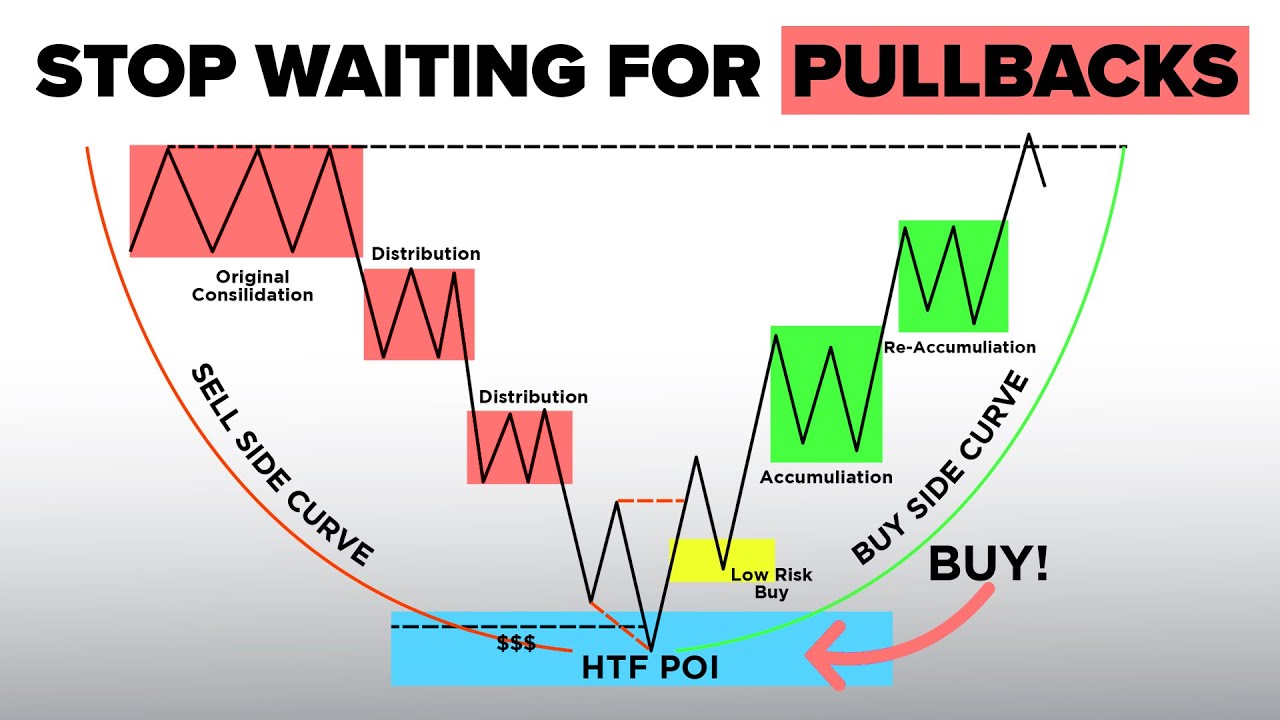

Stop Waiting for Pullbacks, Use Market Maker Models Instead (ICT Concepts)

Why Overtrading is the Silent Killer of Your Trading Account

Using Fear of Failure to Create a Successful Trading Psychology

Does more trade = more income? Realistic expectations. becoming a risk manager

Lukamu Karena Pikiranmu Sendiri - ISLAM ITU INDAH (28/2/25) P1

Cara Mengatasi Overtrade trading | Psikologi trading

5.0 / 5 (0 votes)