Video Riset 33

Summary

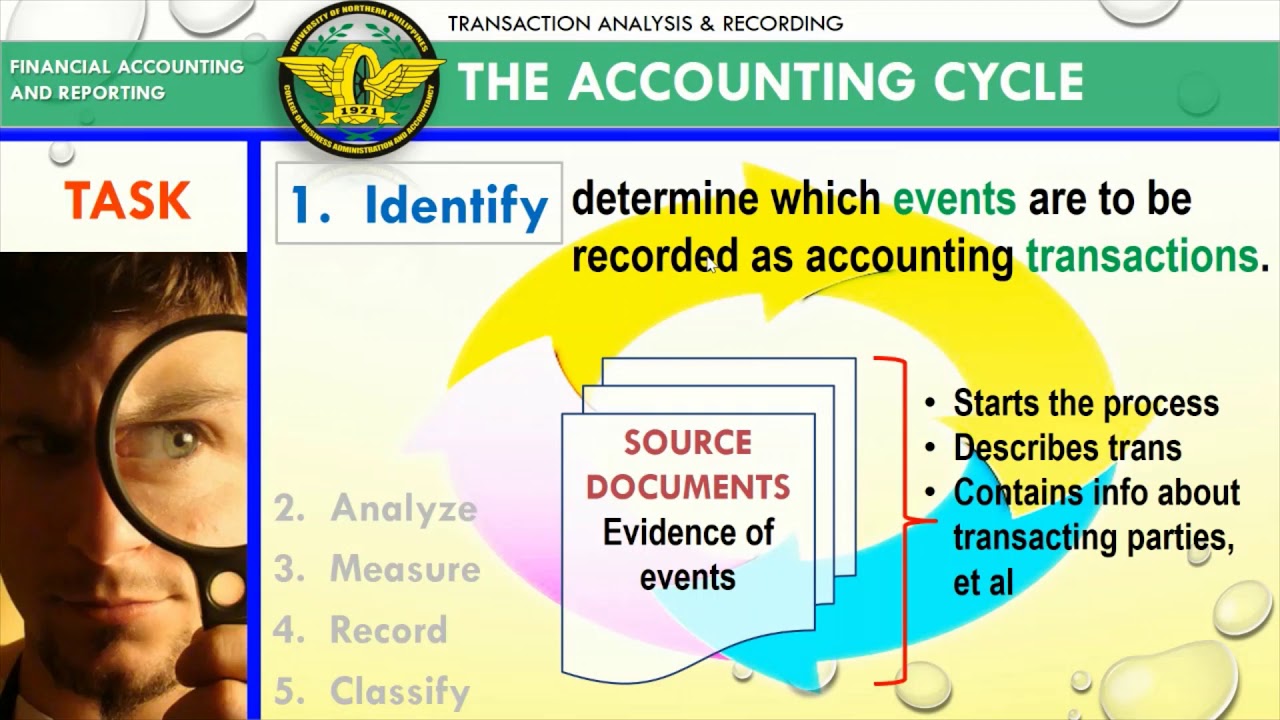

TLDRFinancial accounting is essential for recording, classifying, and summarizing a business's financial transactions. This practice provides valuable financial reports that aid in decision-making and financial planning. Adhering to established principles ensures that the reports are accurate, relevant, and timely. The four key financial reports are: the profit and loss report, the balance sheet, the cash flow report, and the capital change report. These reports are crucial for assessing a business’s performance, health, and financial stability, facilitating cooperation with investors, creditors, and business managers.

Takeaways

- 😀 Financial accounting is a science that teaches how to record, classify, and summarize financial transactions in a business entity.

- 😀 The primary goal of financial accounting is to provide relevant, accurate, and timely financial report information for decision-making and financial planning.

- 😀 Financial reports must comply with generally accepted principles or standards to ensure accuracy and reliability.

- 😀 Accurate financial reports are crucial for assessing business performance and objectives.

- 😀 Without accountable financial reports, it becomes difficult for a business entity to collaborate with investors or other parties.

- 😀 Financial reports serve as a bridge between business managers, creditors, and investors.

- 😀 There are four main financial reports that every business entity should present: profit and loss, balance sheet, cash flow, and capital change reports.

- 😀 The profit and loss report measures business performance by showing income generated and operational expenses.

- 😀 The balance sheet report assesses the financial health of a business, showing the proportion of assets, debts, and equity.

- 😀 The cash flow report explains the inflow and outflow of cash from investment, financing, and operational activities.

- 😀 The capital change report indicates the changes in the business's capital over a specific period.

Q & A

What is financial accounting?

-Financial accounting is a science that teaches how to record, classify, and summarize financial transactions in a business entity, and how to interpret them for decision-making and financial planning.

Why is it important for financial accounting to be accurate, relevant, and timely?

-Accurate, relevant, and timely financial reports are essential because they provide essential information for assessing a business's performance, facilitating cooperation with external parties, and guiding decisions on investment and financial planning.

What could happen if a business entity cannot present accurate financial reports?

-If a business cannot present accurate financial reports, it will be difficult to assess its performance and objectives. It may also face challenges in establishing cooperation with investors and creditors.

What role do financial reports play in business?

-Financial reports serve as a bridge of information between business managers, creditors, and investors. They help in decision-making and assessing the financial health of the business.

What are the four main financial reports that a business entity must present?

-The four main financial reports are the profit and loss report, balance sheet report, cash flow report, and capital change report.

What is the purpose of the profit and loss report?

-The profit and loss report explains how much income is generated, along with operational expenses, to assess whether the business is making a profit or incurring a loss.

What does the balance sheet report reveal?

-The balance sheet report shows the portion of assets, debts, and capital in the business, helping to determine if the business is primarily financed by debt or equity.

How does the balance sheet help assess the business's health?

-By revealing the proportion of assets funded by debt or equity, the balance sheet helps assess the financial stability and health of the business.

What information does the cash flow report provide?

-The cash flow report provides information on the cash inflows and outflows from investment, financing, and operational activities, showing how cash is managed within the business.

What does the capital change report show?

-The capital change report explains the changes in the capital portion of a business, indicating whether the capital has increased or decreased during a specific period.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Meaning and Definitions & Attributes of Accounting | Class 11 Accountancy Chapter 1 | CBSE 2024

Transaction & Analysis Recording, Part I

ONLINE CLASSES| INTER 1ST YEAR MEC AND CEC\(ACCOUNTING) UNIT-1 BOOK KEEPING & ACCOUNTING IMPORTANT

Akuntansi Sebagai Sistem Informasi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

ACCOUNTING BASICS: a Guide to (Almost) Everything

WHAT IS ACCOUNTING?

5.0 / 5 (0 votes)