WHAT IS ACCOUNTING?

Summary

TLDRAccounting is the systematic process of recording, classifying, and summarizing financial transactions to inform business decisions. Accountants utilize various methods to analyze and report financial data, including financial statements, budgets, and cost-benefit analyses. They serve in diverse sectors like public firms, private businesses, government, and non-profits. Their tasks range from maintaining ledgers and preparing financial statements to advising on financial matters and ensuring regulatory compliance. Accountants can be specialized as CPAs, CAs, or management accountants, each with distinct roles, which will be detailed in subsequent videos.

Takeaways

- 📚 Accounting is the process of recording, classifying, and summarizing financial transactions to provide valuable information for business decisions.

- 🔍 Accountants employ various methods to collect, analyze, and report financial data, including financial statements, budgets, and cost-benefit analyses.

- 🏢 They may work in public accountancy firms, private businesses, government, or non-profit organizations.

- 📈 Accountants perform tasks such as recording financial transactions, preparing financial statements, and analyzing financial information to identify trends or issues.

- 💼 They provide financial advice to clients or managers and ensure compliance with financial regulations and laws.

- 🔍 Auditing and assurance services are part of an accountant's role to verify the accuracy of financial records.

- 💼 Accountants assist with tax preparation and planning, which is crucial for both individuals and businesses.

- 🏅 There are different types of accountants, such as Certified Public Accountants (CPA), Chartered Accountants (CA), and Management Accountants, each with specific roles.

- 📊 Accountants prepare key financial statements like balance sheets, income statements, and cash flow statements to provide a financial snapshot of a business.

- 🔑 Compliance with financial regulations is a critical aspect of accounting, ensuring that businesses operate within legal and ethical boundaries.

Q & A

What is the primary function of accounting?

-The primary function of accounting is to record, classify, and summarize financial transactions to provide useful information for business decisions.

What tools do accountants use to collect and analyze financial information?

-Accountants use a range of methods including financial statements, budgets, and cost-benefit analyses to collect, analyze, and report financial information.

In what types of organizations might accountants work?

-Accountants may work for public accountancy firms, private businesses, governments, and non-profit organizations.

What are some specific tasks that accountants perform?

-Accountants perform tasks such as recording financial transactions, preparing financial statements, analyzing financial information, providing financial advice, ensuring compliance with financial regulations, performing auditing services, and assisting with tax preparation and planning.

What is a financial statement and why is it important?

-A financial statement is a formal record of a company's financial activities, including balance sheets, income statements, and cash flow statements. It is important for understanding a company's financial health and making informed business decisions.

What does it mean to analyze financial information to identify trends or issues?

-Analyzing financial information to identify trends or issues involves examining financial data to recognize patterns, forecast future performance, and detect potential problems that may affect a company's financial stability.

What is the role of compliance with financial regulations and laws in accounting?

-Ensuring compliance with financial regulations and laws is crucial in accounting as it helps maintain the integrity of financial records, prevents fraud, and ensures that the company operates within the legal framework.

What are the different types of accountants mentioned in the script?

-The script mentions Certified Public Accountants (CPA), Chartered Accountants (CA), and Management Accountants as different types of accountants.

What is a Certified Public Accountant (CPA) and what do they do?

-A Certified Public Accountant (CPA) is a licensed professional who provides accounting services to the public. They often specialize in auditing, taxation, and financial advisory services.

What is a Chartered Accountant (CA) and what are their responsibilities?

-A Chartered Accountant (CA) is a designation for professionals who have completed a rigorous program of study, examination, and practical experience. They are responsible for a wide range of accounting services, including auditing, financial reporting, and business advisory.

What is a Management Accountant and how do they differ from other accountants?

-A Management Accountant focuses on providing financial information to internal management for decision-making purposes. They differ from other accountants in that they work closely with management to analyze financial data and provide insights to improve business operations.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Meaning and Definitions & Attributes of Accounting | Class 11 Accountancy Chapter 1 | CBSE 2024

ONLINE CLASSES| INTER 1ST YEAR MEC AND CEC\(ACCOUNTING) UNIT-1 BOOK KEEPING & ACCOUNTING IMPORTANT

Video Riset 33

Introduction To Accounting | Meaning, Definition And Objectives Of Accounting | Class 11 Accounts |

Akuntansi Sebagai Sistem Informasi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

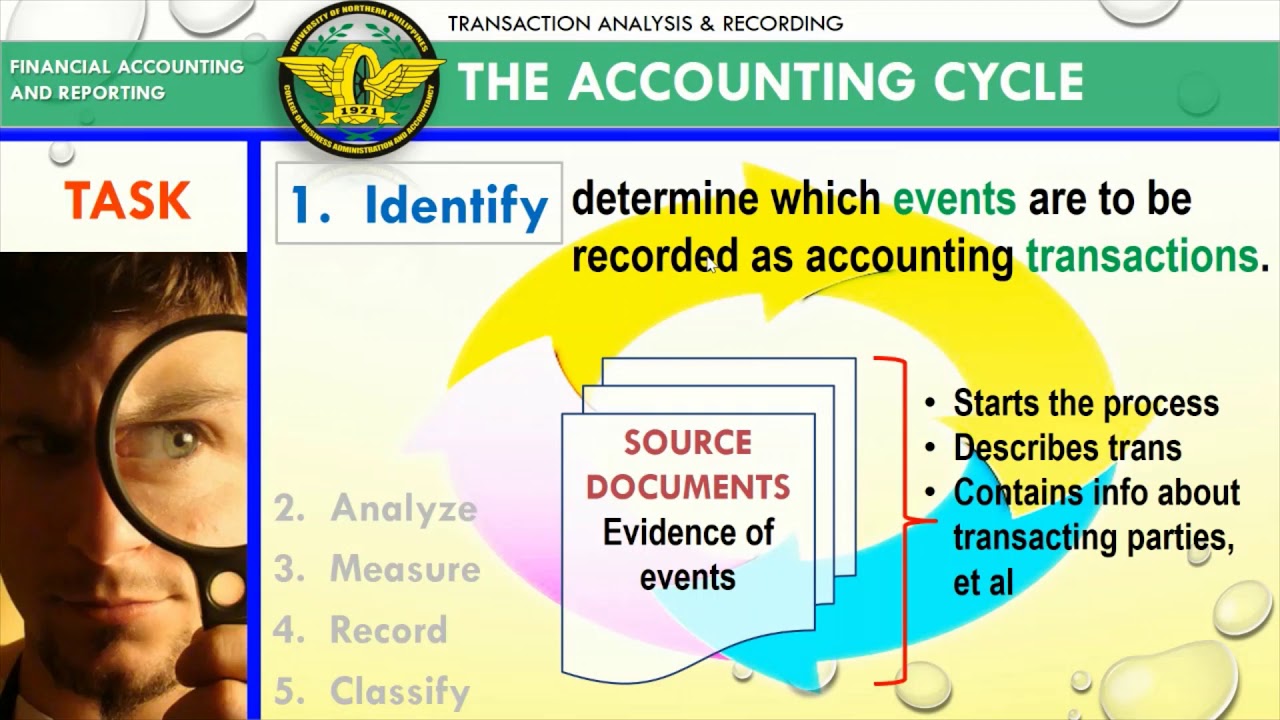

Transaction & Analysis Recording, Part I

5.0 / 5 (0 votes)