PPh Orang Pribadi (Update 2023) - 13. Panduan Pengisian SPT 1770 (Status KK)

Summary

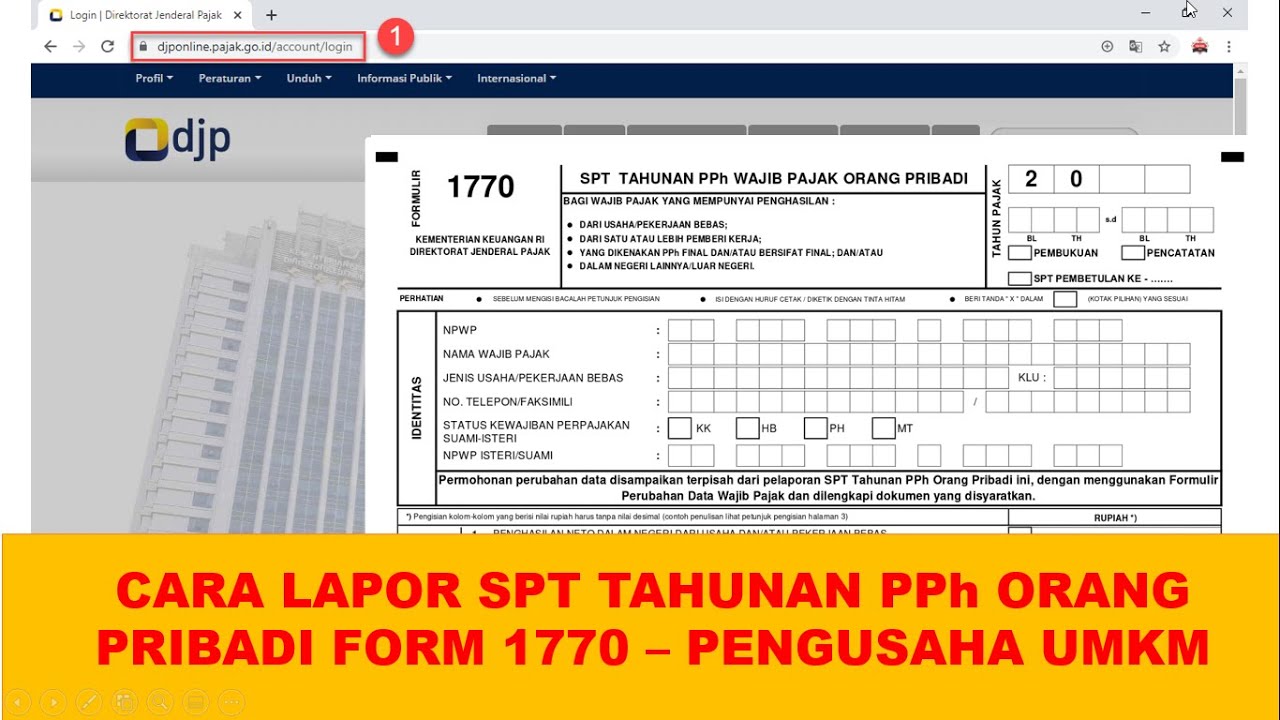

TLDRThis video provides a detailed guide on filling out the SPT 1770 tax form, focusing on specific cases such as that of Pak Puja Wibowo. The speaker walks through various sections, including family status, income reporting, and tax calculations, while highlighting the process of filling out the form manually using Excel. Key points include handling PPh 23, PP 23, and international income, as well as how to calculate tax obligations. The video is aimed at helping individuals navigate the complexities of tax reporting, with an emphasis on practical, step-by-step guidance.

Takeaways

- 😀 The video explains how to report SPT 1770, with a focus on the 'KK' status (family card) and the case of Pak Puja Wibowo.

- 😀 The speaker initially tried using DJP online form but encountered issues with hidden personal details, so switched to Excel for easier reporting.

- 😀 Excel format allows easier entry of personal and family data compared to the official DJP online system, which automatically fills some fields.

- 😀 The speaker walks through the required sections in the SPT, such as asset lists, liabilities, and family details.

- 😀 When reporting debts, the code for the type of loan is selected from a dropdown, and the lender's name, address, and loan amount need to be entered.

- 😀 SPT 1770 includes fields for non-taxable income, such as certain family earnings or income exempt from tax.

- 😀 For the case of Pak Puja Wibowo, he has a business with an income of 2.4 billion, using PP 23 tax regulations, which reduces his taxable income.

- 😀 The tax report involves calculations based on business revenue, and the applicable tax rate under PP 23, which is 0.5% for earnings between 100 million and 500 million.

- 😀 The SPT form includes sections for income, deductions, and final tax payments. Data from the past tax year and withholding certificates (bukti potong) are used.

- 😀 The video mentions that the SPT includes forms for different income types, like wages and income from services, and it also discusses the tax calculation for overseas income.

Q & A

What is the purpose of the SPT 1770 form?

-The SPT 1770 form is an annual tax return used by individuals in Indonesia to report their income, deductions, and other tax-related information. It is crucial for tax compliance.

Why did the speaker decide to use Excel instead of the DJP online form?

-The speaker found that some personal information could not be hidden or removed from the DJP online form, leading them to choose Excel for easier customization and privacy.

What is the role of the PP23 regulation mentioned in the transcript?

-PP23 refers to a tax regulation for businesses with revenue below a certain threshold. It provides a simplified tax rate, and in this case, the speaker used it for a business with a revenue of 2.4 billion IDR.

How does the tax calculation for PP23 work in this example?

-For the PP23 tax calculation, the first 200 million IDR is exempt from tax. The remaining amount is taxed at a rate of 0.5%. For example, 100 million IDR is taxed at 0.5%, resulting in a tax of 9.5 million IDR.

What is the importance of the 'bukti potong' or tax withholding certificates in the process?

-'Bukti potong' are tax certificates that show the amount of tax withheld from a person’s income. They are necessary for reporting income and tax deductions in the SPT 1770 form.

What is the significance of the 'penghasilan lainnya yang tidak termasuk objek pajak' section?

-This section records income that is not subject to taxation. It helps ensure that non-taxable income is properly documented and excluded from the tax calculation.

How does the speaker handle foreign income in the tax return?

-The speaker includes foreign income in the tax return and calculates its taxable amount. For example, a foreign income of 100 million IDR is subject to tax, and a credit for tax paid abroad is calculated accordingly.

What challenges are mentioned regarding filling out the SPT 1770 form?

-One challenge mentioned is the difficulty in using the DJP online form due to certain information not being removable or hidden, which prompted the speaker to switch to Excel for better control.

How is the income from 'PT maju bersama' reported in the form?

-The income from 'PT maju bersama' is reported with details such as NPWP, income amount (260 million IDR), and the tax withheld (9.5 million IDR). This information is crucial for calculating the tax due.

What is the process for handling foreign tax credits in the SPT 1770 form?

-Foreign tax credits are handled by calculating the amount of tax paid abroad and applying it against the domestic tax liability. In this case, the speaker calculates the foreign income tax credit based on 100 million IDR of foreign income.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Cara Lapor SPT Tahunan untuk Orang Pribadi Pengusaha dan Pekerja Bebas

Cara Lapor SPT Masa PPN Lebih Bayar Kompensasi | Tutorial Lengkap

Tutorial Pelaporan SPT Tahunan 1770 | Bagi WP Orang Pribadi dengan e-Form

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Tutorial Pengisian SPT 1771 Melalui e-Form - WP Badan UMKM

PPh Orang Pribadi (Update 2023) - 12. Panduan Pengisian SPT 1770S Menggunakan E-Filing

5.0 / 5 (0 votes)