Cara Lapor SPT Tahunan untuk Orang Pribadi Pengusaha dan Pekerja Bebas

Summary

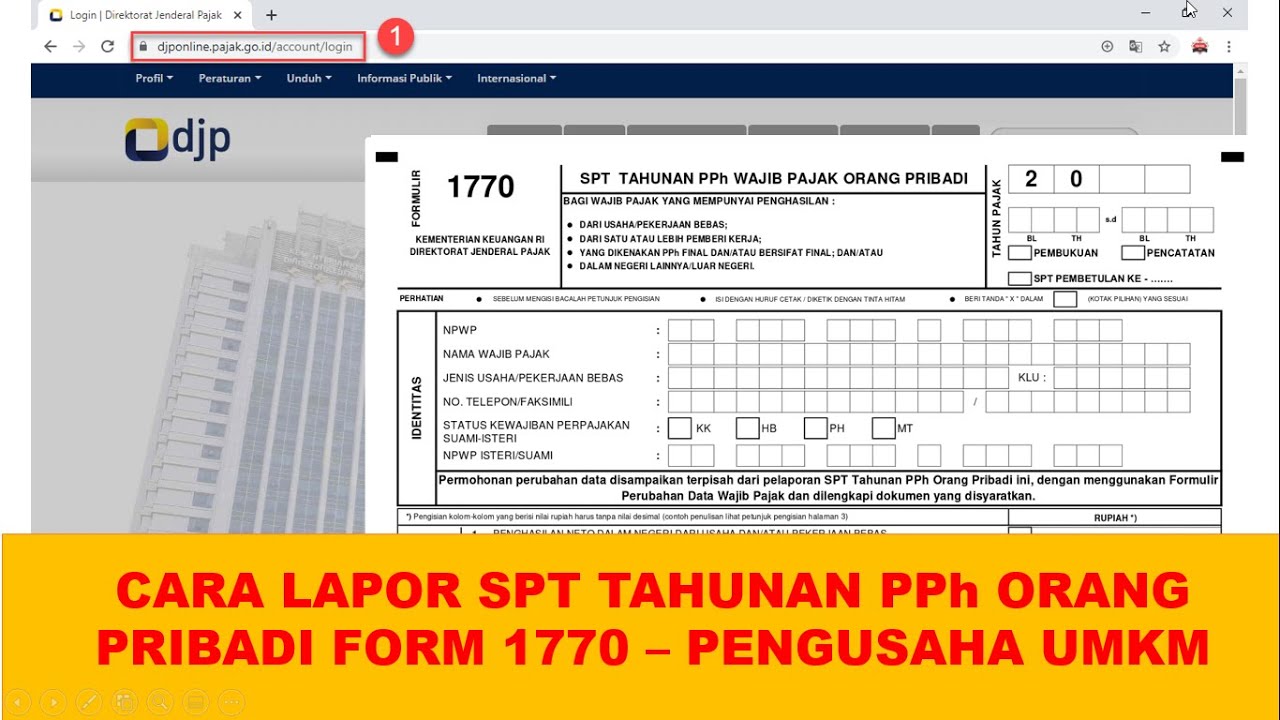

TLDRIn this comprehensive tutorial, viewers are guided through the process of filling out the SPT 1770 tax form in Indonesia. The presenter demonstrates how to log into the online tax portal, select the correct form, and enter necessary financial information. Key steps include reporting income, managing deductions, and ensuring accurate submission of documents. The video also highlights essential tips for taxpayers, such as the importance of verifying entries and understanding tax rates for different income levels. Overall, the tutorial aims to simplify tax reporting, making it accessible and straightforward for users.

Takeaways

- 😀 Introduction to filling out the SPT 1770 tax form using the DJP online platform.

- 📑 To access the tax form, log in at pajak.go.id using your NPWP, password, and security code.

- 🔄 The SPT 1770 form can be filled out online, but certain versions must be downloaded and filled in Adobe Reader.

- 🗂️ Ensure the correct version of the form is downloaded based on your system specifications (32-bit or 64-bit).

- 📅 Select the appropriate tax year and reporting status when filling out the form.

- 💼 Include a detailed list of assets and liabilities in the tax declaration.

- 📊 If applicable, provide proof of tax deductions and any other income sources.

- 🧾 Ensure all information is accurate to avoid double reporting or discrepancies.

- 🚨 If there are overpayments, taxpayers can request refunds or adjustments through specific procedures.

- ✅ Confirm submission by receiving a verification code via email after uploading necessary documents.

Q & A

What is the main purpose of the video?

-The main purpose of the video is to simulate the process of filling out SPT 1770, which is the annual tax return for individuals in Indonesia.

How do you log in to the DJP Online system?

-To log in to the DJP Online system, navigate to pajak.go.id, enter your NPWP (Taxpayer Identification Number), password, and the security code.

What should you do if you are unfamiliar with the registration process?

-If you are unfamiliar with the registration process, it is recommended to watch the previous videos provided on the channel for guidance.

What steps should be taken after selecting the SPT 1770 option?

-After selecting the SPT 1770 option, you should choose the relevant tax status and the reporting year before proceeding to fill out the form.

Why is Adobe Reader mentioned in the process?

-Adobe Reader is mentioned because the downloaded form needs to be opened and filled out using this software, as it is compatible with the form format.

What type of income needs to be reported on the SPT 1770?

-The SPT 1770 requires reporting of various income types, including income from employment, investments, and any other taxable sources.

What is the significance of the PP 23 tax regulation mentioned?

-PP 23 is a tax regulation for taxpayers with an annual turnover below 4.8 billion IDR, allowing them to be taxed at a lower rate of 0.5% on their gross turnover.

What should a taxpayer do if they have overpaid their taxes?

-If a taxpayer has overpaid their taxes, they have options to either reclaim the overpayment or carry it forward as a credit against future tax liabilities.

What must be done if a taxpayer has an underpayment?

-If there is an underpayment, the taxpayer must first pay the owed amount before submitting the SPT.

What is the final step after completing the SPT submission?

-The final step after completing the SPT submission is to review the SPT list for confirmation and to ensure all necessary documents have been uploaded.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Tutorial Pelaporan SPT Tahunan 1770 | Bagi WP Orang Pribadi dengan e-Form

PPh Orang Pribadi (Update 2023) - 13. Panduan Pengisian SPT 1770 (Status KK)

Tutorial Pengisian SPT 1771 Melalui e-Form - WP Badan UMKM

Cara Lapor SPT Masa PPN Lebih Bayar Kompensasi | Tutorial Lengkap

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Cara Pelaporan (SPT) Pajak Tahunan PNS diatas 60 juta tahun 2023

5.0 / 5 (0 votes)