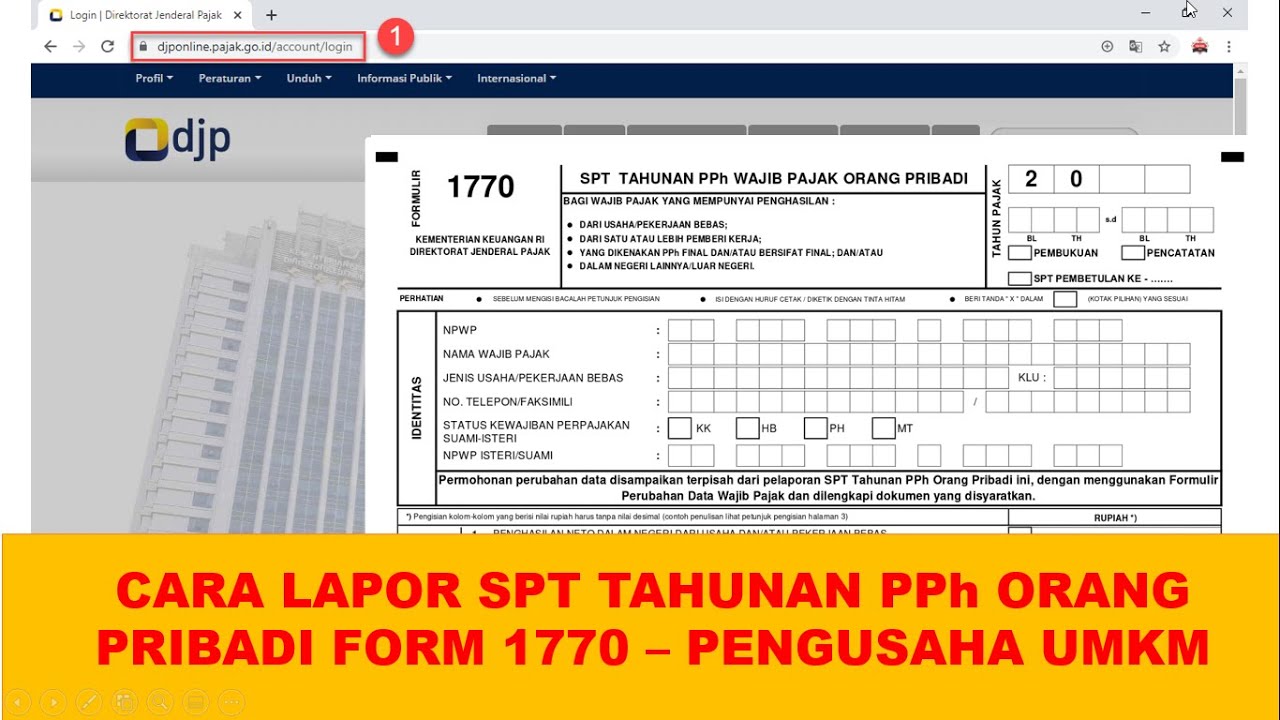

Tutorial Pelaporan SPT Tahunan 1770 | Bagi WP Orang Pribadi dengan e-Form

Summary

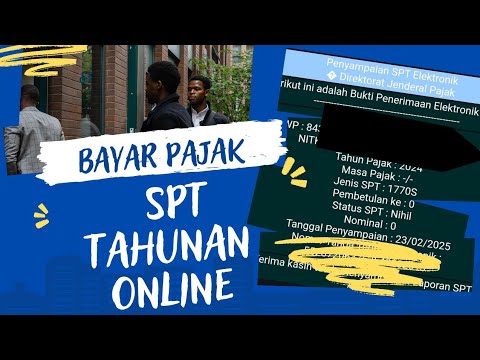

TLDRThis tutorial guides individual taxpayers in Indonesia through the process of completing the e-SPT 1770 form for tax reporting. It covers key steps, including logging into the official tax portal, selecting the correct form, filling in personal, income, asset, and debt details, and attaching necessary documents. It also highlights how to handle tax adjustments and corrections. After completing the form, users are instructed on how to submit it and receive an electronic receipt. The tutorial is ideal for business owners and freelancers seeking to meet their tax obligations efficiently.

Takeaways

- 😀 Visit www.pajak.go.id to start the e-form submission for your tax report.

- 😀 Log in using your NPWP (Taxpayer Identification Number), password, and security code to access your dashboard.

- 😀 Choose the appropriate tax year and whether you are submitting a correction to a previous report.

- 😀 Ensure Adobe Reader is installed on your device for smooth form filling and submission.

- 😀 Fill in your assets, including type, description, and acquisition cost, under the asset section.

- 😀 List your liabilities, including creditor name, loan amount, and other relevant details, under the liabilities section.

- 😀 Include family members' details under the family composition section of the form.

- 😀 Fill in your final income data and tax deductions in the designated sections using your proof of tax deductions.

- 😀 Adjust your fiscal calculations (positive or negative adjustments) if necessary, especially for business expenses and costs.

- 😀 Provide information about non-final income or additional taxable income in the form’s respective sections.

- 😀 Review your form before submitting and attach necessary documents, such as your tax payment receipt and verification code sent to your email.

Q & A

What is the first step in filling out the SPT 1770 e-form?

-The first step is to visit the official tax website at www.pajak.go.id, log in using your Taxpayer Identification Number (NPWP), password, and security code.

What should you do if you don’t have Adobe Reader installed on your device?

-You need to download and install Adobe Reader. You can click the download link on the page if it's not installed.

How do you initiate the process of creating an SPT form on the website?

-After logging in, go to the dashboard and click on the 'Lapor' tab, then select 'e-Form'.

What is the significance of the 'Pembetulan' option in the form?

-The 'Pembetulan' option is selected if you are making a correction to an SPT that has already been submitted previously.

How do you enter asset data in the SPT form?

-In the asset section, list the assets you have at the end of the year. If you want to add more assets, click the 'Add' symbol, enter the asset's code, description, acquisition year, and its purchase value.

What is required when filling out the debt section of the form?

-In the debt section, you must input details such as the type of debt, lender's name, lender's address, loan year, and remaining debt at the end of the year. You can add more debts by clicking the 'Add' symbol.

How should you fill in the family member section in the form?

-In the family section, input the details of family members according to your situation at the beginning of the tax year.

What is the role of the 'Lampiran 3' section in the form?

-In Lampiran 3, you must report any final income received, such as from UMKM (small businesses), and the tax deducted. The system will automatically calculate the total tax owed.

What happens if you don't keep bookkeeping records?

-If you do not maintain bookkeeping, you will need to report your gross income, apply the prescribed business norms, and calculate the net income based on these norms.

How do you report your tax obligations if you have paid monthly tax installments?

-If you have paid monthly tax installments under Article 25 of the Income Tax Law, you should input the amount you have already paid in the provided section on the form.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Lapor SPT Tahunan untuk Orang Pribadi Pengusaha dan Pekerja Bebas

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Tutorial Cara Lapor SPT Masa PPN di Coretax di 2025 Status Nihil, Kurang Bayar/LB & Blling PPN

Tutorial Pengisian SPT 1771 Melalui e-Form - WP Badan UMKM

Cara Lapor Spt Online Tahun 2025

PPh Orang Pribadi (Update 2023) - 13. Panduan Pengisian SPT 1770 (Status KK)

5.0 / 5 (0 votes)