Stanley Druckenmiller: Tariffs are simply a consumption tax that foreigners pay for some of it

Summary

TLDRIn this insightful interview, Stan discusses his continued short position on U.S. Treasuries, emphasizing his belief that the Federal Reserve is making a mistake with its monetary policies. He expresses concerns about the country's fiscal situation, particularly the growing deficit and mandatory spending. Stan acknowledges the potential role of tariffs as a necessary but imperfect solution to generate revenue, contrasting them with income taxes. He also shares his thoughts on Scott Bessent's appointment as Treasury Secretary, praising his capabilities but warning of the immense fiscal challenges ahead, particularly regarding inflation and interest expenses.

Takeaways

- 😀 The speaker maintains a short position on U.S. Treasuries, anticipating continued inflation and a poor fiscal situation despite the Federal Reserve's actions.

- 😀 The speaker acknowledges surprise at the rising interest rates following the Federal Reserve's cut but believes the Fed is making a mistake.

- 😀 The speaker views the current fiscal situation as dire, with mandatory spending and interest expenses consuming almost 100% of federal revenues.

- 😀 The speaker suggests that the U.S. may have no choice but to implement tariffs as a form of revenue generation to address the fiscal crisis.

- 😀 Tariffs are considered the 'lesser evil' compared to income or consumption taxes, but the risks of retaliation are acknowledged.

- 😀 The speaker believes tariffs function similarly to a consumption tax, with foreigners shouldering a portion of the cost, but warns about possible consequences.

- 😀 The speaker expresses skepticism about the success of tariff policies due to potential backlash but thinks the rewards may outweigh the risks.

- 😀 Scott Bessent, the incoming Treasury Secretary, is highly regarded for his market knowledge and experience, especially his involvement in global markets.

- 😀 The speaker suggests that Scott Bessent understands the fiscal situation well but is concerned about the broader issues facing the Treasury Department, particularly the growing deficit.

- 😀 The speaker is doubtful about the possibility of significant fiscal reform, even with Bessent's capabilities, given the scale of the country's debt and deficit issues.

Q & A

Why is the speaker shorting U.S. Treasuries?

-The speaker believes the Federal Reserve is making a mistake with its interest rate cuts and is concerned about the U.S.'s fiscal situation. They foresee inflationary pressures and the possibility that the bond market could be negatively impacted, making them remain short on U.S. Treasuries.

What does the speaker mean by 'seventh inning' in economic terms?

-The 'seventh inning' metaphor refers to being relatively late in an economic cycle, where there may still be opportunities for profit, but the situation is approaching its end. The speaker suggests that we are nearing the end of a cycle but acknowledges that significant financial opportunities remain.

How does the speaker view the risks of tariffs as a fiscal solution?

-The speaker acknowledges that tariffs could be a necessary fiscal measure due to the U.S.'s deficit and low private savings. They see tariffs as a form of consumption tax, which is the lesser evil compared to income or consumption taxes, though they warn of retaliation risks, which they believe are overstated.

Why does the speaker describe tariffs as 'a consumption tax that foreigners pay for some of it'?

-The speaker compares tariffs to a consumption tax because they believe tariffs primarily affect consumers of imported goods. They also suggest that because foreign entities bear some of the cost through increased prices, tariffs may not be as burdensome for Americans compared to other forms of taxation.

What are the fiscal challenges that the U.S. is facing, according to the speaker?

-The speaker highlights the U.S.'s massive fiscal deficit, which stands at 6.7% of GDP, and the growing interest expenses due to high national debt. They also emphasize the inability of both political parties to cut entitlement spending, which exacerbates the fiscal situation.

How does the speaker view Scott Bessent's appointment as Treasury Secretary?

-The speaker expresses confidence in Scott Bessent's capabilities, describing him as highly intelligent, experienced in global markets, and capable of understanding fiscal issues. However, they are cautious and skeptical about the potential for significant change given the scale of the fiscal challenges.

What is the speaker's concern about the U.S. fiscal situation under the new administration?

-The speaker is concerned that the fiscal situation will worsen due to the combination of rising interest payments, a growing deficit, and the administration's commitments not to raise taxes on certain groups, which complicates the ability to manage the fiscal crisis.

What does the speaker say about the potential for inflation and its impact on the economy?

-The speaker warns that inflation could rise due to the Federal Reserve's actions and the broader economic situation. They do not expect lower inflation and suggest that a surge in inflation could create a problem in the bond market, making their short position on Treasuries even more significant.

Why does the speaker express skepticism about the future of fiscal reforms?

-The speaker is skeptical due to the entrenched political gridlock and the size of the fiscal problems at hand. They doubt significant reforms will occur and express cynicism about the ability to reduce the deficit or control inflation meaningfully.

What specific fiscal reforms does the speaker hope for?

-The speaker hopes for reductions in entitlement spending and suggests that tariff revenues could help reduce the deficit. They also express some hope that fiscal reforms could potentially cut down the deficit by $1 trillion or more over the next decade, but remain doubtful about such changes occurring.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

minhas últimas operações com OPÇÕES na pratica do ano

Stephen King on the Craft of Short Story Writing

Steve Carell Explains Fine Dining Standards To Gordon Ramsay | Uncut | The Jonathan Ross Show

How Chris Walker Approaches B2B GTM Strategy in 2024

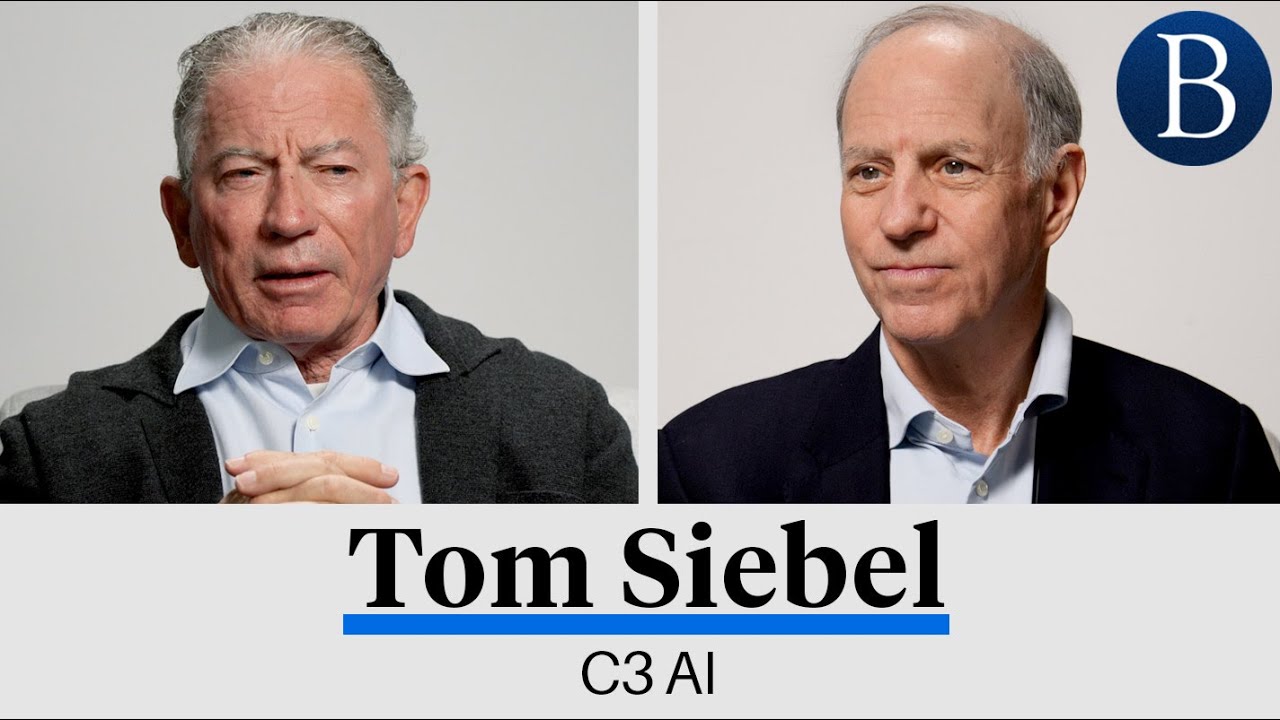

C3 AI's Billionaire CEO on How AI Will Change Our Lives | At Barron's

FEDERALES TENIAN EN LA MIRA A CDOBLETA

5.0 / 5 (0 votes)