PPN & Fasilitas super mewah Pejabat Indonesia

Summary

TLDRIn this vlog, the speaker critiques Indonesia's upcoming VAT increase to 12% in 2025, highlighting its disproportionate impact on the public while government officials continue to enjoy luxurious privileges. Drawing comparisons with Scandinavian countries, the speaker argues that the lack of fairness in Indonesia's tax system and the excessive perks for officials contribute to public dissatisfaction. Emphasizing the need for political will and systemic reforms, the speaker calls for the government to lead by example, reducing corruption and excess, while ensuring that tax policies benefit all citizens equitably, not just the elite.

Takeaways

- 😀 The speaker disagrees with the proposed increase in VAT (PPN) from 11% to 12%, citing that no one enjoys being taxed more, regardless of their love for the country.

- 😀 The speaker contrasts Indonesia with Scandinavian countries, where despite higher taxes, public services like education, healthcare, and social welfare are available to all citizens.

- 😀 In Scandinavian countries, high taxes are accepted due to the extensive benefits provided to the public, which is not the case in Indonesia, where public officials enjoy lavish privileges.

- 😀 Public officials in Indonesia enjoy extraordinary benefits such as multiple government-provided luxury cars and houses, with the costs borne by the state.

- 😀 The contrast between the wealth and privileges of Indonesian public officials and the struggles of ordinary citizens fuels public resistance to policies like the VAT increase.

- 😀 The speaker emphasizes that while the government is pushing for a healthier and more efficient national budget, it is unfair for the public to bear the burden of fiscal policy while officials live in luxury.

- 😀 The speaker criticizes the inefficiency of public spending, noting that a significant portion of the state budget goes to the salaries and privileges of public officials, while regular citizens face poverty and hardship.

- 😀 The government’s failure to address the vast inequality between officials and the public contributes to a lack of trust, making it difficult for the public to accept unpopular policies.

- 😀 Public resistance to the VAT increase stems from a sense of injustice, not ignorance or misunderstanding of the policy’s necessity, as the government continues to prioritize the privileges of the elite.

- 😀 The speaker argues that effective governance and public support can be achieved if the government first addresses the privileges of public officials and demonstrates solidarity with the people by sharing the burdens of public policy.

Q & A

Why does the speaker disagree with the increase in VAT (PPN) to 12% in Indonesia?

-The speaker disagrees with the VAT increase because, naturally, no one likes paying taxes. They believe the public resistance is not based on ignorance, but rather on a sense of injustice, as many people already struggle with economic pressures while the wealthiest public officials enjoy significant perks.

How does the speaker compare Indonesia's tax system to Scandinavian countries?

-The speaker compares Indonesia with Scandinavian countries like Sweden and Norway, where high taxes are accepted due to the comprehensive public services provided, such as healthcare, education, and social security. The speaker argues that in contrast, the perks in Indonesia disproportionately benefit the elite public officials rather than the general public.

What is the core issue with Indonesia's public servants and their benefits according to the speaker?

-The core issue is that Indonesian public servants, especially at high levels, enjoy lavish perks such as multiple official residences and luxury vehicles, which are funded by taxpayers. Meanwhile, the general population faces economic struggles and high taxes, creating a stark disparity.

How does the speaker view the relationship between public servants' perks and the general public's tax burden?

-The speaker views the relationship as deeply inequitable. Public servants are enjoying immense privileges funded by taxpayer money, while the public bears the burden of the tax hikes. The speaker argues that this imbalance is a key factor in the public's resistance to the VAT increase.

What examples of government officials' luxuries does the speaker provide?

-The speaker provides examples such as public officials owning multiple official residences, with costs like electricity, water, and security covered by the state. They also mention luxury vehicles like Mercedes-Benz and Range Rover as part of the official fleets, which are not subject to taxes and can be used for personal purposes.

What is the speaker's critique of the Indonesian government's approach to addressing inequality?

-The speaker critiques the government's failure to address the vast inequality in the country. Despite the enormous government spending on officials' perks, there is a significant gap between the privileges enjoyed by the elite and the hardships faced by the general population, including the persistence of poverty among many public servants.

How does the speaker feel about Indonesia's ambition to join the OECD?

-The speaker acknowledges Indonesia's ambition to join the OECD but views it skeptically, especially considering the recommendations from the OECD regarding tax efficiency and VAT increases. The speaker believes that the government's commitment to reform is still lacking, particularly when it comes to addressing corruption and inequality.

What is the OECD's role in shaping Indonesia's tax policies?

-The OECD recommends that Indonesia improve the efficiency of its public finances, including increasing VAT and expanding the tax base. The speaker notes that this advice is influencing Indonesia's tax policies, even though the policies may not align with the best interests of the general public.

What is the speaker's suggestion for how the government should demonstrate political will?

-The speaker suggests that the government should first lead by example by reducing the extravagant perks enjoyed by public officials. Only when the government demonstrates a genuine commitment to reforming its own privileges and aligning with public interests will citizens support policies like the VAT increase.

What does the speaker believe is the key to achieving good governance in Indonesia?

-The speaker believes that good governance in Indonesia can only be achieved when the government shows political will to address corruption, reduce the wealth gap, and prioritize public welfare over the interests of the elite. Without this shift, the speaker argues that no policy, even those with good intentions, can achieve its desired outcome.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Why Indonesia Keeps Raising Taxes | Value Added Tax (VAT)

Anggaran Tekor, PPN Capai Rekor

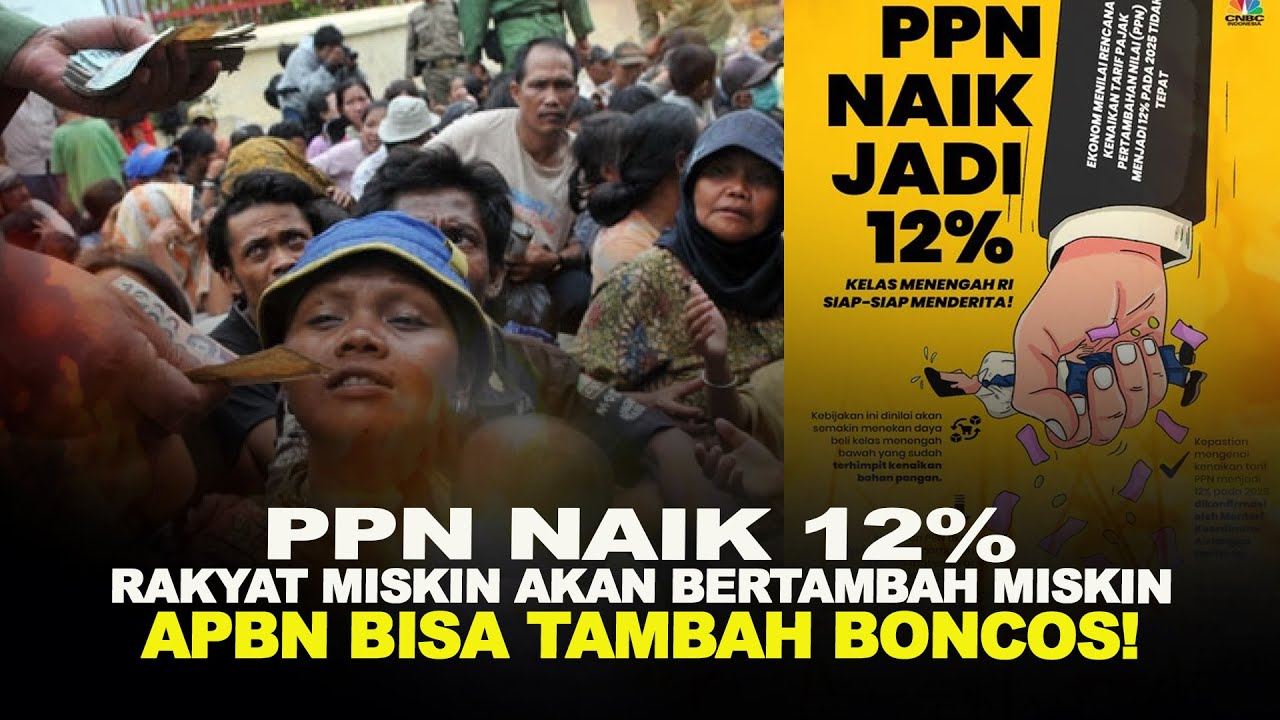

PPN NAIK 12%, RAKYAT MISKIN AKAN BERTAMBAH MISKIN. APBN BISA TAMBAH BONCOS!

PPN 12 Persen Tetap Berlaku 1 Januari 2025, tapi Bukan untuk Rakyat Kecil

Tarif PPN RI Terbesar Kedua di ASEAN, Ini Efek Kengeriannya

Memahami Kenaikan Tarif PPN 12%

5.0 / 5 (0 votes)