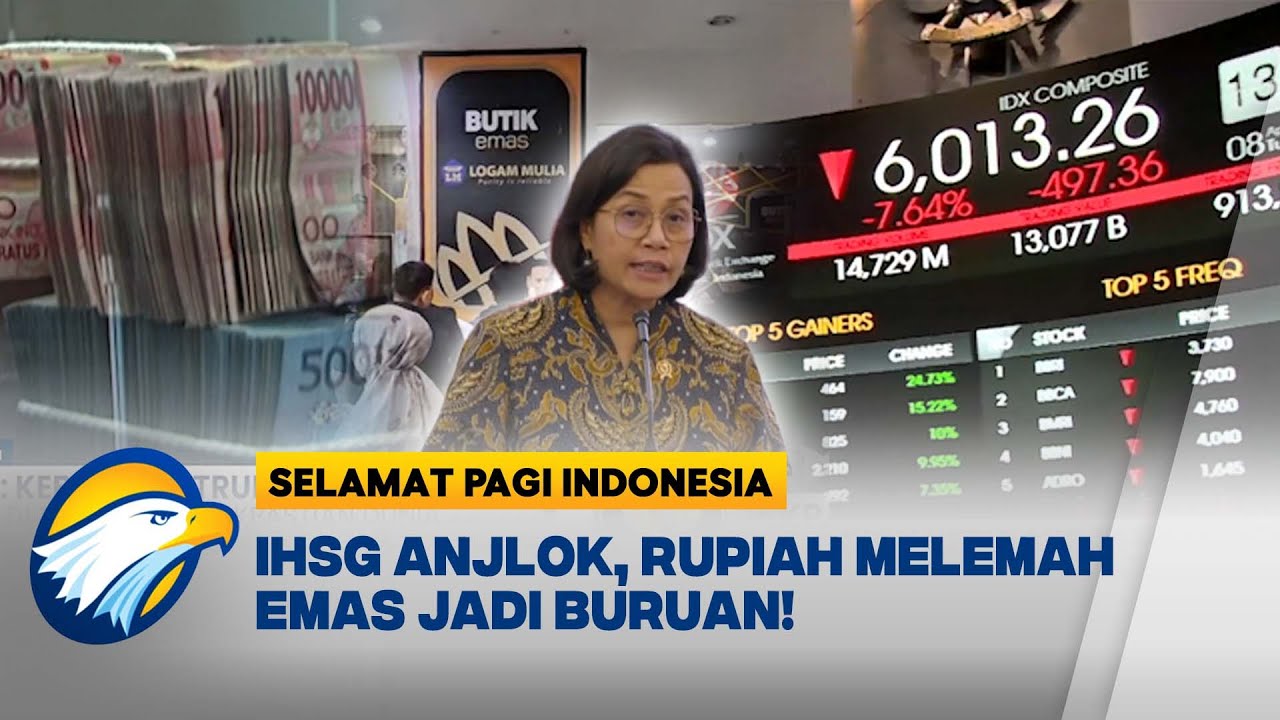

Asing Kabur, IHSG Memerah & Rupiah Anjlok ke Rp16.000 Per USD

Summary

TLDRThe Indonesian stock market (IHSG) is facing volatility due to a mix of domestic and global factors. Key influences include anticipated interest rate decisions from Bank Indonesia and the U.S. Federal Reserve, along with the impact of a VAT increase to 12% in 2024. While the trade surplus offers some positive sentiment, concerns about inflation, the weakening rupiah, and potential foreign capital outflows are creating uncertainty. The market is expected to consolidate between 7,000 and 7,500 points, with a potential 'Santa Claus rally' if rate cuts materialize, offering hope for a year-end boost.

Takeaways

- 😀 The Indonesian stock market (IHSG) is currently facing volatility due to a mix of internal and external factors, with investor sentiment being significantly influenced by upcoming interest rate decisions from Bank Indonesia and the Federal Reserve.

- 😀 The market is awaiting critical monetary policy announcements from Bank Indonesia on the 18th and the Federal Reserve on the 19th, which are expected to shape market direction for the rest of the year.

- 😀 The recent increase in Indonesia's VAT to 12% will likely impact investor sentiment. The government aims to increase revenue while managing consumer purchasing power, though its long-term effects are uncertain.

- 😀 The weakening Indonesian rupiah, which has crossed the 16,000 level against the US dollar, is contributing to a shift in investment towards safer assets, further pressuring the domestic stock market.

- 😀 The uncertainty around global economic conditions, including rising US Treasury yields and inflation data, is causing pessimism in the market and raising concerns over the prospect of interest rate cuts in the US.

- 😀 The trade surplus in Indonesia, largely driven by declining imports, is seen as a positive sign for the economy, though it reflects a broader trend of businesses holding back on imports due to the weak rupiah.

- 😀 Despite the trade surplus, the weak rupiah is increasing the cost of imports, which could negatively affect businesses, especially those reliant on foreign goods and services.

- 😀 The stock market is expected to remain volatile until key decisions are made regarding interest rates. The IHSG may fluctuate between 7,000 and 7,500 points, with 7,000 being a strong support level.

- 😀 If interest rates are cut, this could trigger a market rally, with the potential for a 'Santa Claus rally' into the new year and positive momentum in the early months of 2024.

- 😀 If the Fed and Bank Indonesia signal a continuation of restrictive policies or raise interest rates further, it could dampen market expectations, leading to more pessimism and potential capital outflows.

Q & A

What is the current sentiment affecting the performance of the Indonesian stock market (IHSG)?

-The Indonesian stock market (IHSG) is currently affected by various uncertainties. This includes domestic factors like the upcoming interest rate decisions by Bank Indonesia and The Fed, as well as external factors such as global economic conditions. The market is seeing volatility as investors await clarity on these issues.

How are interest rate policies influencing market behavior in Indonesia right now?

-Interest rate policies from both Bank Indonesia and The Fed are creating uncertainty. Investors are particularly focused on the upcoming announcements, which are expected to influence market movements. A potential interest rate reduction could bring optimism, while a lack of action or a more hawkish stance could dampen market sentiment.

What impact is the VAT increase to 12% expected to have on Indonesia's economy?

-The increase in VAT to 12% is expected to have a mixed impact. On one hand, it is meant to boost government revenue, but on the other, it could burden consumers and businesses, especially those in the middle-income bracket. The overall effect on the economy will depend on how well the government can manage inflation and consumer purchasing power.

How does the depreciation of the rupiah affect the stock market and investor sentiment in Indonesia?

-The depreciation of the rupiah is a significant concern as it makes imports more expensive and affects business costs. This leads to a cautious sentiment among investors, especially foreign ones, who may pull their investments out of the market. The weakening of the rupiah also puts pressure on the stock market, making it more volatile.

What role does external economic uncertainty play in the current market conditions in Indonesia?

-External economic uncertainty, particularly from global inflation data, U.S. monetary policy, and geopolitical events, is contributing to investor caution. The anticipation of policy shifts, especially by The Fed, has created a wait-and-see attitude in the market, with potential foreign capital outflows if the global environment remains unstable.

How does Indonesia's trade balance impact market sentiment despite other uncertainties?

-Indonesia’s trade balance remains in surplus, which is a positive indicator for the economy. However, the trade surplus is partly due to reduced imports, as businesses are holding back on purchasing foreign goods due to the weak rupiah. While this helps the trade balance, it also signals a slowdown in economic activity, which could be a concern for investors.

What is the likely short-term outlook for the Indonesian stock market given the current uncertainties?

-The short-term outlook for the Indonesian stock market is uncertain, with potential for consolidation within the 7,000–7,500 range. The market is expected to remain volatile, with key decisions regarding interest rates and inflation data likely to influence the market direction. There could be a rally if the outlook improves, but if investor pessimism persists, further declines are possible.

What is the significance of the upcoming announcements from Bank Indonesia and The Fed on Indonesia's financial markets?

-The announcements from Bank Indonesia and The Fed are critical in shaping the market's direction. Investors are particularly focused on any changes in interest rates, as this will affect liquidity, foreign investment, and overall market sentiment. A rate cut could boost confidence, while a rate hike or more hawkish stance could lead to a market pullback.

How do the upcoming changes in government policies, such as the VAT increase and social insurance rate hikes, affect consumer behavior?

-The increase in VAT and other policy changes, like higher social insurance rates (BPJS), could strain the disposable income of middle-income consumers. These additional financial burdens may reduce consumer spending, which could negatively impact businesses reliant on domestic consumption. However, the government aims to balance these challenges by boosting revenue while maintaining consumer purchasing power.

What is the significance of foreign capital flows in the current market situation in Indonesia?

-Foreign capital flows are a crucial indicator of investor sentiment in Indonesia. As global uncertainties grow, foreign investors are more likely to move their capital to safer assets, such as U.S. Treasuries or gold. This outflow can lead to a weaker rupiah and further market volatility, making it important for Indonesia to manage both domestic and external economic factors carefully.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

IHSG Tembus 7.100, Akankah Pertahankan Tren Bullish? | IDX CHANNEL

What's behind the global stock market volatility & how it may impact India

Gejolak Ekonomi, Antrean Emas Mengular di Berbagai Kota [Selamat Pagi Indonesia]

"Why US Election Result May not Tonight?" Pre-Market Report - Nifty & Bank Nifty 05 Nov 2024 Range

5 Dampak Tarif Impor Donald Trump 32 Persen bagi Indonesia

IHSG & Nilai Tukar Rupiah ke Dollar Makin Ambruk - [Metro Hari Ini]

5.0 / 5 (0 votes)