PPH FINAL UMKM 0 5% BERAKHIR 2024? BEGINI TAX PLANNING DI 2025

Summary

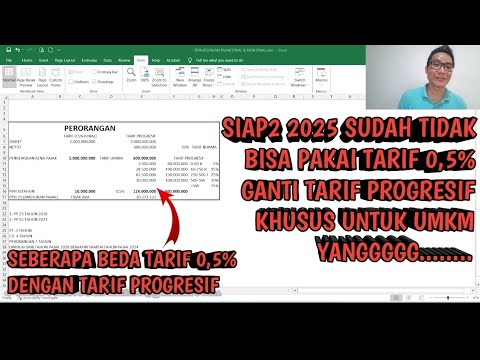

TLDRThe video discusses tax changes for UMKM (small businesses) in Indonesia, focusing on the transition from a 0.5% final tax rate to progressive rates starting in 2025. It explains how business owners like Roni can manage their taxes using methods like NPPN (norma calculation) or bookkeeping, and highlights the impact of expenses on taxable income. The video also provides strategies for minimizing tax liabilities, such as establishing a new business entity to continue benefiting from the final tax rate or optimizing bookkeeping practices. Strategic tax planning is crucial for UMKM owners to avoid higher taxes and ensure efficient business growth.

Takeaways

- 😀 The government has set a tax policy for small and medium enterprises (SMEs) with an annual turnover under IDR 4.8 billion, based on Government Regulation No. 23 of 2018.

- 😀 In 2022, the government offered tax incentives for SMEs with personal income under IDR 100 million per year, as per Article 5 of PP 23/2018.

- 😀 SMEs are subject to a 0.5% final income tax (PPH) for individual taxpayers for 7 years starting from 2017, with 2024 being the last year to use this rate.

- 😀 After the final 0.5% tax ends in 2024, individuals will be taxed based on progressive rates according to Article 17 of the Tax Law.

- 😀 Progressive tax rates are: 5% for income up to IDR 60 million, 15% for income between IDR 60 million and IDR 250 million, 25% for income between IDR 250 million and IDR 500 million, and 30% for income above IDR 500 million.

- 😀 Taxable income can be calculated using two methods: the Net Income Norm (NPPN) method or through bookkeeping/financial statements, which will be mandatory starting in 2025.

- 😀 In the example case, a business owner named Roni with an annual turnover of IDR 2.4 billion paid IDR 9,500 in final tax under the 0.5% rate in 2024.

- 😀 Using the NPPN method in 2025, Roni’s taxable income would be IDR 660 million after deductions, resulting in a tax liability of IDR 143,800.

- 😀 The NPPN method for 2025 results in a higher tax obligation compared to the final 0.5% tax, but taxes paid by third parties like PPH 21, 22, 23, and 26 can offset the liability.

- 😀 Alternatively, using bookkeeping for tax calculation results in a lower tax burden due to the deduction of business-related expenses, with Roni’s payable tax being IDR 55 million.

- 😀 As 2024 is the last year for using the 0.5% final tax rate, SMEs should consider tax planning strategies, possibly transitioning to a PT (limited liability company) or CV (partnership) structure to continue benefiting from the 0.5% final tax rate.

Q & A

What is the government regulation regarding tax for small and medium-sized enterprises (UMKM) with an annual revenue under 4.8 billion?

-The government has set regulations for taxing UMKM with an annual turnover below 4.8 billion through Government Regulation (PP) No. 23 of 2018. These businesses benefit from a final tax rate of 0.5%.

What incentive did the government provide for UMKM in 2022?

-In 2022, the government offered a tax incentive where UMKM owners with annual incomes below 100 million IDR were exempt from taxes.

What does the 0.5% final tax rate apply to, and how long can UMKM use it?

-The 0.5% final tax rate applies to personal UMKM owners, and they can use it for 7 years starting from 2017. The final tax rate will expire in 2024.

What happens after the final 0.5% tax rate ends in 2024 for UMKM owners?

-After 2024, UMKM owners will be subject to progressive income tax under Article 17, Paragraph 1 of the Income Tax Law, with rates ranging from 5% to 35%, depending on the income level.

What are the progressive tax rates applicable to UMKM owners after 2024?

-The progressive tax rates for income above 60 million IDR are as follows: 5% for income up to 60 million IDR, 15% for income above 60 million to 250 million IDR, 25% for income above 250 million to 500 million IDR, and 30% for income above 500 million IDR.

How can UMKM owners calculate their taxable income using two different methods?

-UMKM owners can calculate their taxable income using either the 'Norma Penghitungan Penghasilan Neto' (NPPN) method or the 'pembukuan' method (bookkeeping), which will be mandatory starting in 2025.

What is the difference in tax calculation between the final 0.5% tax and the NPPN method?

-The final 0.5% tax is simpler and results in a lower tax payment (e.g., 9,500 IDR for 2.4 billion IDR revenue), while the NPPN method, based on a 30% norm, leads to a significantly higher tax payment (e.g., 143,800 IDR) due to progressive tax rates.

How does the NPPN method compare to the bookkeeping method for tax calculation?

-In the bookkeeping method, businesses can deduct expenses related to their operations, resulting in a lower taxable income and, consequently, a lower tax bill. This method proved to be more tax-efficient for Roni's business in the example provided.

What tax benefit does Roni gain by using the bookkeeping method over NPPN?

-By using the bookkeeping method, Roni can deduct operational costs like the cost of goods sold and business expenses, lowering his taxable income and reducing the tax burden compared to the NPPN method.

What strategic advice is given to UMKM owners before the expiration of the 0.5% tax rate in 2024?

-UMKM owners are advised to plan their taxes efficiently before the expiration of the 0.5% final tax rate in 2024. They can consider setting up a legal entity (such as a PT or CV) to re-qualify for the 0.5% tax rate or optimize their tax situation through careful planning.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Belajar Pajak untuk UMKM (PPh Final/PP23 2018)

Lembaga Keuangan Mikro-IKNB | Ekonomi Kelas X (Kurikulum Sekolah Penggerak) | EDURAYA MENGAJAR

Tarif UMKM 0,5% berakhir di 2024, 2025 Pakai Pajak Progresif lagi !! || Solusi,Bayar Pajak Kecil

How To Pay Low / No Tax in South Africa (Not a meme)

Strategi Pengembangan UMKM

Perusak Harga! Kenapa Belanja di Aplikasi ini 70% lebih murah?

5.0 / 5 (0 votes)