IGCSE Business Studies: Chapter 1.4 Types of Business Organisations

Summary

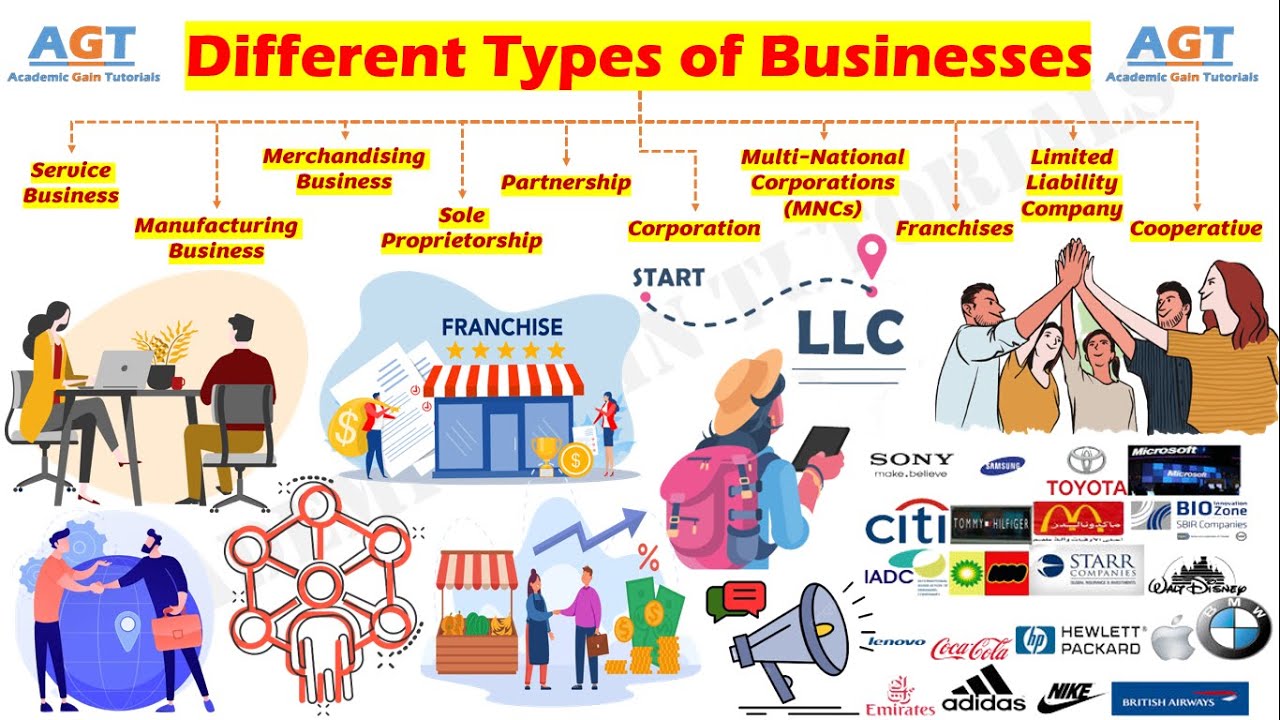

TLDRThis video provides an insightful overview of various types of business organizations, including sole traders, partnerships, franchises, joint ventures, and limited companies. It discusses the advantages and disadvantages of each ownership structure, highlighting key concepts like liability, capital, and continuity. The video also contrasts private and public limited companies, emphasizing their access to capital and regulatory requirements. Additionally, it touches on the public sector's role in delivering essential services. Through practical examination questions, viewers learn about the implications of different business forms, equipping them with knowledge to make informed decisions in the business landscape.

Takeaways

- 😀 Sole traders have full ownership and control of their business but face unlimited liability, risking personal assets.

- 😀 Partnerships involve 2 to 20 people sharing ownership, capital, and responsibilities, which can lead to conflicts.

- 😀 Franchises allow rapid business expansion by licensing another party to operate under an established brand, but poor franchisee decisions can harm the franchisor's reputation.

- 😀 Joint ventures involve collaboration between businesses on a specific project, combining resources and expertise while sharing risks.

- 😀 Private limited companies are owned by shareholders who cannot publicly sell shares, providing limited liability and better capital access than sole traders.

- 😀 Public limited companies can sell shares on the stock market, allowing for significant capital influx, but they also face more stringent regulations and disclosure requirements.

- 😀 Unincorporated businesses, like sole traders and partnerships, lack a separate legal identity, resulting in unlimited liability for the owners.

- 😀 Incorporated businesses, including private and public limited companies, have a separate legal identity, protecting owners' personal assets from business debts.

- 😀 The public sector focuses on providing essential services like education and healthcare, aiming to improve societal welfare rather than generate profit.

- 😀 Business ownership structures significantly impact liability, capital access, control, and continuity, influencing long-term business viability.

Q & A

What is a sole trader, and what are its main advantages?

-A sole trader is a business owned and operated by one individual. The main advantages include easy setup, full control of the business, receipt of all profits, and minimal paperwork involved in the establishment.

What are the disadvantages of operating as a sole trader?

-The disadvantages include unlimited liability, meaning personal assets can be seized if the business fails; limited capital due to being a single owner; and a lack of continuity, as the business may cease to exist if the owner dies.

How does a partnership differ from a sole trader?

-A partnership involves two to 20 individuals who share ownership and management of the business. Unlike a sole trader, partnerships allow for shared skills, capital contributions, and costs, but also introduce potential for conflicts and shared liability.

What are the key benefits and drawbacks of forming a franchise?

-Key benefits of franchising include rapid expansion and access to local market knowledge. However, drawbacks include potential harm to the franchisor's reputation due to franchisee actions and costs associated with providing training and support.

What is a joint venture, and what are its main advantages?

-A joint venture is a collaboration between two or more businesses to undertake a specific project. Its main advantages include risk and cost sharing, along with the pooling of expertise from each partner.

What are the characteristics of a private limited company (Ltd)?

-A private limited company is owned by shareholders, who cannot sell shares publicly. Characteristics include limited liability, continuity, and the ability to control who buys shares, although it has a more complex setup process compared to sole traders.

What distinguishes a public limited company (PLC) from a private limited company?

-A public limited company is able to sell shares to the public on the stock market, providing significant capital. Unlike a private limited company, PLCs have mandatory financial disclosures, which can expose them to competition, and they may face a loss of control over the company.

What are the differences between incorporated and unincorporated businesses?

-Incorporated businesses have a separate legal identity and limited liability, protecting owners' personal assets. In contrast, unincorporated businesses do not have this separation, meaning the owner is personally liable for all debts.

What is the primary focus of the public sector?

-The public sector focuses on commercial activities run by the government, aimed at improving public welfare rather than making a profit. Objectives include enhancing essential services like education, healthcare, and public utilities.

What are the implications of unlimited liability in partnerships?

-In a partnership, unlimited liability means that if the business incurs debt or goes bankrupt, the personal assets of all partners can be seized to settle business debts, which increases personal financial risk.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)