IGCSE ECONOMICS: MONETARY POLICY

Summary

TLDRIn this informative video, the host explores the fundamentals of monetary policy, detailing its crucial role in managing the money supply and influencing aggregate demand. Key concepts such as expansionary and contractionary monetary policies are discussed, highlighting how central banks adjust interest rates and money circulation to impact consumer spending. The video emphasizes the relationship between interest rates, borrowing, and economic growth, ultimately illustrating how effective monetary policy can shape a country's economic landscape. Viewers are encouraged to engage with the content and share their questions.

Takeaways

- 😀 Money supply refers to the total amount of money circulating in a country, including cash and bank deposits.

- 😀 Monetary policy involves decisions made by the central bank on money supply, interest rates, and exchange rates to influence aggregate demand.

- 😀 Expansionary monetary policy increases the money supply and lowers interest rates to stimulate economic activity and increase aggregate demand.

- 😀 Contractionary monetary policy reduces the money supply and raises interest rates to reduce aggregate demand and slow down inflation.

- 😀 Interest rates affect both borrowing and spending. Lower interest rates encourage borrowing and spending, while higher rates discourage them.

- 😀 Central banks can influence the money supply by printing more money, buying government bonds, or lending more to commercial banks.

- 😀 When the central bank lowers interest rates, aggregate demand tends to increase as consumers are more encouraged to borrow and spend.

- 😀 A lower exchange rate can make exports cheaper and more attractive to foreign buyers, boosting export demand.

- 😀 The central bank’s control over interest rates and money supply plays a key role in influencing the overall economic activity and growth.

- 😀 Commercial banks, when encouraged by the central bank, can lend more money to consumers, contributing to increased spending and investment.

Q & A

What is the definition of money supply?

-Money supply is the total amount of money in circulation in a country, including cash and other liquid instruments.

How does monetary policy influence aggregate demand?

-Monetary policy influences aggregate demand by making decisions about the money supply, interest rates, and exchange rates to stabilize the economy.

What is expansionary monetary policy?

-Expansionary monetary policy involves increasing the money supply and lowering interest rates to boost aggregate demand.

What is contractionary monetary policy?

-Contractionary monetary policy entails reducing the money supply and raising interest rates to decrease aggregate demand.

How can a central bank increase the money supply?

-A central bank can increase the money supply by printing more money, purchasing government bonds, and encouraging commercial banks to lend more.

What are the two types of interest mentioned in the script?

-The two types of interest are interest on spending and interest on borrowing.

How does raising interest rates affect consumer behavior?

-Raising interest rates discourages consumers from spending and borrowing, leading to a decrease in aggregate demand.

What happens when the central bank decreases interest rates?

-When the central bank decreases interest rates, it encourages consumers to spend and borrow more, thereby increasing aggregate demand.

How do changes in interest rates impact commercial banks?

-Changes in interest rates affect the rates that commercial banks charge consumers; higher rates reduce consumer expenditure and investment.

What effect does increasing aggregate demand have on businesses?

-Increasing aggregate demand compels businesses to increase their output to meet the higher demand for goods and services.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

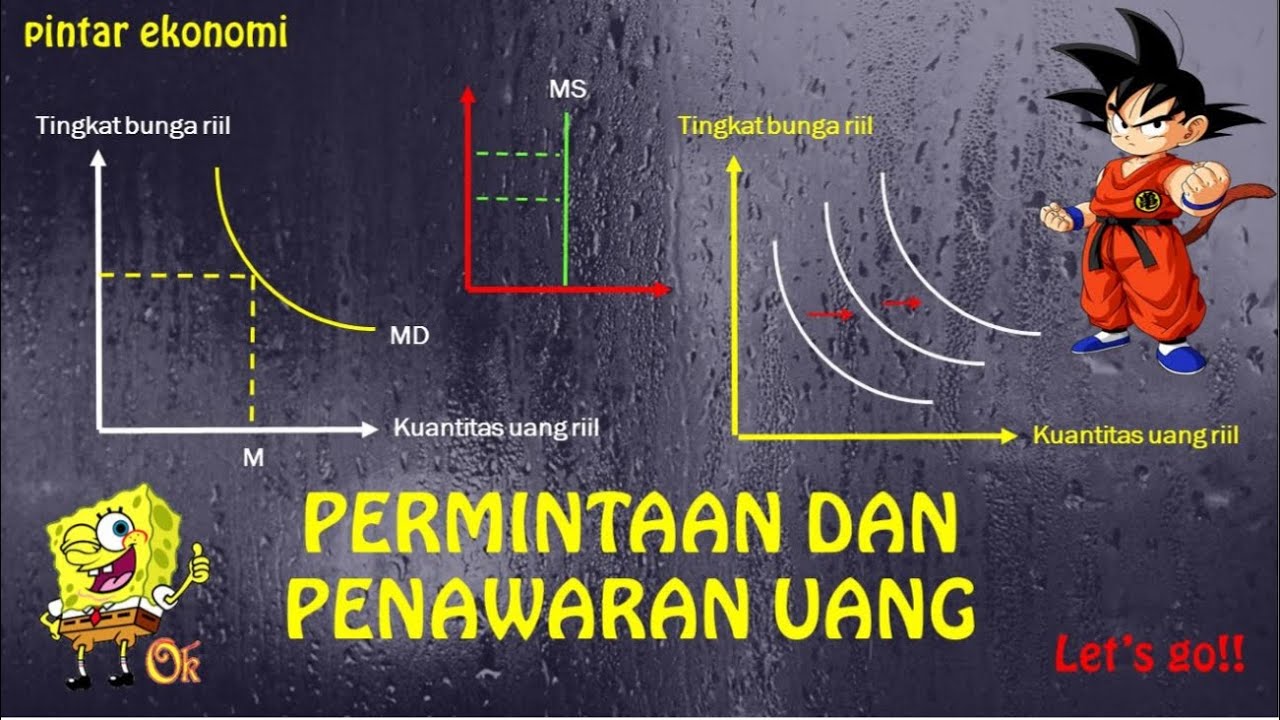

PERMINTAAN DAN PENAWARAN UANG

Permintaan dan Penawaran Uang | Ekonomi SMA Kelas 11

Monetary and fiscal policy | Aggregate demand and aggregate supply | Macroeconomics | Khan Academy

1c Uang dan Lingkup Kebijakan Moneter

Pengantar Ekonomi Makro - Pengaruh Kebijakan Moneter dan Fiskal terhadap Permintaan Agregat

ch 22 demand for money part 1 of 5 fisher 1

5.0 / 5 (0 votes)