1c Uang dan Lingkup Kebijakan Moneter

Summary

TLDRIn this video, Prof. Dr. Andriitra Ma discusses the vital role of monetary policy in managing a nation's economy. He explains how central banks control money supply and interest rates to stabilize inflation, currency value, and economic growth. Through tools like interest rate adjustments, money circulation management, and inflation targeting, central banks ensure price stability and a resilient financial system. The relationship between money supply, demand, and economic indicators is explored, demonstrating how effective monetary policy is crucial for sustainable economic health and growth.

Takeaways

- 😀 Monetary policy is key in maintaining the value of money by regulating the money supply and setting interest rates.

- 😀 The central bank controls the money supply to stabilize the economy, ensuring consistent growth and manageable inflation.

- 😀 Interest rates set by central banks affect loan costs and investment returns, impacting the overall economy.

- 😀 Too much money circulation can lead to inflation, while too little can cause economic stagnation or deflation.

- 😀 Inflation targeting is an important tool in monetary policy, helping central banks keep inflation within a set range.

- 😀 Bank Indonesia plays a vital role in stabilizing the Rupiah by intervening in foreign exchange markets and other policies.

- 😀 The money supply includes currency (banknotes and coins), bank deposits, and electronic money.

- 😀 The demand for money is influenced by interest rates, income levels, and prices of goods, affecting how much liquid money is desired.

- 😀 Stability in the value of the Rupiah against foreign currencies is crucial for maintaining Indonesia’s economic balance.

- 😀 The central bank uses various tools like the open market operations to adjust the money supply in the economy.

- 😀 Effective monetary policy supports sustainable economic growth, ensuring a stable price environment and strong currency.

Q & A

What is the primary role of monetary policy in an economy?

-Monetary policy plays a key role in maintaining the value of money by regulating money supply and setting interest rates, which helps stabilize the economy, control inflation, and encourage sustainable growth.

How does the central bank control the money supply in an economy?

-The central bank controls the money supply by using tools such as adjusting interest rates, setting reserve requirements for commercial banks, and conducting open market operations, like buying and selling government securities.

What is the relationship between inflation and monetary policy?

-Inflation is directly affected by monetary policy. If inflation is too high, the central bank can increase interest rates to reduce the money supply. Conversely, if inflation is low or deflation is occurring, the central bank may lower interest rates to stimulate economic activity.

Why is currency stability important in monetary policy?

-Currency stability is vital for maintaining predictable prices for goods and services, ensuring confidence in the national currency, and avoiding disruptions in international trade. Fluctuations in the value of the currency can negatively impact import prices, export competitiveness, and foreign investment.

How does the central bank manage interest rates to stabilize the economy?

-The central bank sets a base interest rate, known as the policy rate, which influences borrowing costs for consumers and businesses. By adjusting this rate, the bank can control inflation, influence investment, and ensure the economy grows at a sustainable rate.

What is the role of the central bank in creating money?

-The central bank is responsible for issuing physical money (banknotes and coins) and regulating the total money supply. It also manages electronic money through policies affecting commercial banks, which create additional money through loans.

What is the significance of target inflation in monetary policy?

-Target inflation is a key tool used by central banks to keep inflation at a stable level. By setting an inflation target, central banks can adjust interest rates and other policies to prevent excessive inflation or deflation, maintaining a stable economic environment.

How do commercial banks contribute to money creation?

-Commercial banks create money by lending out deposits. When they issue loans, they simultaneously create new deposits, increasing the money supply in the economy. This process is crucial for the liquidity and credit flow in the financial system.

What is the impact of excessive money circulation in an economy?

-Excessive money circulation can lead to inflation, where the value of money decreases and prices rise uncontrollably. It can erode purchasing power, destabilize the economy, and discourage investment and savings.

How do factors like income, interest rates, and prices affect the demand for money?

-The demand for money is influenced by factors such as income, interest rates, and prices. Higher income increases the demand for money for consumption, while higher interest rates reduce the demand for holding money, as individuals and businesses prefer to invest. Lower prices can increase money demand as consumers seek to capitalize on cheaper goods.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

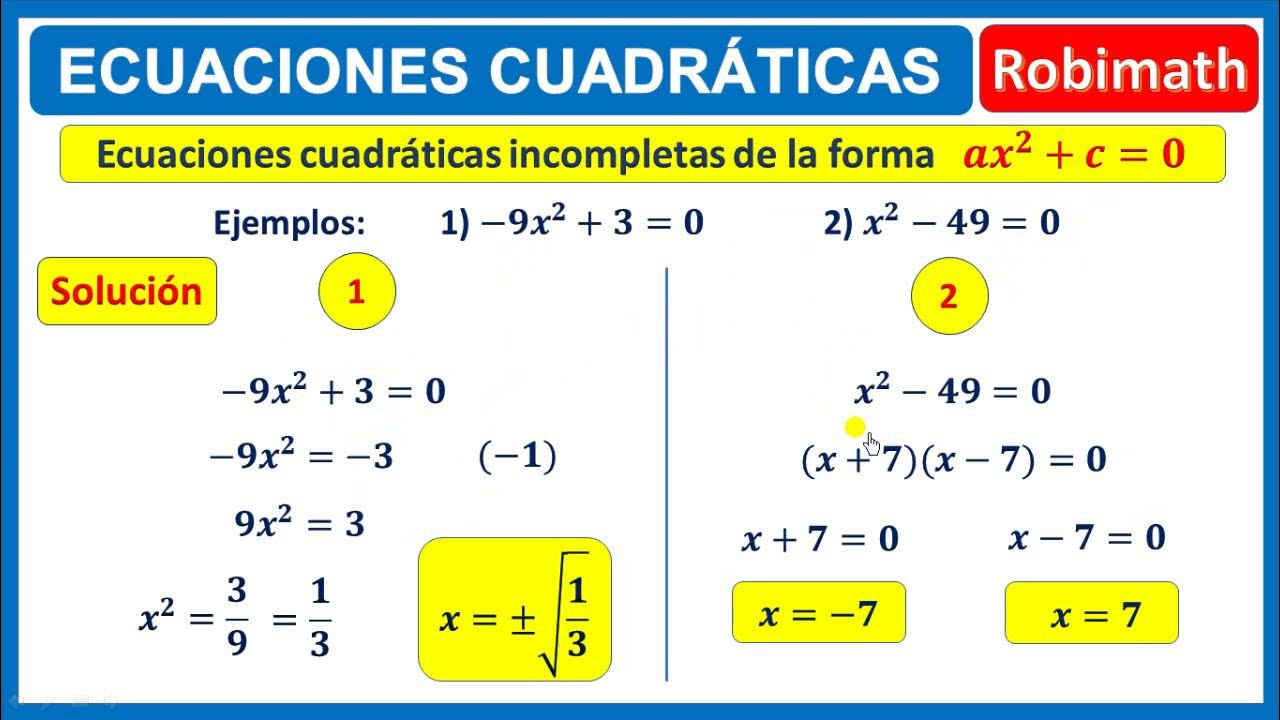

Ecuaciones cuadráticas de la forma ax2 + c=0

Memahami Conversion, Cara Menghitungnya dan 3 Cara Meningkatkan Conversion Rate Digital Marketing

Prof. Ali Saukah: Kemitraan Pembelajaran untuk English DL (PM)-Eps.1 @Suyantoid

FUNÇÃO DO 1 GRAU | FUNÇÃO AFIM | \Prof. Gis/- AULA 1

Kontribusi BINUS dalam Memperkaya Riset untuk RI | JURNAL BINUSIAN

Cara Membuat Literature Review Tiga Tips Mudah | Tirta Mursitama

PROF RACHMAT KRIYANTONO (PROF RK); ISU, KRISIS DAN PUBLIC RELATIONS, STUDI KASUS ARLA

5.0 / 5 (0 votes)