Langsung Paham Metode Imprest dan Fluktuasi Kas Kecil | Semudah itu

Summary

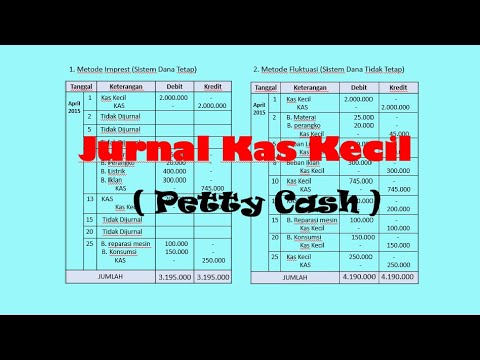

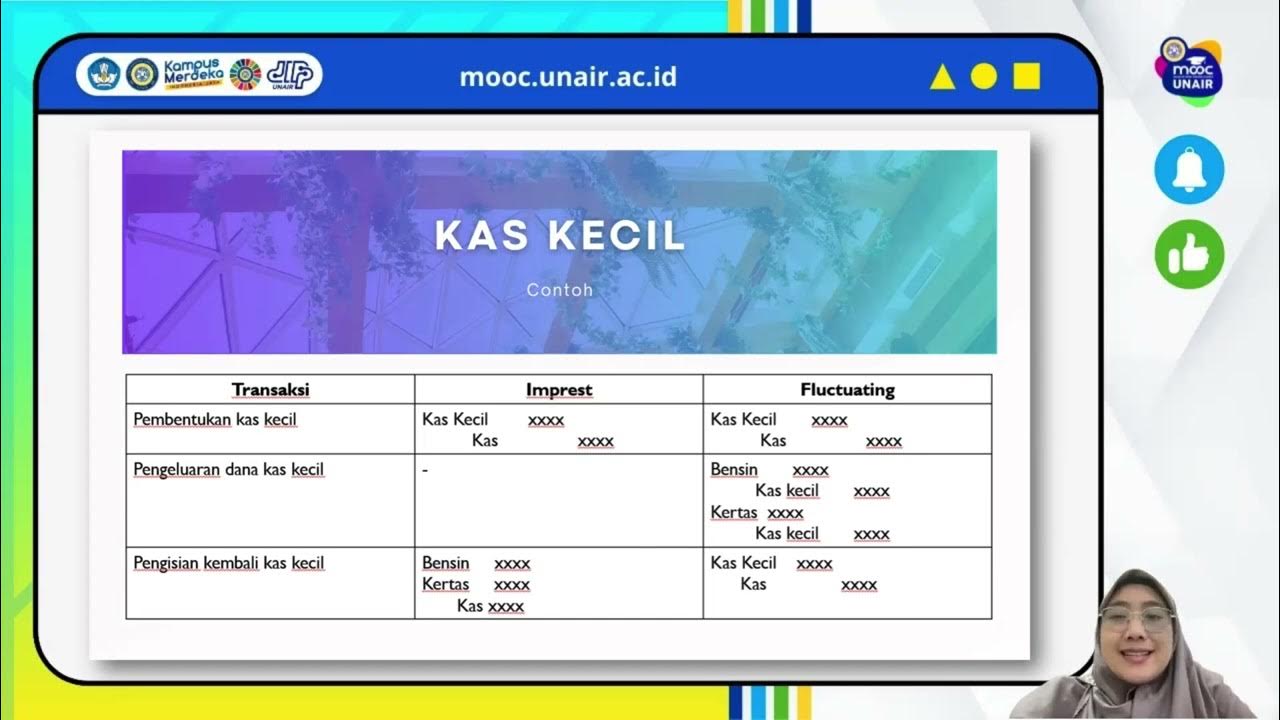

TLDRThis educational video script discusses two methods for managing petty cash: imprest and fluctuation. The imprest method involves maintaining a fixed cash balance, replenished based on expenditures, ensuring detailed recording and efficiency. Conversely, the fluctuation method records expenses in real-time, keeping the cash balance updated but potentially lacking detailed categorization. The script uses a case study of PT Given Abadi to illustrate these methods, guiding viewers to consider which method suits their company's needs better.

Takeaways

- 💼 The script discusses two methods for managing petty cash: imprest and fluctuation.

- 💼 Petty cash is a small amount of money set aside by a company for routine, small expenses.

- 🔒 The imprest method involves maintaining a fixed amount in the petty cash fund, which is replenished to the initial balance after expenditures.

- ⏰ An advantage of the imprest method is its efficiency in time management as recording of expenditures only occurs during fund replenishment.

- 🔎 The imprest method allows for detailed tracking of expenditures due to complete payment evidence.

- 📉 A disadvantage of the imprest method is that the petty cash balance is not always up-to-date, leading to potential discrepancies.

- 🔄 The fluctuation method involves variable balances in the petty cash fund, with expenditures recorded each time they occur.

- 📈 A benefit of the fluctuation method is that the balance is always current, providing real-time updates on the petty cash fund.

- 📋 The fluctuation method does not allow for detailed tracking by expense type or category, unlike the imprest method.

- 🏢 The script provides an example of a company, PT Given Abadi, which uses petty cash for small routine expenditures, illustrating transactions for December 2018.

- 📝 The script concludes by encouraging viewers to consider which method, imprest or fluctuation, is more suitable for their company's needs.

Q & A

What is the purpose of a petty cash fund as described in the script?

-A petty cash fund is a small amount of money set aside by a company for routine, small expenditures. It is typically used for expenses that are minor and recurring.

What are the two methods for managing petty cash mentioned in the script?

-The two methods for managing petty cash mentioned in the script are the imprest method and the fluctuation method.

How is the imprest method defined in the script?

-The imprest method is a cash management system where a fixed amount is maintained in the petty cash fund, and the cash is replenished to this fixed amount each time it is restocked.

What is the advantage of using the imprest method according to the script?

-The imprest method is efficient in terms of time because the recording of expenditures only needs to be done when the cash is restocked. It also allows for more detailed tracking of expenses due to complete payment evidence.

What is a disadvantage of the imprest method as described in the script?

-A disadvantage of the imprest method is that the petty cash balance is not always updated because the recording of expenditures is only done once when the cash is restocked, which means the current balance may not be known without a physical count.

How is the fluctuation method different from the imprest method?

-The fluctuation method involves maintaining a non-fixed balance in the petty cash fund, which can change, and recording expenditures each time they occur, unlike the imprest method where recording is done only upon restocking.

What is the advantage of using the fluctuation method as outlined in the script?

-The fluctuation method keeps the balance always updated because expenditures are recorded each time they occur.

What is a disadvantage of the fluctuation method according to the script?

-A disadvantage of the fluctuation method is that it does not allow for recording based on the type or group of expenditures like the imprest method, making it harder for a company to quickly identify which types of expenditures require larger amounts of cash.

What is an example of a transaction that might be recorded in the petty cash fund as given in the script?

-An example of a transaction recorded in the petty cash fund is the payment for document delivery costing 100,000 on December 8th.

How does the script suggest handling the restocking of petty cash under the imprest method?

-Under the imprest method, the restocking of petty cash is handled by debiting the petty cash account and crediting the cash account for the total amount of expenditures, ensuring the petty cash balance is brought back to the initial fixed amount.

What is the significance of the fluctuation in the fluctuation method as explained in the script?

-In the fluctuation method, the significance of the fluctuation is that the balance after restocking can differ from the initial balance due to the varying amounts that the petty cash holder may request for restocking, which is based on their needs at the time.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

KAS KECIL METODE IMPREST DAN FLUKTUASI || Kas Kecil Sistem Dana Tetap dan Sistem Dana Tidak Tetap

Kas kecil Metode Imprest dan Fluktuasi

Kas & Setara Kas | MOOC | Materi Akuntansi Perpajakan Seri 2

AKM 1 - Bab 7. Kas & Rekonsiliasi Bank

SISTEM AKUNTANSI PENGELUARAN KAS || DAFS OFFICIAL

Akuntansi Keuangan - Dana Kas Kecil Definisi, fungsi dan tujuan

5.0 / 5 (0 votes)