KAS KECIL METODE IMPREST DAN FLUKTUASI || Kas Kecil Sistem Dana Tetap dan Sistem Dana Tidak Tetap

Summary

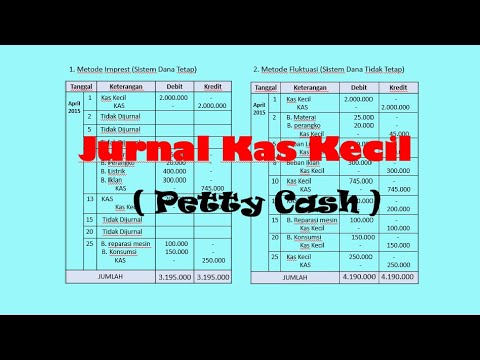

TLDRIn this video, the instructor explains the concept of petty cash and its management in accounting, highlighting two methods: the imprest system and the fluctuation system. The petty cash fund is used for minor office expenses, and the two methods offer different approaches to tracking and replenishing it. The imprest system maintains a fixed amount in the fund, while the fluctuation system adjusts the balance based on needs. The video walks through a practical example, showing how transactions are recorded and explaining the differences between the two methods, with detailed journal entries and calculations.

Takeaways

- 😀 Kas kecil is a cash fund provided by a company to cover small and frequent expenses.

- 😀 The main purpose of kas kecil is to manage office supplies, reduce impractical payment methods, and facilitate urgent, unplanned expenditures.

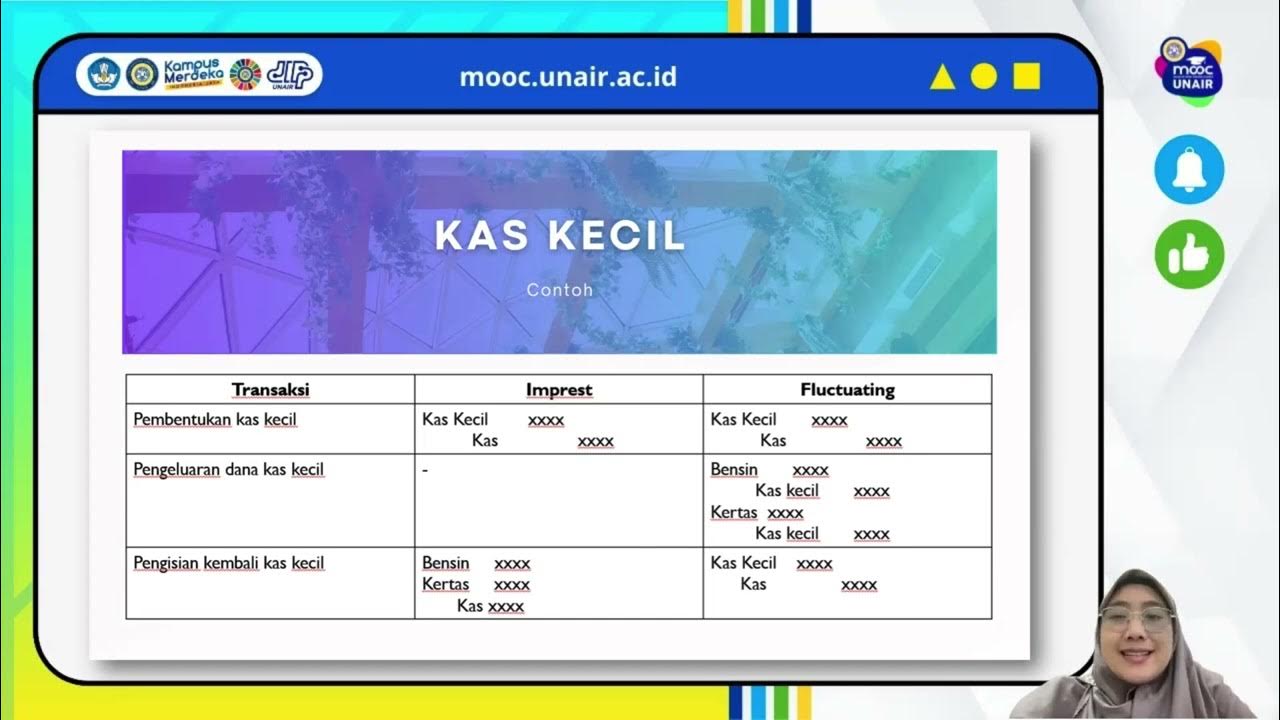

- 😀 Two main methods of managing kas kecil are: the imprest system (fixed amount) and the fluctuation system (variable amount).

- 😀 The imprest method keeps the kas kecil amount fixed. After each transaction, the fund is replenished to maintain the same balance.

- 😀 The fluctuation method adjusts the kas kecil amount based on actual needs, with the fund varying each time.

- 😀 Under the imprest system, small expenses are not directly recorded in the journal. Instead, evidence of the transaction is collected for later reconciliation.

- 😀 The fluctuation method requires every small expense to be recorded in the journal, ensuring proper tracking of each expenditure.

- 😀 A sample case involves setting up kas kecil with an initial amount of IDR 2 million, with top-ups occurring on the 1st and 15th of each month.

- 😀 Key transactions, such as purchasing supplies or paying for services, are recorded in the fluctuation system, but not in the imprest system.

- 😀 In the case of replenishment, the imprest system requires the calculation of total expenses to determine the required amount to refill, while the fluctuation system simply refills to the necessary amount based on usage.

Q & A

What is petty cash?

-Petty cash is a small amount of money kept on hand by a company to cover minor, unexpected expenses. It allows for quick payments without needing to go through formal payment processes.

What are the main purposes of petty cash?

-The main purposes of petty cash are to manage small, unexpected office expenses, prevent inefficiency in payment processing, and support employees in handling small, urgent expenditures.

What are the two methods of managing petty cash?

-The two methods of managing petty cash are the Imprest system (fixed fund method) and the Fluctuation system (variable fund method).

How does the Imprest system work?

-In the Imprest system, the petty cash fund is set to a fixed amount. When expenses occur, the fund is replenished to the original balance, but individual transactions are not recorded in the journal.

How does the Fluctuation system work?

-The Fluctuation system allows the petty cash fund to vary according to actual expenses. Each transaction is recorded in the journal, and the fund is adjusted based on actual needs.

What is the main difference between the Imprest and Fluctuation systems?

-The main difference is that the Imprest system keeps the petty cash fund at a fixed amount, and only total replenishments are recorded, whereas the Fluctuation system records every individual transaction, and the fund balance changes based on expenses.

What happens when petty cash is replenished in the Imprest system?

-When petty cash is replenished in the Imprest system, a journal entry is made to record the replenishment amount, typically reflecting the total expenses incurred.

What is the journal entry for replenishing petty cash in the Fluctuation system?

-In the Fluctuation system, the journal entry for replenishing petty cash is a debit to Petty Cash and a credit to Cash, with the replenishment amount typically set at the amount required to restore the fund.

What transactions are recorded in the Imprest system?

-In the Imprest system, only the replenishment transactions are recorded in the journal, and individual expenses, like the purchase of stamps or repairs, are not journalized.

What are the journal entries for purchasing office supplies in the Fluctuation system?

-In the Fluctuation system, the journal entry for purchasing office supplies (e.g., stamps or materials) involves a debit to the respective expense account (e.g., Postage Expense) and a credit to Petty Cash.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Kas kecil Metode Imprest dan Fluktuasi

Langsung Paham Metode Imprest dan Fluktuasi Kas Kecil | Semudah itu

Akuntansi Keuangan - Dana Kas Kecil Definisi, fungsi dan tujuan

Kas & Setara Kas | MOOC | Materi Akuntansi Perpajakan Seri 2

AKM 1 - Bab 7. Kas & Rekonsiliasi Bank

AKUNTANSI KEUANGAN MENENGAH - Bagian 2

5.0 / 5 (0 votes)