Cards and Payments - Part 2 - Role of a Merchant and Acquirer

Summary

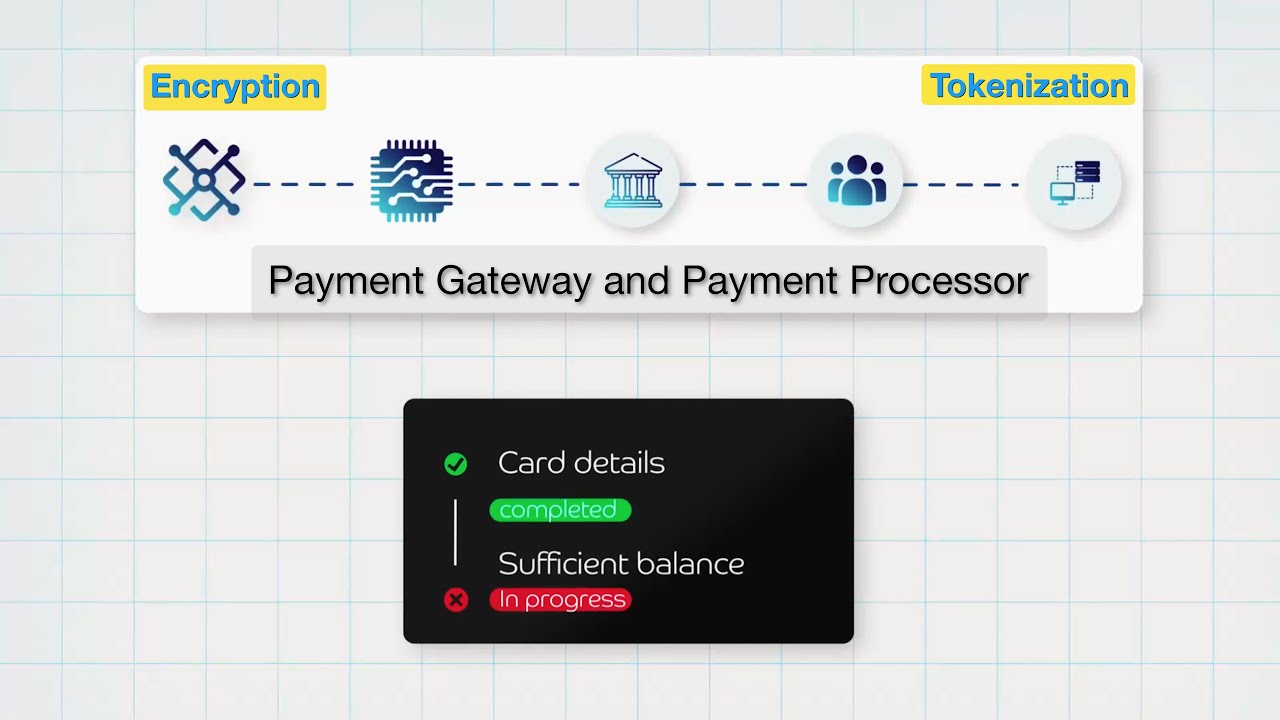

TLDRThe video discusses key players in the payment processing ecosystem, focusing on merchants and acquirers. It explains who merchants are, their obligations, and the different types, including retail, e-commerce, and mobile merchants. The video also introduces the acquirer's role in facilitating transactions, managing merchant accounts, and processing payments, often with the help of third-party processors. Additionally, it touches on the importance of compliance, particularly PCI standards, to ensure security in payment systems. The video concludes by teasing a future discussion on the difference between payment processors and gateways.

Takeaways

- 💳 Merchants are entities that provide goods or services for profit, dealing either with consumers or businesses.

- 🏷️ There are different types of merchants, such as retail, internet, e-commerce, and mobile merchants, each with varying transaction methods.

- 📦 Wholesale merchants deal in large quantities with businesses, while retail merchants focus on small quantities for consumers.

- 📱 Mobile merchants can process payments on the go, such as food trucks, while telephone and mail merchants handle transactions via phone or mail.

- 🔐 Merchants must comply with security standards, such as those set by the PCI Security Standards Council, to protect cardholder data.

- 🛡️ PCI compliance includes following guidelines for secure infrastructure and ensuring physical security for in-person transactions.

- 🏦 An acquirer is an intermediary that manages a merchant’s bank accounts and processes payments on behalf of the merchant, often charging a fee.

- 💼 Acquirers may handle transaction processing directly or outsource it to third-party payment processors if they lack the infrastructure.

- ⚙️ Payment processors facilitate transactions, but merchants usually communicate only with acquirers, not directly with processors.

- 🌐 Payment processors like PayPal, Stripe, and Apple Pay handle payment processing for major e-commerce and tech giants.

Q & A

What is the role of a merchant in payment processing?

-A merchant provides goods or services to customers and is involved in the business of selling these products to make a profit. In payment processing, the merchant accepts payments from customers for the goods or services sold.

What are the different types of merchants discussed in the video?

-The video discusses wholesale merchants, retail merchants, internet and e-commerce merchants (e.g., Amazon, Alibaba), mobile merchants (e.g., food trucks), and telephone or mail order merchants.

What is the difference between wholesale and retail merchants?

-Wholesale merchants deal in large quantities and primarily sell to other businesses, while retail merchants sell directly to consumers and usually deal in smaller quantities.

What are the obligations of a merchant in payment processing?

-Merchants must comply with security standards set by bodies like the PCI Security Standards Council to ensure the safety of cardholder data and maintain secure physical and technical infrastructures for processing payments.

What is the PCI Security Standards Council, and what does it do?

-The PCI Security Standards Council is an organization that provides a compliance framework for securing payment processes. It sets guidelines for merchants and other entities involved in payment processing to ensure data protection and transaction security.

What role does an acquirer play in payment processing?

-An acquirer acts as an intermediary between the merchant and the customer. It processes payments on behalf of the merchant and manages the merchant's account. Acquirers often take a fee for their services and may outsource payment processing to a third party.

How do payment processors differ from acquirers?

-While acquirers handle the merchant's account and are responsible for managing the transaction, payment processors are responsible for the actual facilitation and processing of the transaction. Some acquirers may have their own processing infrastructure, while others outsource to third-party payment processors.

What are some examples of acquirers and payment processors?

-Examples of acquirers include First Data, Worldpay, and Bank of America. Examples of payment processors include PayPal, Stripe, Google Pay, Apple Pay, and Amazon Pay.

Why do merchants need an acquirer for payment processing?

-Merchants need an acquirer because they typically do not have the capability to process payments directly. The acquirer manages transactions, processes payments, and ensures that the merchant can accept payments from customers efficiently.

What security measures must brick-and-mortar merchants follow when processing card payments?

-Brick-and-mortar merchants must ensure that the physical infrastructure used to process payments is secure. This includes ensuring that customers feel safe when swiping their cards on point-of-sale (POS) machines and that there are no potential security breaches that could expose sensitive cardholder data.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How Card Payments Work

Payment Gateway, Payment Processor and Payment Security Explained

Industry Pricing Options

Parking Lot Design | Grokking The Object Oriented Design Interview Question

Cards and Payments - Part 1 - Introduction to Payments and Cards Industry

Revolutionizing Online Payments: Insights from Georgi Stoianov, COO of Lapayo | SiGMA Eurasia 2024

5.0 / 5 (0 votes)