Payment Gateway, Payment Processor and Payment Security Explained

Summary

TLDRThis video script delves into the world of digital payments, focusing on the roles of payment gateways like PayPal and Stripe, and payment processors. It explains how these systems ensure secure transactions through encryption and tokenization, protecting payment data during transit and at rest. The script also touches on the function of payment networks such as Visa and Mastercard, and the collaboration between banks and financial institutions in the authorization and processing of transactions. The goal is to provide viewers with a comprehensive understanding of the digital payment ecosystem, setting the stage for a follow-up video on designing a payment system.

Takeaways

- 💳 Digital payments are integral to everyday transactions, from coffee purchases to splitting expenses among friends.

- 🛒 The payment gateway acts as an intermediary, ensuring payment information is correctly formatted and secure, akin to a 'Special Assistant'.

- 🔒 Data encryption is used to protect payment information during transmission, making intercepted data unreadable without the decryption key.

- 🗝️ Tokenization is employed to safeguard sensitive payment data when stored, replacing actual credit card numbers with tokens that are useless to hackers.

- 🔍 Address verification helps prevent fraud by ensuring the customer's billing address matches the bank's records.

- 🏦 The payment processor is responsible for checking the availability of funds and moving money between accounts, often working with issuing and acquiring banks.

- 🔄 Payment gateways and processors work together to authorize and process transactions, with the gateway handling data transmission and the processor ensuring funds are available.

- 💼 Companies like Visa and Mastercard facilitate communication between banks during credit and debit card transactions, but do not directly process transactions themselves.

- 🔄 The payment network ensures the transaction is authorized and securely moves money from the customer to the merchant, completing the payment process.

- 🤝 Some companies, such as Stripe and PayPal, offer both payment gateway and payment processing services, making it common for businesses to use a single provider for both needs.

- 🛡️ Security measures like encryption and tokenization work in tandem to protect against unauthorized access and fraud in the digital payment ecosystem.

Q & A

What is the primary role of a payment gateway in digital transactions?

-A payment gateway acts as the first point of contact when a customer initiates a card transaction online. It takes the payment information, verifies the details, and ensures they are correctly formatted and complete, including credit card number, expiration date, and CVV. It also handles the authorization of the transaction and the secure transfer of payment information.

How does encryption protect payment information during online transactions?

-Encryption converts the original payment data into a coded format that can only be deciphered with the proper decryption key. This ensures that even if someone intercepts the data during transmission, it would be virtually unreadable without the key.

What is tokenization and how does it differ from encryption in terms of data protection?

-Tokenization is a process where sensitive payment data is replaced with a non-sensitive equivalent, called a token, which represents the actual data. Unlike encryption, which protects data during transit and can be decrypted for processing, tokenization protects data at rest, ensuring the original data is never stored or exposed.

What is the difference between a payment gateway and a payment processor?

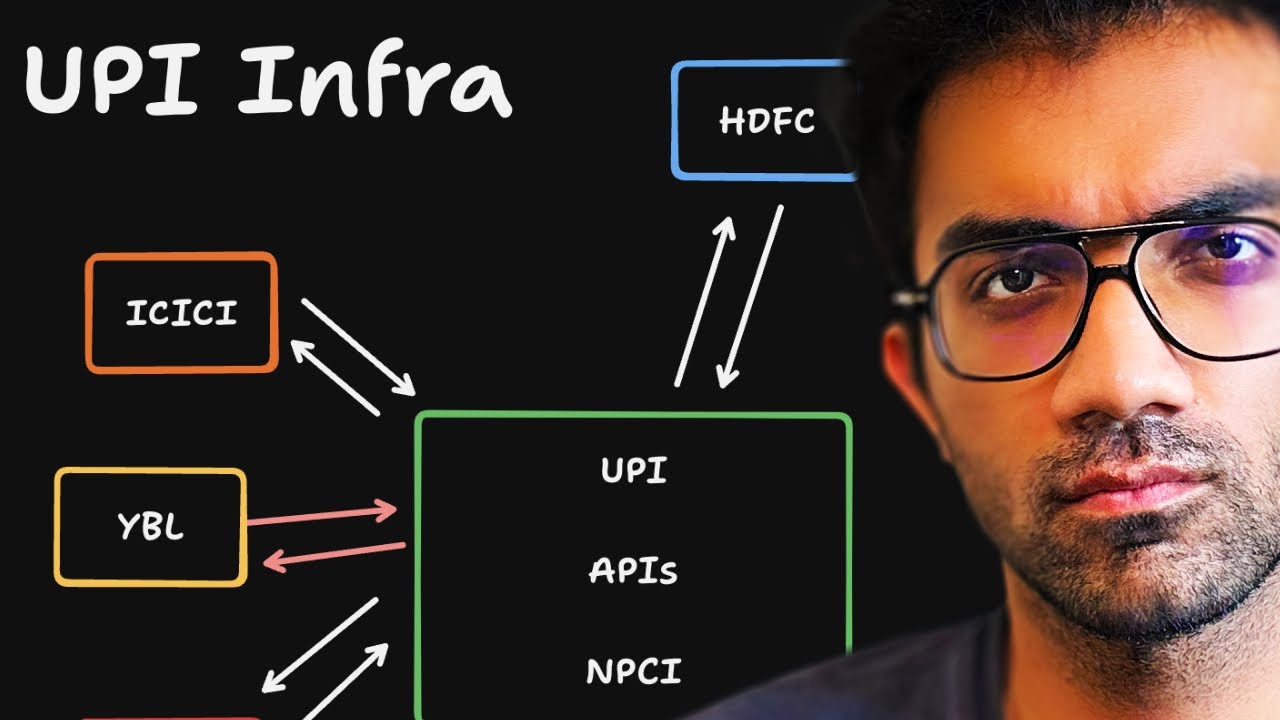

-A payment gateway primarily handles the transmission of payment data and acts as a bridge between the customer, merchant, and payment processor. A payment processor, on the other hand, is responsible for actually moving the money between accounts and communicates with the customer's bank to verify sufficient funds for the transaction.

What is the role of banks in the context of digital payments?

-Banks play a crucial role in verifying the availability of funds in a customer's account and authorizing transactions. They work closely with payment processors and are involved in the authorization process to confirm that the customer has the necessary funds or credit limit.

How do payment networks like Visa and Mastercard fit into the digital payment ecosystem?

-Payment networks like Visa and Mastercard facilitate communication between the issuing bank (the customer's bank) and the acquiring bank (the merchant's bank). They process transaction data and ensure that the transaction is authorized and the money is securely moved from the customer's account to the merchant's account.

What is the purpose of address verification in digital payments?

-Address verification helps to prevent fraud by ensuring that the customer's billing address matches the one on record with the bank. This adds an extra layer of security to the transaction process.

Why is it important for online stores to offer multiple payment options?

-Offering multiple payment options provides customers with flexibility and convenience, allowing them to choose the payment method that best suits their needs. This can enhance the customer experience and increase the likelihood of completing a purchase.

What factors do businesses consider when choosing a payment gateway and payment processor?

-Businesses evaluate factors such as transaction fees, types of payment methods supported, security features, customer support, and other relevant services when choosing a payment gateway and payment processor.

Can a single company perform both payment gateway and payment processing services?

-Yes, some companies, like Stripe and PayPal, perform both payment gateway and payment processing services. However, it's important to note that while many companies offer both, there are exceptions where some companies may only deal with one of these services.

How does the payment process work when a customer makes a purchase online?

-When a customer makes a purchase online, they add items to their cart and proceed to the checkout page. The payment gateway verifies the payment details, the payment processor communicates with the bank to confirm sufficient funds, and if approved, the payment network facilitates the transfer of funds from the customer's account to the merchant's account, completing the transaction.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)