Industry Pricing Options

Summary

TLDRThis video script delves into the various pricing options in the payment processing industry, with a focus on traditional models. It discusses interchange plus, flat rate, tiered pricing, subscription models, and surcharging, explaining how each covers interchange costs differently. The script also touches on the transparency and predictability of these options, highlighting the impact of bi-annual interchange rate increases on merchants. It briefly mentions cash discount and hybrid models, suggesting further resources for深入了解.

Takeaways

- 💡 The video discusses various pricing options in the payment processing industry, focusing on traditional models and alternative methods.

- 🔍 It highlights that the core of all pricing structures is to cover the cost of interchange, which is the cost of card acceptance.

- 📊 Interchange Plus pricing involves a base interchange rate plus a markup, and it's the most transparent option but can fluctuate with bi-annual interchange rate increases.

- 🏪 Flat Rate processing is gaining popularity for its simplicity and predictability, charging a set fee per transaction regardless of card type.

- 📉 Tiered pricing, once common, is now less prevalent due to a lack of industry regulation and potential for manipulation by processing companies.

- 📝 Subscription pricing charges the raw interchange rate with no markup but includes a monthly fee, which can be high and not volume-based.

- 💳 Surcharging is a method where a fee is added to credit card transactions to cover processing costs, but it's not allowed in Massachusetts and Connecticut.

- 💵 Cash Discount is another method to pass some of the processing fees to customers, potentially offsetting all processing costs for the merchant.

- 📉 The video notes that larger merchants might find that their actual costs with Interchange Plus pricing are lower than with Flat Rate due to the nature of the cards they process.

- ⚖️ The script emphasizes the importance of understanding who pays the processing fees and how they are priced out, whether through fees, price increases, or other means.

Q & A

What are the different pricing options discussed in the video?

-The video discusses various pricing options including interchange plus, flat rate processing, tiered pricing, subscription pricing, surcharging, and cash discount.

What is the primary focus of all pricing structures in the industry?

-The primary focus of all pricing structures is to cover the cost of interchange, which is the cost of card acceptance.

How does interchange plus pricing work?

-Interchange plus pricing involves taking the interchange rate set by card brands and networks and adding a markup rate, typically in the form of a small percentage and a per-transaction cost.

What are the advantages of interchange plus pricing?

-Interchange plus pricing is the most common and transparent form of processing, allowing merchants to see the exact costs passed through by card networks.

What are the potential downsides of interchange plus pricing?

-Downsides include potentially confusing statements and less predictable bills compared to flat rates. It can also be more affected by bi-annual interchange rate increases.

How does flat rate processing differ from interchange plus?

-Flat rate processing charges a consistent fee for all types of cards, regardless of their interchange rates, making billing predictable and easy to understand.

What is tiered pricing and why is it less common today?

-Tiered pricing categorizes transactions into different 'tiers' or categories with varying fees. It's less common due to a lack of industry regulation leading to potential misuse by some processors and confusion for merchants.

What is subscription pricing and how does it work?

-Subscription pricing involves charging the raw interchange rate with no markup, but adding a monthly subscription fee. It's often used by companies that offer additional software or services.

Why might a merchant prefer surcharging over other pricing models?

-Surcharging allows merchants to pass the cost of processing fees onto customers, potentially reducing the merchant's out-of-pocket expenses.

What is cash discounting and how does it save merchants money?

-Cash discounting involves increasing the price of goods to cover processing fees, allowing merchants to offset all processing costs and sometimes resulting in substantial savings.

How do the bi-annual interchange rate increases affect different pricing models?

-Bi-annual interchange rate increases can affect all pricing models, but interchange plus pricing is more directly impacted as it includes the interchange rate as a component of the cost.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Bisnis Kos-kosan Di Era Digital. THE INSIDER with Anggit, CEO & Co-founder Mamikos.

No More Processing Fees

How to Sell Your Product or Service - Presenting Pricing or Proposals (Part 10 of 11)

Why Airbnb Fails to Disrupt the Hotel Industry

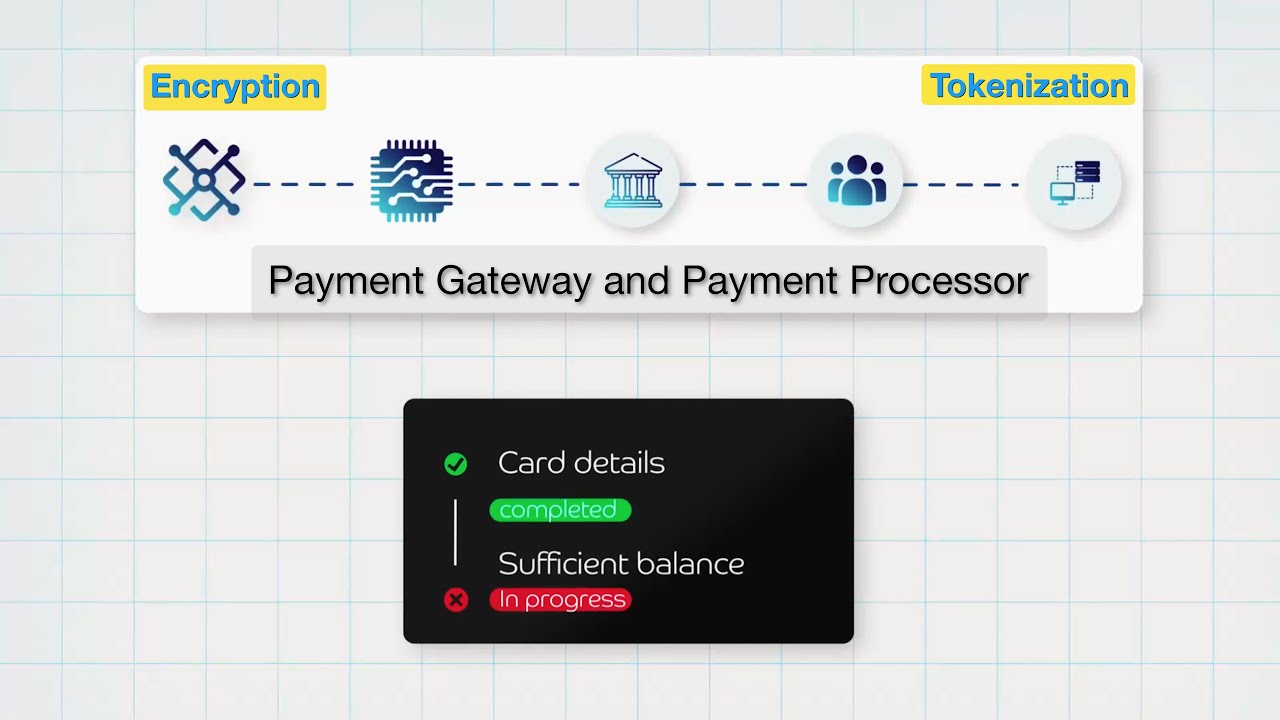

Payment Gateway, Payment Processor and Payment Security Explained

[MKT420] MARKETING MIX 4P'S_PIZZA HUT

5.0 / 5 (0 votes)