Why Independent Quants Don't Exist

Summary

TLDRThe video addresses the misconception that one can easily become a successful independent Quant. It debunks the idea that Quants can make millions without working for firms, explaining the financial and operational challenges. The speaker uses hypothetical scenarios to illustrate that working for a firm is often more lucrative and less stressful, with a guaranteed salary and benefits. The video also touches on the reality of scaling in finance, suggesting that successful Quants typically transition from working for firms to running their own, leveraging experience and networks to attract investors and manage teams.

Takeaways

- 🤔 The common myth is that one can become a successful independent Quant, but the reality is often more complex.

- 💼 Most Quants work for firms due to the financial and operational support they provide, which is crucial for success in quantitative finance.

- 💰 The idea of making millions as an independent Quant is romanticized, but it overlooks the significant challenges and resources required.

- 📈 Historically, Quants have made significant money, but this was often during a different market era and with different economic conditions.

- 💼 Working for a firm provides a stable salary, benefits, and lower stress levels compared to the uncertainties of independent trading.

- 💹 The market average return is around 6-8%, and achieving a 10% return consistently is challenging and not guaranteed for independent Quants.

- 📊 The script emphasizes the importance of scalability in finance, suggesting that without the ability to scale, it's not profitable to be an independent Quant.

- 🏦 To be successful, Quants often need to transition from independent trading to running a firm, which involves managing a team and dealing with investors.

- 💼 The transition from an independent Quant to a firm owner involves significant legal, regulatory, and operational overhead that is often underestimated.

- 💡 The script debunks the fairy tale of easy wealth through independent trading, highlighting the hard work and team effort required in the finance industry.

Q & A

Can an individual be a successful independent Quant?

-It is challenging for an individual to be a successful independent Quant. Historically, Quants who made millions did so in a different financial climate, and today's markets are more competitive and require more resources.

What are the typical earnings for a Quant starting at a firm?

-A Quant starting at a firm can expect to earn around $100,000 to $120,000 per year, with additional benefits and a guaranteed salary regardless of performance.

What are the advantages of working for a firm as a Quant?

-Working for a firm provides a guaranteed salary, lower stress due to a regular work schedule, and benefits. It is also easier and less risky compared to being an independent Quant.

What are the potential earnings for an independent Quant with a $1 million investment?

-An independent Quant with a $1 million investment could potentially earn $100,000 in the first year with a 10% return, assuming no costs or salary for themselves.

How does the script suggest scaling a Quant's operations to increase earnings?

-To scale operations, a Quant would need to find investors to raise significant capital, which allows for larger profits. This involves managing a team, dealing with legal and regulatory issues, and potentially setting up a firm.

What are the risks associated with being an independent Quant?

-The risks include market volatility, the need for significant initial capital, the challenge of consistently achieving high returns, and the overhead costs of running a trading operation.

Why is it difficult for an independent Quant to attract investors without experience?

-Without experience, it is hard for an independent Quant to prove their ability to generate profits, which makes it difficult to attract investors who are looking for a track record of success.

What is the significance of having a team when running a Quantitative trading operation?

-A team is significant because it allows for the division of labor, including strategy development, trade execution, data management, legal compliance, and investor relations, which are all crucial for a successful trading operation.

What is the role of a Quant in a firm setting?

-In a firm setting, a Quant's role may include developing trading algorithms, conducting quantitative research, risk management, and contributing to the overall strategy of the firm.

What are the potential career paths for a Quant according to the script?

-A Quant can either work for a firm, gaining experience and eventually starting their own fund with investors, or they can remain working for a firm, leveraging the firm's resources and expertise to manage risks and operations.

How does the script describe the transition from an independent Quant to running a firm?

-The script describes the transition as a natural progression where Quants who start independently often end up creating a firm to manage growing operations, investors, and a team, thus moving away from true independence.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

What makes an entrepreneur? | Sahar Hashemi | TEDxYouth@Bath

Legal But Dangerous OTC & RX Drugs - Prescription Drug Abuse

Market Lens - Expansion Model: Section 1, Ep 3 - Common Mistake (AM)

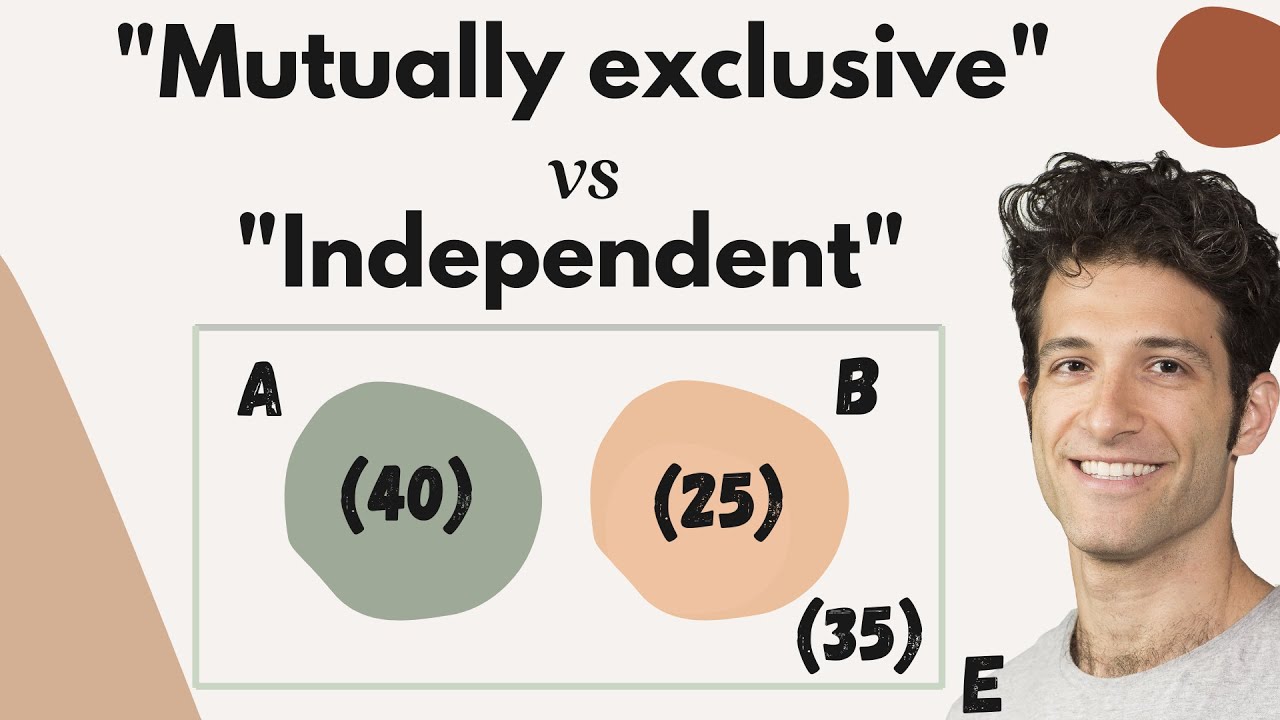

"Mutually Exclusive" and "Independent" Events (...are VERY different things!)

How to Find Good App Ideas

Lesson 52: Controlling DC Motor using two relays | Arduino Step By Step Course

5.0 / 5 (0 votes)