$750 Billion Set to Surge into Markets: The Fed's Next Move Explained!

Summary

TLDRThis video script discusses the impact of the Treasury General Account (TGA) on asset prices amidst economic uncertainties. It highlights the potential for a significant liquidity injection into the economy through the TGA, especially during debt ceiling showdowns. The script suggests that such injections could lead to a rise in asset prices, including Bitcoin, tech stocks, and real estate, despite the broader economic implications. The presenter advises viewers to monitor these developments closely over the next 9 to 12 months for potential investment opportunities.

Takeaways

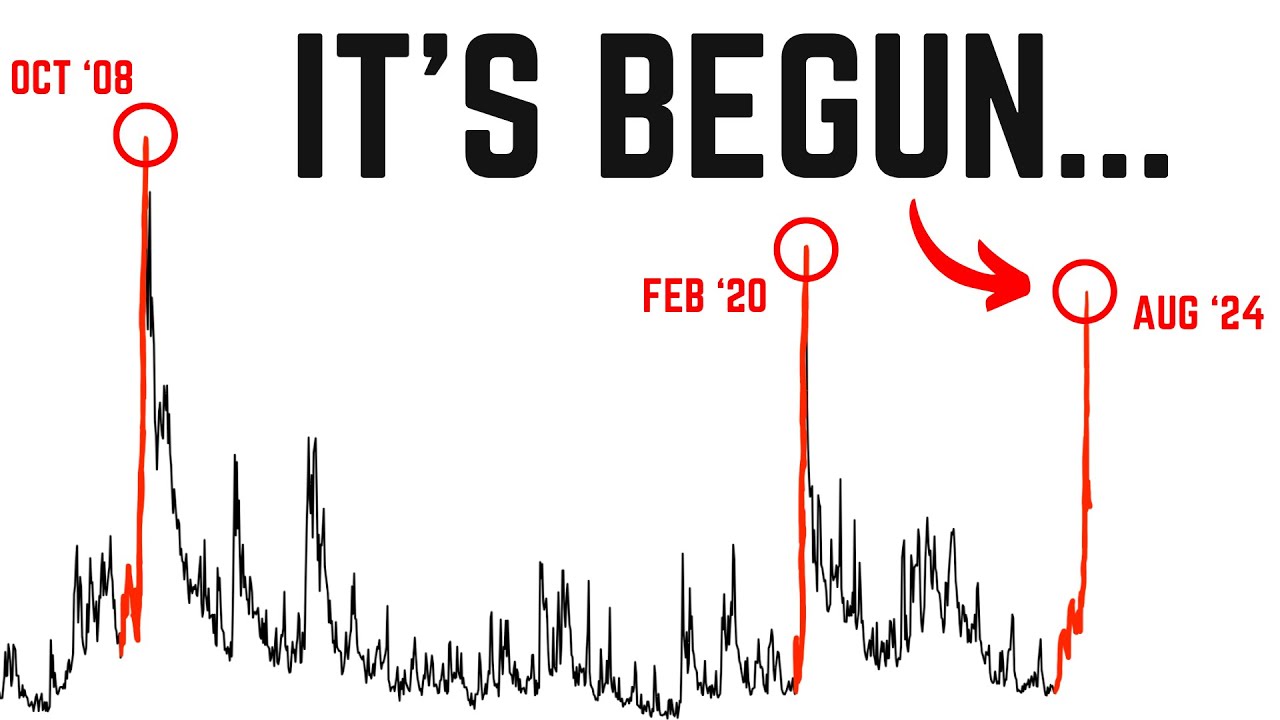

- 📉 The script discusses the fear among investors due to market crashes, upcoming elections, and potential wars, suggesting that many economic indicators are signaling a recession.

- 📊 It highlights that while economic indicators can show the direction of the economy, they may not accurately predict asset prices, which are better indicated by liquidity levels.

- 💰 The importance of the Treasury General Account (TGA) is emphasized as the government's bank account, which influences liquidity when it accumulates or releases funds.

- 📈 The script suggests that the TGA levels are currently high, which is typically bad for liquidity, but the government's future actions could inject significant funds into the economy.

- 🤔 The reliability of government forecasts is questioned, as they are often incorrect and later revised, which could impact understanding of future liquidity.

- 💡 The concept of 'Extraordinary Measures' is introduced, where the government uses the TGA to fund operations during debt ceiling debates, potentially leading to increased liquidity.

- 🗓️ Historical patterns show that during debt ceiling showdowns, the TGA is often drawn down to around $100 billion, which could happen again in the upcoming 2025 debt ceiling debate.

- 💸 The potential for a massive liquidity increase is highlighted, suggesting that around $750 billion could be injected into the economy, similar to the 2008 TARP program.

- 🚀 The script predicts that this liquidity increase could lead to a rise in asset prices, including Bitcoin, tech stocks, and real estate, despite potential negative impacts on the overall economy.

- 🔒 A cautionary note is given about the security of Bitcoin, recommending that individuals secure their own assets rather than relying on exchanges.

- 👀 The video encourages viewers to keep an eye on the economic situation over the next 9 to 12 months, anticipating significant changes due to the potential liquidity injection.

Q & A

What is the main concern of investors mentioned in the video script?

-The main concern of investors mentioned in the video script is the fear of an imminent market crash due to various factors such as economic indicators, yield curve inversion, weakening unemployment, slowing home sales, and potential political and military events.

What economic indicator is discussed as a signal for asset prices movement?

-The Treasury General Account (TGA) is discussed as the best indicator for asset prices movement, as it reflects the liquidity in the system which directly affects asset prices.

What is the Treasury General Account (TGA) and why is it significant?

-The Treasury General Account (TGA) is the U.S. government's bank account where it keeps its funds. It is significant because changes in the TGA balance can influence the liquidity in the economy, which in turn affects asset prices.

How does the level of the TGA account affect the economy?

-When the TGA account is high, it indicates that money is being taken out of the market, reducing liquidity, which can be negative for the economy. Conversely, when the TGA is low or being drained, it is akin to injecting money into the economy, which can increase liquidity and potentially boost asset prices.

What is the expected change in the TGA account level by the end of Q3 2024 according to the government's estimates?

-According to the government's estimates, the TGA account is expected to increase to about 850 billion by the end of Q3 2024.

What does the video suggest about the accuracy of government forecasts for the TGA account?

-The video suggests that the government's forecasts for the TGA account are often inaccurate, as they have historically been revised after being proven wrong.

What is the 'debt ceiling showdown' mentioned in the script?

-The 'debt ceiling showdown' refers to the political debate and negotiations that occur when the U.S. government approaches its borrowing limit and needs to decide whether to raise it to continue funding government operations.

What measures does the government take when it cannot agree on raising the debt ceiling?

-When the government cannot agree on raising the debt ceiling, it takes 'extraordinary measures' which may include using the TGA account to fund the gap where they cannot get new debt.

How does the video script relate the TGA account to the potential increase in asset prices?

-The script suggests that if the TGA account is drained and the funds are injected directly into the economy, it could lead to an increase in asset prices, as it did during the 2008 financial crisis with the TARP program.

What advice does the video give regarding Bitcoin and exchange security?

-The video advises viewers not to trust their Bitcoin on exchanges and to secure it themselves using hardware devices like Trezor, which keep private keys safe and make the process of managing cryptocurrencies easier and more secure.

What is the potential impact of the TGA account changes on the U.S. economy and asset prices according to the video?

-According to the video, changes in the TGA account can have a significant impact on the U.S. economy and asset prices. If the TGA is drained and the money is injected into the economy, it could lead to increased liquidity, which may result in higher asset prices, although it could also diminish the purchasing power of dollars.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

You MUST have this in your portfolio! | Better Returns than NIFTY | CA Rachana Ranade

Tesouro Direto: vale a pena vender com taxa baixa para recomprar com taxa de juros mais alta?

The 2024 Recession Just Started... (Do THIS Now)

Resep Cuan Jualan Rempeyek Online

The Bull Market Will Continue Into 2025 As Liquidity Heads Higher | Michael Howell

Understanding the Current Economic Cycle

5.0 / 5 (0 votes)