Market Structure Simplified (For Beginner to Advanced Traders)

Summary

TLDRThis video script delves into the intricacies of market structure for trading, emphasizing the importance of understanding both major and minor trends to identify optimal entry and exit points. The presenter showcases live account profits, discusses impulse and correction phases, and provides practical examples of trading strategies using different time frames. The aim is to demonstrate how to read market movements effectively, apply trading techniques, and maintain discipline to achieve success in trading.

Takeaways

- 💰 The speaker has successfully withdrawn $50,000 from a live trading account to pay off debts and fund a vacation, demonstrating the profitability of their trading strategies.

- 📈 Understanding market structure is crucial for professional trading as it helps in identifying market trends and optimal entry points for trades.

- 🔍 Market trends consist of impulse and correction phases, where prices push up or down and then retrace, creating patterns of higher highs and lows in an uptrend, and lower highs and lows in a downtrend.

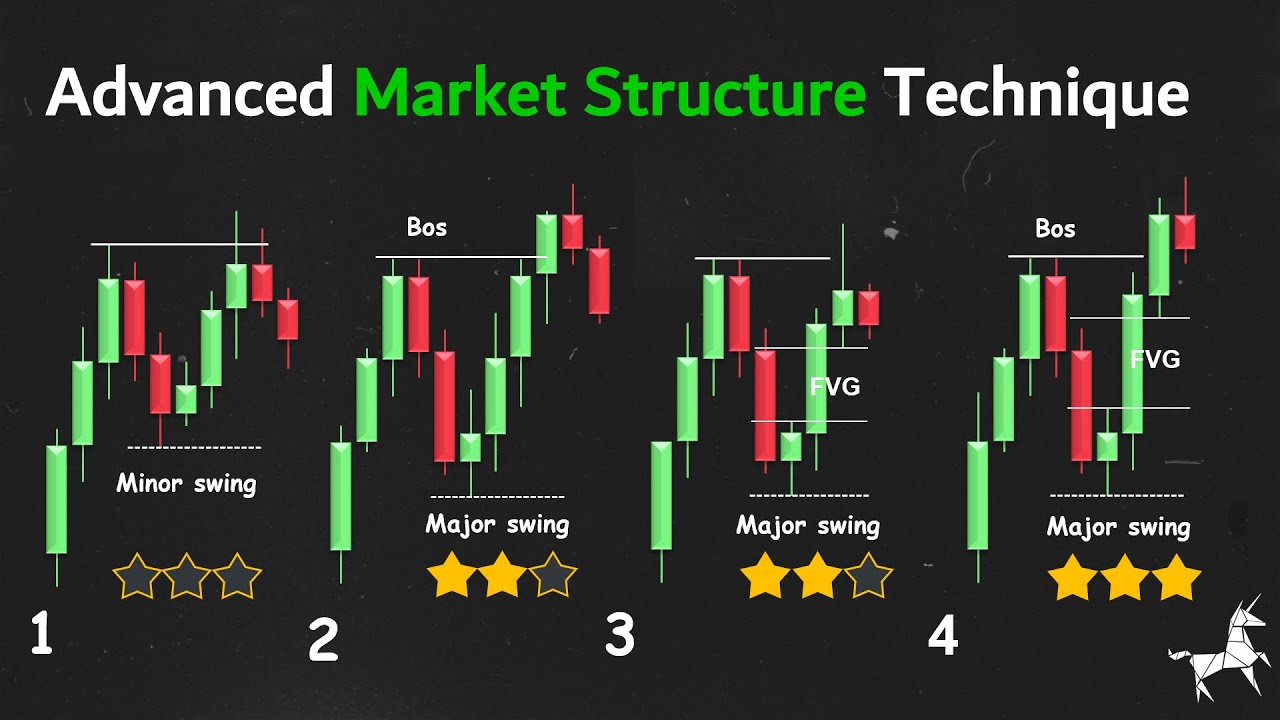

- 📊 Major market structure is best analyzed on larger time frames like daily or four-hour charts, while minor structure is observed on smaller time frames such as one-hour, 15-minute, or five-minute charts.

- 📉 During a retracement, if the price creates a new lower high, it signals the start of a correction phase, indicating a potential opportunity to sell.

- 🤑 Traders can capitalize on retracements by selling during the correction phase if they are scalpers or intraday traders, or by waiting for the correction to end to buy if they are swing traders.

- 🎯 For precise entries, traders can zoom into even smaller time frames like the 15-minute chart to find 'sniper' entries based on specific patterns or candlestick formations.

- 📝 Keeping a trading journal or practicing on a demo chart can help traders to better understand and identify market structures and improve their trading skills.

- 🚫 Avoiding the mistake of focusing on a single time frame is emphasized, as it can lead to misunderstandings about the market's direction and result in poor trading decisions.

- 🛑 The importance of having a trading plan and not constantly monitoring the trade once executed is highlighted, to prevent premature exit from profitable trades.

- 🔗 The speaker offers a course for those interested in advanced market structure training, suggesting further learning for enhancing trading strategies.

Q & A

What is the main topic of the video script?

-The main topic of the video script is understanding and trading Market Structure, which is a key criterion for becoming a professional trader.

What does the speaker claim to have done with the profits from shorting gold?

-The speaker claims to have withdrawn fifty thousand dollars from their live trading account, using the profits to pay off debt and fund a dream vacation.

What is the significance of understanding Market Structure in trading?

-Understanding Market Structure allows traders to comprehend how the market flows and moves, enabling them to get optimal entries and exits, thus managing risk and maximizing rewards.

What is the difference between an impulse move and a correction in the context of Market Structure?

-An impulse move is a significant price movement in the direction of the trend, while a correction is a retracement where the price moves in the opposite direction, often after an impulse move, allowing for consolidation before the next impulse.

How does the speaker describe the process of identifying a potential entry point for a trade?

-The speaker describes identifying entry points by looking for breaks in the Market Structure, such as when the price creates a new higher or lower high/low, and then breaks through the previous high/low, signaling a potential reversal.

What is the importance of zooming out to see the major structure on higher time frames like the daily or four-hour chart?

-Zooming out to see the major structure on higher time frames helps traders understand the overall trend and market flow, which is crucial for making informed trading decisions and not getting caught up in minor fluctuations.

What trading strategy does the speaker use to trade Market Structure?

-The speaker uses a strategy that involves identifying the major structure on higher time frames to understand the overall trend, then looking at minor structures on lower time frames to find optimal entry points for trades.

How does the speaker suggest managing trades after they are placed?

-The speaker suggests not constantly monitoring the trades, as it may lead to premature exit due to anxiety. Instead, traders should trust their analysis and let the trade play out, moving stop losses to new highs or lows as the market progresses.

What is the role of retracements in the Market Structure according to the speaker?

-Retracements are part of the Market Structure process, allowing the market to consolidate after an impulse move. They provide opportunities for traders to enter or exit trades based on the breaking of the retracement levels.

How does the speaker use confluence in their trading decisions?

-The speaker uses confluence, which is the meeting of multiple technical analysis signals, to confirm trading decisions. For example, a bearish engulfing candlestick, a new lower high, and a break of a support area can all signal a potential short entry.

What advice does the speaker give for traders who are struggling with trading decisions?

-The speaker advises traders to practice identifying Market Structure on charts of various currency pairs to gain experience. They also emphasize the importance of having a consistent trading style and sticking to it.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

1 Internal, External Range Liquidity & Catalysts for Pullback

I Discovered Best Market Structure Analysis (Premium Video)

Master SMC/ ICT Market Structure The Correct Way (very easy)

ICT's 2022 Mentorship Program - Lesson Six Review

just copy this, don't even think, this is how you trade

AMT: Le REGOLE della MIA STRATEGIA di Trading

5.0 / 5 (0 votes)