What investors ACTUALLY want to see in your PITCH DECK.

Summary

TLDRThis video script offers essential advice for creating effective pitch presentations, highlighting eight critical slides that should be included. The speaker, a venture capitalist with experience in investing and running startups, emphasizes the importance of a strong opening slide, clearly defining the problem and solution, demonstrating market size and opportunity, showcasing traction, explaining the business model, presenting a capable team, and concluding with a clear ask. The script is a valuable guide for entrepreneurs looking to connect with investors and audiences.

Takeaways

- 😀 The importance of having a clear and concise opening slide with a strong one-liner that connects your brand and logo to your company's purpose.

- 🔎 Emphasize the problem you are solving in your pitch, making sure it is understandable to the audience even if they are not experts in your field.

- 💡 Highlight the solution you offer, using persuasive techniques to convince the audience that your solution is the right one.

- 📈 Demonstrate the size of the market opportunity with clear evidence of growth, using terms like 'Compound Annual Growth Rate' (CAGR) to show market momentum.

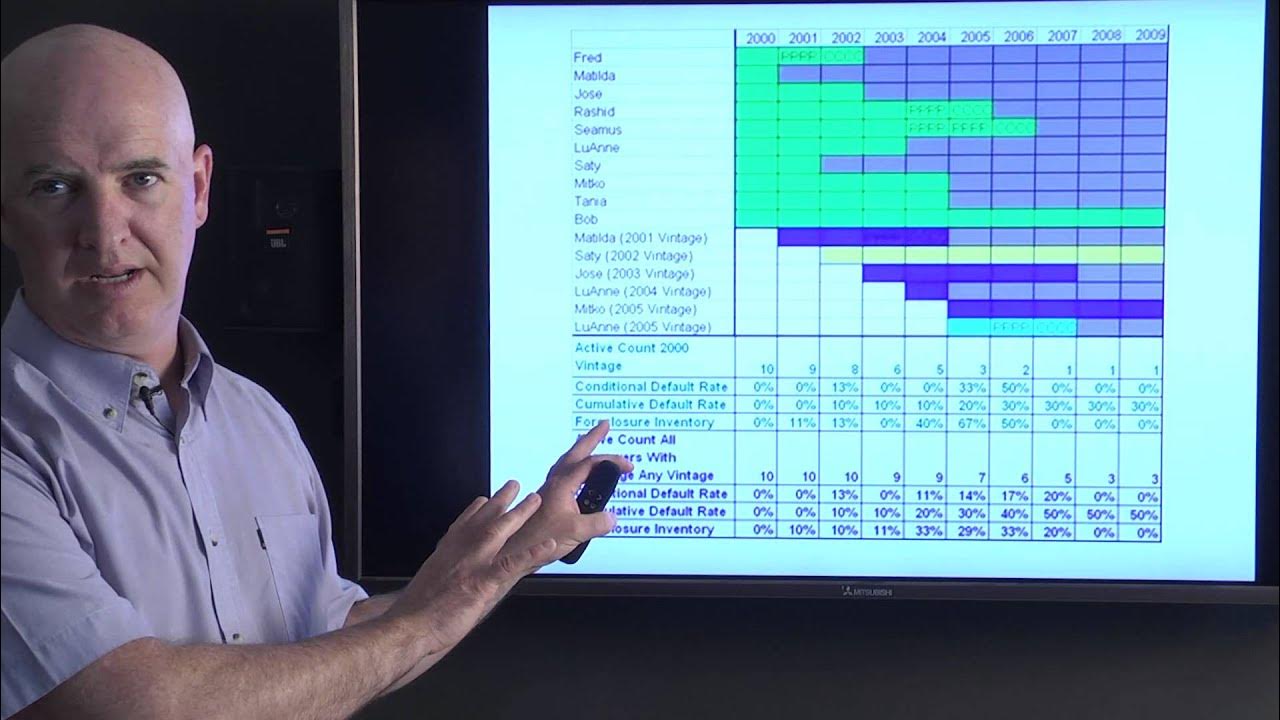

- 🚀 Show traction to prove your team's execution capabilities, which can include revenue growth, customer acquisition, or even assembling a strong founding team.

- 💼 Clearly explain the business model, ensuring it is understandable and realistic, avoiding overly complex financial forecasts for early-stage companies.

- 👥 Showcase the team's strengths and how they complement each other, addressing any known weaknesses by demonstrating proactive steps to hire or partner with experts.

- 🤝 End with a strong 'ask', making it clear what you need from the audience, whether it's investment, connections, or expertise.

- 👔 The significance of personal branding in pitches, where the presenter connects their name and identity to the company's logo and mission.

- 📊 A tip for finding market growth data: research competitors' presentations to find pre-existing research and CAGR figures.

- 📝 The presenter's background in venture capitalism and experience in running and selling companies, which adds credibility to the advice given.

Q & A

What is the main topic of the video?

-The main topic of the video is about the eight essential bullet points that should be included in any pitch or presentation.

What is the speaker's background that qualifies them to talk about pitch decks?

-The speaker has been a venture capitalist for several years, investing in unicorns like Farfetch and Vestier Collective, runs an investor accelerator in Oslo, Norway, and has experience running and selling their own company.

Why is the opening slide of a presentation important?

-The opening slide is important because it often stays on the screen the longest, allowing the audience to associate the startup's branding and logo with what the company does.

What is the purpose of selling the problem in a presentation?

-Selling the problem is crucial because it helps the audience understand the importance of the issue being addressed, especially if the audience is not familiar with the specific industry or field.

How should the solution be presented in a pitch?

-The solution should be presented in a way that is easy to understand, using simple diagrams or graphics, and should aim to win the audience's support by either being an obvious solution or a surprising, inventive one.

What is the significance of the market size slide in a presentation?

-The market size slide is significant because it convinces the audience that the market is growing and presents a market opportunity, which is attractive to investors.

What is the 'hack' suggested for finding compound annual growth rate (CAGR) and momentum figures?

-The hack suggested is to research competitors' presentations to find the CAGR and momentum figures they have likely already researched and included in their presentations.

Why is the traction slide important in a startup presentation?

-The traction slide is important because it shows momentum and proof of execution by the team, demonstrating that they are making progress over time.

What should be the focus of the business model slide in a pitch?

-The focus of the business model slide should be on providing a realistic understanding of how the company plans to monetize within its industry, without getting into overly complex financial forecasts.

Why is the team slide considered so important in a pitch presentation?

-The team slide is important because it shows that the team has the right balance and capabilities to solve the problem they are addressing, which is a key factor for investors when considering an investment.

What is the purpose of the 'ask' slide at the end of a presentation?

-The purpose of the 'ask' slide is to clearly state what the presenter is seeking from the audience, whether it be investment, connections, or expertise, providing a strong conclusion to the presentation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)