How to analyse ACCA FR Section C question Print Co 2022 past paper | ACCA Financial Reporting Exam

Summary

TLDRThis video tutorial guides viewers on how to tackle a financial reporting question for the ACCA F7 exam, focusing on the statement of financial position and the income statement. The presenter offers insights on exam techniques, the importance of timelines, and adjustments, and emphasizes the necessity of detailed workings to secure marks. Exclusive notes and further resources are available through the provided link, aiming to streamline preparation and enhance exam performance.

Takeaways

- 📚 The video is a tutorial on analyzing and preparing for an ACCA F7 exam question, focusing on the Statement of Financial Position and the Income Statement.

- 🔍 The presenter suggests downloading a classic financial reporting mock paper from the ACCA study hub to practice.

- ⏰ The recommended time to spend on the question is 36 minutes, based on 1.8 minutes per mark, with a maximum of 40 minutes including adjustments for human marking.

- 📝 The presenter recommends starting with Section A, then Section C, and finishing with Section B to manage time effectively.

- 📈 The importance of creating a timeline when preparing financial statements is emphasized, to track events before and after the accounting period.

- 🧐 The presenter advises using Excel or the CBE platform to layout the Income Statement and Statement of Financial Position for exam preparation.

- 📊 Carrying forward figures correctly, especially net profit or loss to the Statement of Financial Position, is crucial for scoring marks.

- 📋 The presenter suggests making notes on adjustments and using them to review mock papers and past questions for exam technique.

- 💡 Understanding the accounting equation (Assets = Equity + Liabilities) is fundamental for balancing the Statement of Financial Position.

- 🔑 The video highlights the importance of 'workings' in exam technique, as they help the marker understand the candidate's thought process and award marks accordingly.

- 🚨 The presenter warns about the potential for the examiner to use bold or highlighted terms to test candidates' attention to detail, such as a tax refund being a cash inflow.

Q & A

What is the main focus of the video?

-The main focus of the video is to guide viewers through the process of analyzing and preparing a financial reporting classic ACCA question, specifically on the statement of financial position and the income statement, which could appear on the F7 exam.

What is the significance of the timeline in the context of the video?

-The timeline is significant as it helps to distinguish between transactions that occurred before the accounting period and those that occurred afterwards, ensuring accurate adjustments are made in the financial statements.

What is the recommended approach to tackling the ACCA F7 exam questions?

-The recommended approach is to first work on section A, then section C, and finally section B, ensuring no more than 40 minutes are spent on the task. It is also suggested to use workings carried forward figures and to practice with mock papers and past exams.

Why is it important to carry forward figures in the exam?

-Carrying forward figures is important as it helps in maintaining consistency across the financial statements and ensures that the marker can follow the candidate's thought process, which can lead to easier marking and potentially higher scores.

What is the purpose of the notes provided in the video?

-The notes provided in the video are meant to serve as a guide and a template for candidates to follow when preparing their own financial statements, highlighting key components and adjustments that need to be made.

How does the video suggest candidates should approach the income statement and statement of financial position in the exam?

-The video suggests that candidates should use an Excel spreadsheet or the CBE platform to layout the income statement and statement of financial position based on the answers, ensuring they understand where each component fits within the financial statements.

What is the significance of the accounting equation in the context of the video?

-The accounting equation, which states that assets equal equity plus liabilities, is significant as it is the basis for ensuring that the balance sheet balances and reflects the correct financial position of the company.

What should candidates do when they encounter adjustments in the exam?

-Candidates should carefully consider the adjustments, noting the date of each transaction and its impact on the current accounting period, and make the necessary adjustments in their financial statements accordingly.

How does the video address the issue of a non-current asset being sold after the year end?

-The video explains that a non-current asset sold after the year end needs to be reclassified in the statement of financial position as a current asset held for sale, reflecting the change in its status.

What is the importance of 'workings' in the exam according to the video?

-The importance of 'workings' in the exam is emphasized as it helps candidates to demonstrate their understanding of the financial reporting process, making it easier for the marker to award marks and follow the candidate's reasoning.

What is the final tip provided by the video for candidates preparing for the financial reporting exam?

-The final tip is to imagine marking one's own work, which encourages candidates to be thorough and detailed in their workings, ensuring that even the simplest aspects of the financial statements are correctly accounted for.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Financial Statements & their Relationship / Connection | Explained with Examples

Cara Buat Laporan Laba Rugi, Neraca, dan Perubahan Modal - Siklus Akuntansi 4

Laporan Keuangan Organisasi Non Laba Sesuai ISAK 35

Power Point "Laporan Keuangan"

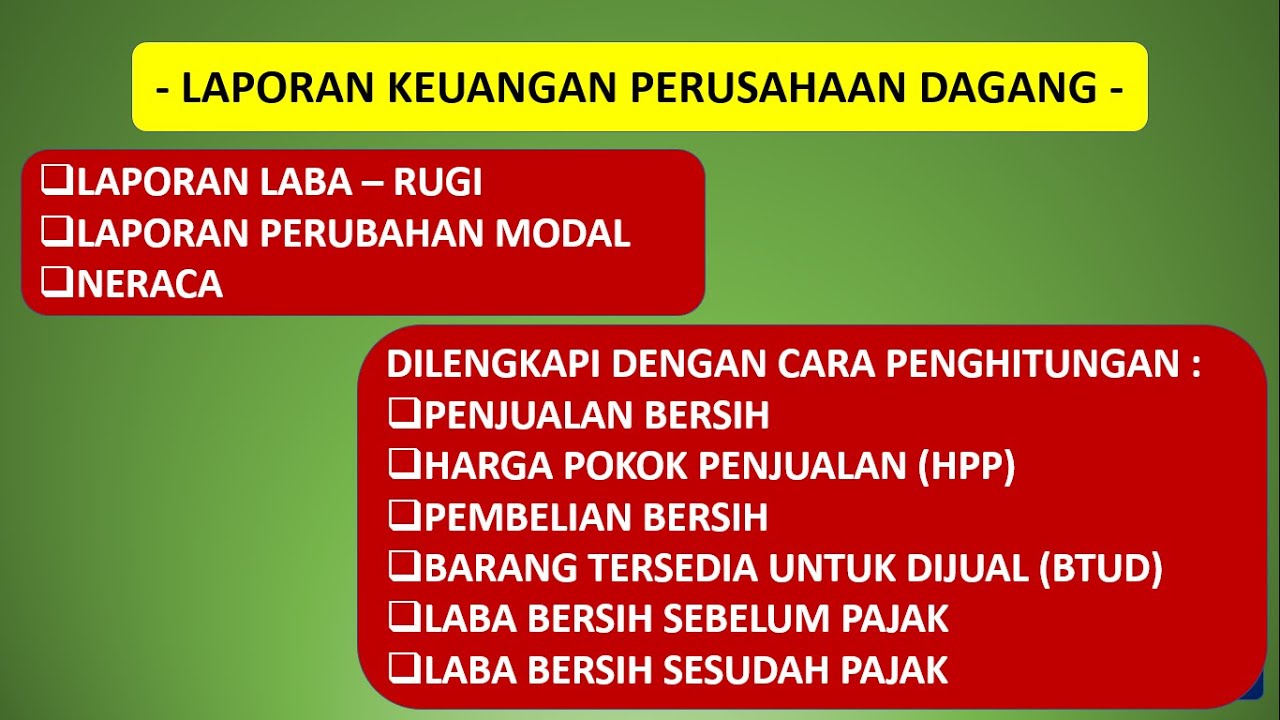

LAPORAN KEUANGAN PERUSAHAAN DAGANG

Projected income statement Grade 11 PART 1

5.0 / 5 (0 votes)