Power Point "Laporan Keuangan"

Summary

TLDRThis presentation introduces key financial reports used by businesses, focusing on the income statement, statement of changes in equity, balance sheet, cash flow statement, and notes to the financial statements. These reports are essential for both internal stakeholders (managers, owners) and external parties (investors, creditors, government agencies) to assess the financial health and performance of a company. The speaker explains how each report helps stakeholders make informed decisions regarding profitability, liquidity, and compliance with regulations, providing a comprehensive overview of financial reporting practices.

Takeaways

- 😀 Financial statements are crucial for recording and evaluating the transactions and financial performance of a business.

- 😀 Internal users of financial statements include managers, owners, and employees who rely on them for decision-making.

- 😀 External users include investors, creditors, and the government, who use financial statements to assess business health and compliance.

- 😀 The main types of financial statements are the income statement, statement of changes in equity, balance sheet, cash flow statement, and notes to the financial statements.

- 😀 The income statement (Laporan Laba Rugi) tracks revenues, expenses, and profits over a period and can be presented in single-step or multi-step formats.

- 😀 The single-step income statement is simpler and combines all income and expenses into one category.

- 😀 The multi-step income statement offers a more detailed breakdown, separating operational and non-operational income and expenses.

- 😀 The statement of changes in equity (Laporan Perubahan Modal) shows the changes in the company’s capital over a period.

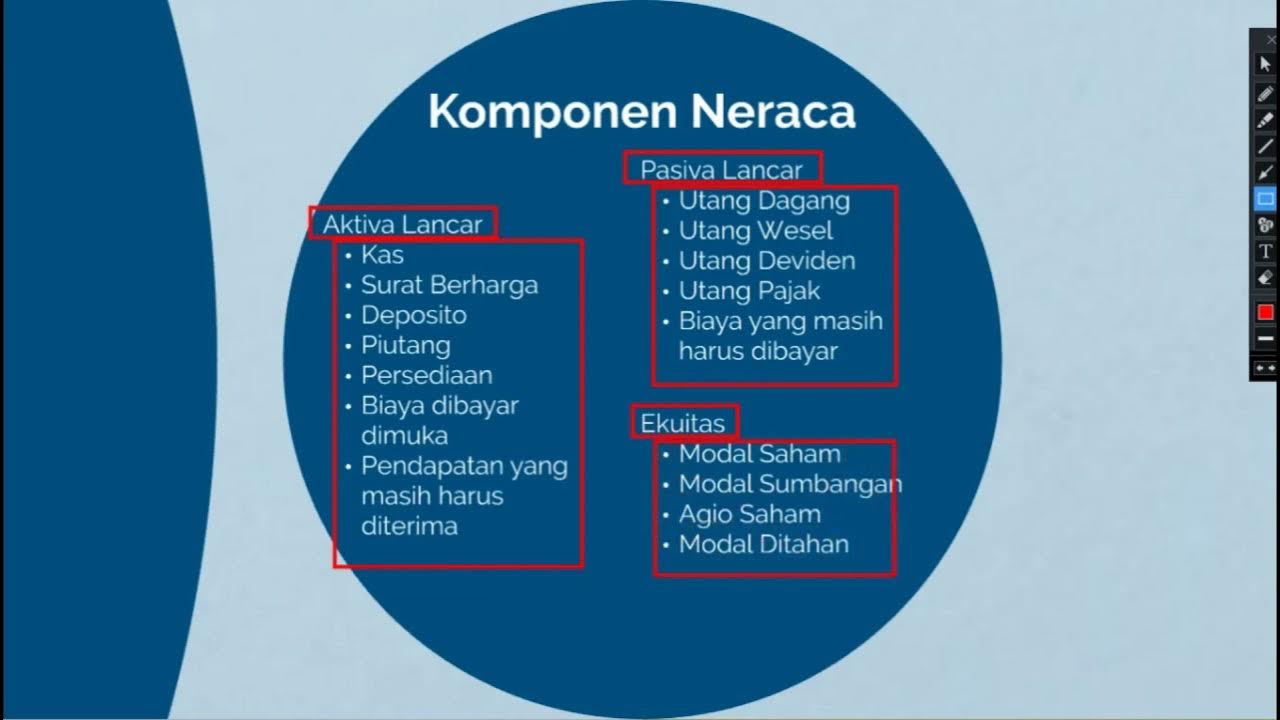

- 😀 The balance sheet (Neraca) gives a snapshot of a company’s assets, liabilities, and owner’s equity at a specific moment in time.

- 😀 The cash flow statement (Arus Kas) helps assess the company’s liquidity and solvency by tracking cash inflows and outflows.

- 😀 Notes to financial statements (Catatan atas Laporan Keuangan) provide detailed explanations about the figures in the financial reports, offering transparency for users.

Q & A

What is the purpose of financial statements?

-The purpose of financial statements is to provide information about the financial position and performance of a business. They help in understanding the company’s economic transactions, whether they involve purchases, sales, or other monetary exchanges.

Who are the internal and external users of financial statements?

-Internal users of financial statements include managers, owners, and employees of the company. External users include investors, creditors, and the government, who use the information for decision-making purposes.

What are the types of financial statements mentioned in the script?

-The financial statements mentioned include the income statement, statement of changes in equity, balance sheet, cash flow statement, and notes to the financial statements.

What does the income statement show?

-The income statement provides an overview of the company’s revenues and expenses during a specific period, showing whether the business is making a profit or a loss.

What is the difference between a single-step and multi-step income statement?

-A single-step income statement combines all revenues and expenses into one category, offering a simpler view. In contrast, a multi-step income statement separates operational and non-operational income and expenses for more detailed financial analysis.

What is the purpose of the statement of changes in equity?

-The statement of changes in equity shows the changes in the ownership equity of a company during a particular period, including the company’s retained earnings, contributions, and withdrawals.

How does a balance sheet present financial information?

-A balance sheet presents a company’s assets, liabilities, and shareholders' equity, showing the financial position of the company at a particular point in time.

What is the role of the cash flow statement?

-The cash flow statement records the cash inflows and outflows of a business over a specific period, helping evaluate the company’s liquidity and ability to meet financial obligations.

What are the notes to the financial statements, and why are they important?

-The notes to the financial statements provide additional explanations or clarifications regarding the financial data presented. They help users understand accounting methods, discrepancies, or unusual transactions.

Why is it important for companies to prepare accurate financial statements?

-Accurate financial statements are crucial because they ensure transparency, help stakeholders make informed decisions, and enable the company to comply with regulations, ensuring its financial health is clearly represented.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

KD 3 10 MENGANALISIS LAPORAN KEUANGAN SEDERHANA || PRODUK KREATIF DAN KEWIRAUSAHAAN

Financial Statements - Interconnectivity

NGERTI AKUNTANSI TANPA MENGHAPAL [PART 3]: Logika Utama Membuat & Membaca Laporan Keuangan.

mgt201 short lectures || vu mgt201 short lectures || Mgt201 vu guess paper || vu mgt201 mcqs

The Financial Statements & their Relationship / Connection | Explained with Examples

Video Pembelajaran Jenis Laporan keuangan

5.0 / 5 (0 votes)