Crypto News: BTC, Trump, Biden, ETH ETFs, Rate Cuts, WLD, HNT & MORE!

Summary

TLDRThe Coin Bureau Weekly News discusses the impact of Donald Trump's pro-crypto stance and his upcoming speech at the Bitcoin conference on crypto markets. It also covers the potential effects of Joe Biden not seeking a second term and the launch of spot Ethereum ETFs on market dynamics. The video speculates on price movements for Bitcoin and Ethereum, considering various bullish and bearish catalysts, including macroeconomic factors and the possible decoupling of crypto from traditional stocks.

Takeaways

- 🗣️ Donald Trump's increased chances of becoming president following an assassination attempt could be bullish for crypto, as he has positioned himself as a pro-crypto candidate.

- 🎉 Trump's VP pick, JD Vance, is a crypto supporter and this, along with support from other industry figures, could put crypto back in the spotlight for retail investors.

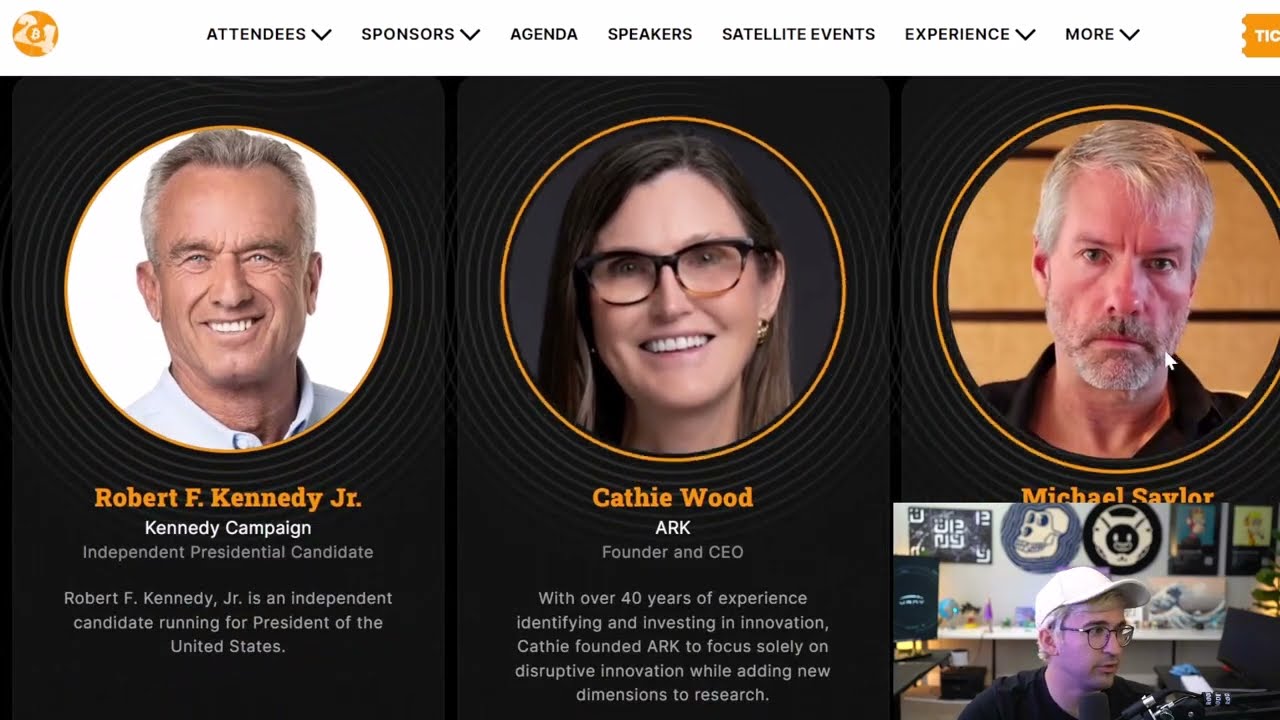

- 📈 The potential for Trump to speak at the Bitcoin conference in Nashville is a significant event, as no presidential candidate has ever done so before, and could spark renewed interest in crypto.

- 🤔 The decision by Joe Biden not to seek a second term and the uncertainty of who will become the Democratic nominee could impact crypto markets differently, depending on the nominee's stance on crypto.

- 💡 The launch of spot Bitcoin ETFs and the inflow of over $1 billion could be a bullish signal for BTC, potentially leading to a rally to new all-time highs.

- 🔄 The macro backdrop with political and geopolitical uncertainties might affect crypto markets, but the focus remains on crypto-specific catalysts for the moment.

- 📊 The weekly Ballinger band moving average is a significant indicator for BTC's market phase, with being above it suggesting a bull phase and below it suggesting a bear phase.

- 💰 The absence of BTC sales from Mount Gox creditors and the presence of bullish catalysts make a bullish scenario for BTC more likely.

- 📈 The upcoming listing of spot Ethereum ETFs is expected to be very bullish for ETH and the broader crypto market, potentially leading to significant price increases.

- 🔑 The correlation between ETH's price and leverage in DeFi, as well as the ETH to BTC pair being a proxy for altcoin strength, suggests that an increase in these could signal an 'alt season'.

- 🌐 Federal Reserve signaling potential interest rate cuts could have mixed effects; while it might stimulate the economy, historical correlations suggest it could also precede market crashes.

Q & A

What is the significance of Donald Trump's upcoming speech at the Bitcoin conference in Nashville?

-Donald Trump's speech at the Bitcoin conference is significant because it is the first time a presidential candidate has spoken at a crypto conference. This could potentially bring crypto back into the spotlight for retail investors in the US.

How might Donald Trump's stance on crypto influence the crypto market?

-Trump's pro-crypto stance and his potential to become president could be bullish for the crypto market. His VP pick, JD Vance, also holds BTC and is not a fan of the SEC, which could further support the crypto market.

What is the potential impact of Joe Biden not seeking a second term on the crypto market?

-Joe Biden's decision to drop out could initially cause a pump in BTC, but the long-term impact depends on who becomes the Democratic nominee and their views on crypto. Kamala Harris, who Biden is backing, has unknown views on crypto, which adds uncertainty.

What are the possible outcomes for BTC if it breaks above the Ballinger band moving average?

-If BTC breaks above the Ballinger band moving average, it could quickly rally to new all-time highs, specifically to around $77,000. Conversely, if it gets rejected, BTC could quickly fall to recent lows, specifically to around $57,000.

What is the potential catalyst for BTC to reach new all-time highs?

-A potential catalyst for BTC to reach new all-time highs could be Trump considering adding BTC as a reserve asset for the US government, which would be a significant move in the crypto space.

What is the expected impact of the spot Ethereum ETFs listing on the crypto market?

-The listing of spot Ethereum ETFs is expected to be very bullish not just for ETH, but for the crypto market more broadly. It could open the door to additional spot crypto ETFs in the future, potentially increasing demand for ETH and other altcoins.

What could be the effect of the Federal Reserve signaling lower interest rates on the crypto market?

-Lowering interest rates by the Federal Reserve could stimulate the economy and the markets, potentially leading to a rotation from large cap stocks into small cap stocks and altcoins. This could benefit the crypto market by proxy, although historically, rate cuts have been correlated with market crashes.

What are the potential benefits of a Trump presidency for the crypto market?

-A Trump presidency could create certainty for crypto due to the likelihood of pro-crypto regulations being passed. Trump's pro-growth policies and desire for a weaker US dollar could also be beneficial for the crypto market, as crypto is inversely correlated with the US dollar.

What is the current state of retail investor interest in crypto?

-Retail investor interest in crypto is currently at its lowest in years, with recent data suggesting that retail-related BTC transactions are the lowest they've been since 2021. This means that most of the money flowing around the crypto market is mercenary capital and experienced retail investors from previous cycles.

What are the potential short-term targets for ETH if it breaks above its key resistance level?

-If ETH breaks above its key resistance level, it could rally as high as $4.9k. Conversely, if there are large net outflows, then ETH could fall as low as $2.9k.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

THIS WEEK IS HUGE FOR CRYPTO

Donald Trump Có Thể Cho Bitcoin To The Moon... Khi Đắc Cử.....

BITCOIN: TRUMPS INSANE CRYPTO PLAN!!!! 🚨 (all holders must see this)

Watch This BEFORE September 17th! (FINAL WARNING!)

We Called It! Coin Bureau 2024 Predictions Reviewed

It Started: INSANE Bitcoin Price Prediction For June 2025

5.0 / 5 (0 votes)