Factoring and Pledging Accounts Receivable

Summary

TLDRThis module, presented by Valerie Chambers, explains factoring and pledging accounts receivable. Pledging involves promising to pay collected receivables to a creditor, typically to secure lower interest rates or more credit. Factoring involves selling receivables to receive immediate cash, minus a factoring fee. The example given illustrates selling $100,000 in receivables with a 2.5% fee, emphasizing the need to credit accounts receivable and account for the fee as a financing expense. The session concludes with guidance on recording these transactions through journal entries.

Takeaways

- 📜 Pledging accounts receivable involves promising to forward future cash receipts from specific receivables to a lender or creditor.

- 🕰️ No money changes hands at the time of the pledge; the pledge is a future promise.

- 💼 Companies may pledge accounts receivable to obtain a lower interest rate, more credit, or an extension of a credit line.

- 🧾 Accounting for pledging receivables is complex and typically covered in intermediate accounting courses.

- 💵 Factoring accounts receivable means selling the receivables to a third party, such as a collection agency or bank, for immediate cash.

- 💰 When factoring, the seller receives money upfront in exchange for giving up the right to collect the receivables.

- 📅 The factoring fee accounts for the implied interest, the risk of non-collection, and the profit margin for the factor.

- 🧮 In the example given, a company sells $100,000 in receivables on May 1st with a 2.5% factoring fee.

- 📝 The journal entry involves crediting accounts receivable for $100,000, recording a $2,500 factoring fee expense, and debiting cash for the net amount received.

- 📚 Factoring is often a practical option for companies in need of immediate funds, despite the high implied interest rate.

Q & A

What does it mean to pledge accounts receivable?

-Pledging accounts receivable means promising to use the cash receipts collected from specific receivables to pay a creditor immediately. No money changes hands at the time of the pledge.

Why might a company choose to pledge accounts receivable?

-A company might pledge accounts receivable to obtain a lower interest rate, gain more credit, or extend a line of credit as part of a larger financial deal.

What is the difference between pledging and selling accounts receivable?

-Pledging accounts receivable involves promising future cash receipts to a creditor, whereas selling accounts receivable (factoring) involves selling the right to collect receivables in exchange for immediate cash.

What is factoring in the context of accounts receivable?

-Factoring involves selling accounts receivable to a third party, such as a collection agency or bank, in exchange for immediate cash, minus a factoring fee.

Why would a company choose to factor its accounts receivable?

-A company might factor its accounts receivable to obtain immediate cash, especially if it needs funds urgently and cannot wait for the receivables to be collected in the future.

How is the factoring fee calculated in the example provided?

-In the example, the factoring fee is 2.5% of the $100,000 accounts receivable, which amounts to $2,500.

What journal entry is made when accounts receivable are sold for cash?

-The journal entry involves crediting accounts receivable for $100,000, debiting a financing expense for the factoring fee of $2,500, and debiting cash for the remainder of $97,500.

Why is the factoring fee considered a financing expense?

-The factoring fee is considered a financing expense because it represents the cost of obtaining immediate cash by selling the accounts receivable.

What are the risks associated with factoring accounts receivable?

-The risks include the potential loss of revenue if the factor cannot collect the receivables and the high implicit interest rate charged by the factor.

How does the timing of cash flow impact the decision to factor accounts receivable?

-If a company needs immediate cash and cannot wait for future receivables, factoring allows it to access funds quickly, despite the associated costs and risks.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

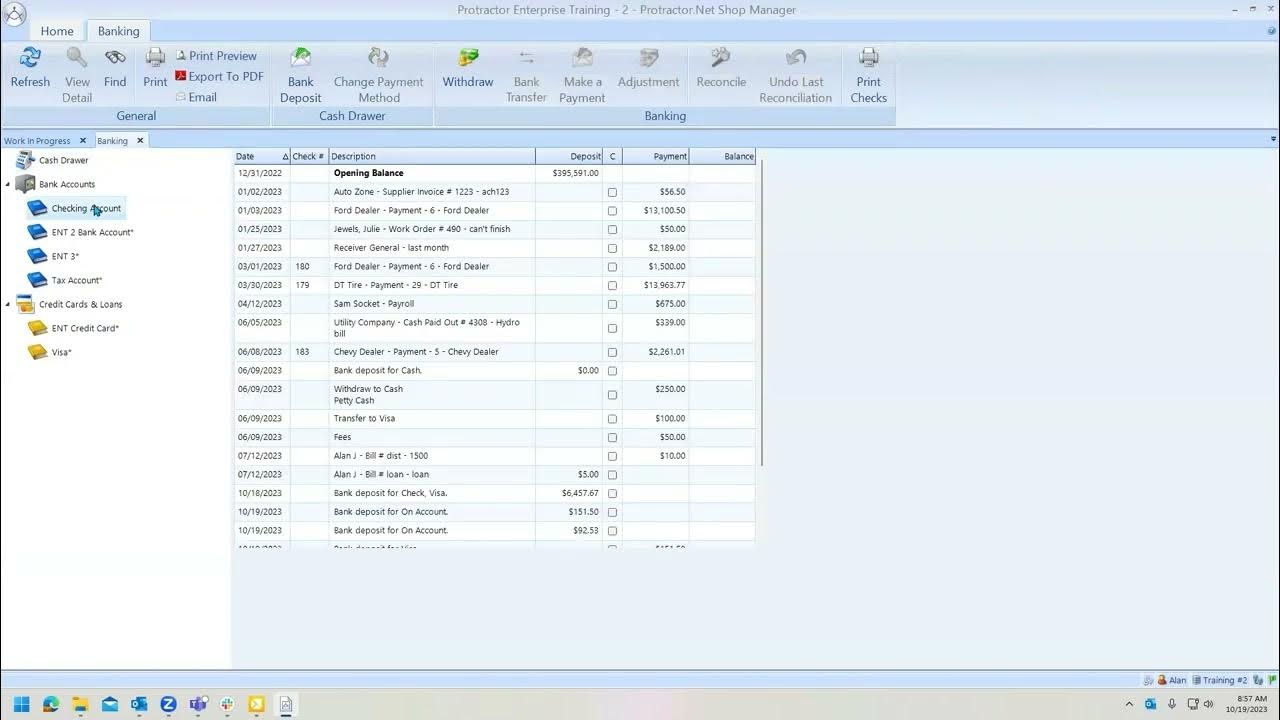

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)