AKM 1: 3-2 Pengakuan Piutang Dagang

Summary

TLDRThis video discusses key concepts in accounting related to receivables, focusing on their recognition and valuation. It explains how accounts receivable arise from credit sales and the accounting treatment for sales, returns, and discounts. The transcript covers different methods for valuing receivables, such as the Gross and Net methods, and the journal entries associated with them. The video also explores the handling of sales returns, discounts, and uncollectible accounts, providing insight into how companies record these transactions. Overall, the video aims to offer a comprehensive understanding of receivable management in accounting.

Takeaways

- 😀 Accounts receivable are recognized when goods or services are delivered on credit, which is fundamental for financial reporting in businesses.

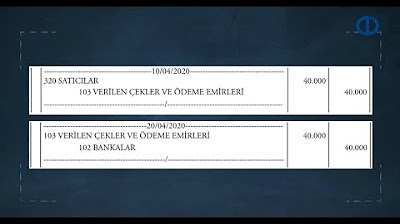

- 😀 When selling goods or services on credit, journal entries include recognizing the receivable and sales revenue simultaneously.

- 😀 If the company uses the perpetual inventory system, additional journal entries are needed to record the cost of goods sold along with sales revenue.

- 😀 Under the periodic inventory system, only sales revenue is recorded at the time of the transaction, simplifying journal entries.

- 😀 A return of goods or sales adjustments reduces the outstanding receivable balance, as illustrated in the example where $100 of goods were returned.

- 😀 Sales discounts are applied when customers pay within a set period, such as 10 days, and reduce the receivable balance accordingly.

- 😀 In the case of a 2% sales discount, a customer pays $882 instead of the original $900, reducing the receivable amount.

- 😀 The Gross Method and Net Method are two ways to account for sales discounts, with the Net Method often considered more accurate as it reflects the actual realizable value of receivables.

- 😀 The Gross Method records the full receivable initially, and the discount is applied later when payment is made.

- 😀 The Net Method anticipates the discount and records the receivable at the discounted value from the outset, resulting in a more precise financial picture.

Q & A

What is the main topic discussed in the script?

-The main topic discussed in the script is the recognition and valuation of accounts receivable (AR), including the processes related to sales, discounts, returns, and bad debts.

When does a company recognize accounts receivable for credit sales?

-Accounts receivable are recognized when the company completes its obligation to deliver goods or services to the customer, as per the revenue recognition principle.

What is the difference between the perpetual and periodic inventory methods in accounting?

-The perpetual method updates inventory records continuously after each sale, while the periodic method updates inventory at specific intervals, typically at the end of an accounting period.

How are sales returns handled in accounts receivable?

-Sales returns reduce the accounts receivable balance. A journal entry is made to decrease the receivable amount, with the corresponding sales return or allowance account being credited.

What happens when a customer pays within the discount period?

-If a customer pays within the discount period, the company applies the discount to the receivable amount, which reduces the cash received. The difference is recorded as a sales discount.

How is the sales discount treated in accounting?

-The sales discount is recorded by debiting the sales discount account and crediting accounts receivable for the discounted amount, reflecting the reduction in revenue.

What are the two methods of handling sales discounts in accounting?

-The two methods are the gross method and the net method. In the gross method, the full sales amount is recorded, and the discount is applied when the customer pays within the discount period. In the net method, the discounted amount is recorded immediately, assuming the customer will take the discount.

What is the difference between the gross method and the net method in sales discounts?

-In the gross method, the total sales amount is recorded initially, and the sales discount is applied later when payment is made. In the net method, the receivable is recorded at the discounted amount upfront, assuming the customer will pay within the discount period.

How is a bad debt or uncollectible receivable accounted for?

-Bad debts are typically accounted for using the allowance method, where an estimated amount of receivables expected to be uncollectible is recorded as an allowance for doubtful accounts, reducing the accounts receivable balance.

What is the impact of a sales return on the accounts receivable balance?

-A sales return reduces the accounts receivable balance. For example, if a return of $100 occurs, the accounts receivable balance decreases by that amount, and a corresponding entry is made to the sales return or allowance account.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)