Accounting for Accounts Receivable (Animation)

Summary

TLDRThis video from Edgy County focuses on financial education, specifically on the topic of receivables. It explains the three types of receivables: accounts receivable, notes receivable, and other receivables. Accounts receivable, a significant asset for many companies, is discussed in terms of its role as a current, liquid asset, and how it's initially recognized and valued. The video also compares the direct write-off and allowance methods for estimating bad debts. Additionally, it covers the concept of selling receivables, as well as the formal nature of notes receivable and other receivables like loans or advances.

Takeaways

- 😀 Accounts receivable (AR) is a crucial part of a company's assets, often comprising more than 50% of its total assets.

- 😀 AR is considered a current asset and is expected to be converted into cash within 30 to 60 days.

- 😀 The process of recognizing AR is straightforward when credit sales are made, with an initial journal entry of debit accounts receivable and credit sales.

- 😀 The challenging part of AR is valuing it when unpaid. Companies must estimate how much will be uncollectible over time.

- 😀 Two primary methods exist for valuing AR: the direct write-off method and the allowance method.

- 😀 The direct write-off method is used when AR is insignificant, and expenses are recognized only when an AR balance is written off.

- 😀 The allowance method is required under GAAP and matches estimated bad debt expenses against revenues on the income statement.

- 😀 Companies can sell their receivables to third parties, receiving cash upfront and paying a fee for the service.

- 😀 Notes receivable are more formalized than AR, typically involving additional credit terms or loans in place of AR.

- 😀 Other receivables include loans to officers, employee advances, or income tax refunds that don't fit into accounts or notes receivable.

- 😀 The key takeaway is that understanding and managing receivables properly helps businesses make better decisions through effective financial data and education.

Q & A

What are the three types of receivables mentioned in the video?

-The three types of receivables are accounts receivable, notes receivable, and other receivables.

Why are accounts receivable considered important for a company?

-Accounts receivable can be a significant part of a company's assets, often making up 50% or more. They represent the amounts promised to be paid for goods and services purchased.

What is the role of accounts receivable in a company's balance sheet?

-Accounts receivable are current assets, considered liquid, and appear toward the top of the balance sheet. They are expected to be collected or converted into cash within 30 to 60 days.

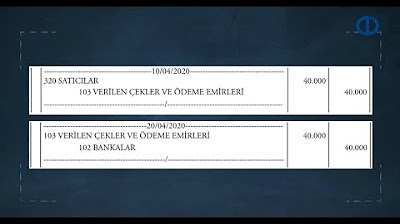

How is accounts receivable recognized in accounting?

-Accounts receivable are recognized when goods are sold on credit. For example, if goods worth $50 are sold on credit, the entry would be a debit to accounts receivable and a credit to sales.

What are the challenges in valuing accounts receivable?

-The challenge in valuing accounts receivable lies in determining how much of it will be uncollectible as time goes by, as it's uncertain how much will be paid back.

What is the direct write-off method for valuing accounts receivable?

-The direct write-off method is used when accounts receivable are considered insignificant. It recognizes expenses only when the receivable is written off, meaning it is certain the amount won't be repaid.

How does the allowance method differ from the direct write-off method?

-The allowance method is a more formal approach and required under GAAP. It estimates bad debt either as a percentage of sales or accounts receivable, helping match expenses with revenue.

What happens when a company sells its receivables?

-When a company sells its receivables, it receives cash for the accounts receivable, and a third party collects the receivable on the company's behalf, usually for a fee.

What are notes receivable, and how do they differ from accounts receivable?

-Notes receivable are more formalized receivables, typically involving extended credit terms, loans of money, or settlements of accounts receivable, and they involve a written agreement.

Can you provide examples of other receivables that don't fit under notes or accounts receivable?

-Examples of other receivables include loans to company officers, advances to employees, or income tax refunds, which do not fall under notes or accounts receivable.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FİNANSAL MUHASEBE - Ünite 3 Konu Anlatımı 1

AKL 1- Hutang Piutang Antar Perusahaan (Part 1)

[MEET 10-1] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI ASET & KEWAJIBAN

LEMBAGA KESEJAHTERAAN RAKYAT |BAB 3 IPS KELAS 8| KURIKULUM MERDEKA

MATEMATIKA KELAS 8 HALAMAN 37 KURIKULUM MERDEKA 2022 || AYO MENCOBA

Fracionamento da despesa

5.0 / 5 (0 votes)