How to Stop Staying Stuck as a Trader

Summary

TLDRThe video script discusses the challenges of trading, emphasizing the importance of understanding market trends and structure. It uses the metaphor of climbing rocks to illustrate the gradual learning process in trading, where traders must avoid the trap of constant change and instead build a solid foundation of knowledge. The speaker shares insights on recognizing market movements, supply and demand, and the significance of sticking to a disciplined approach to achieve profitability and avoid the common pitfalls that lead to failure.

Takeaways

- 📈 Trading is difficult due to the vast number of approaches and the need to master a specific methodology to be successful.

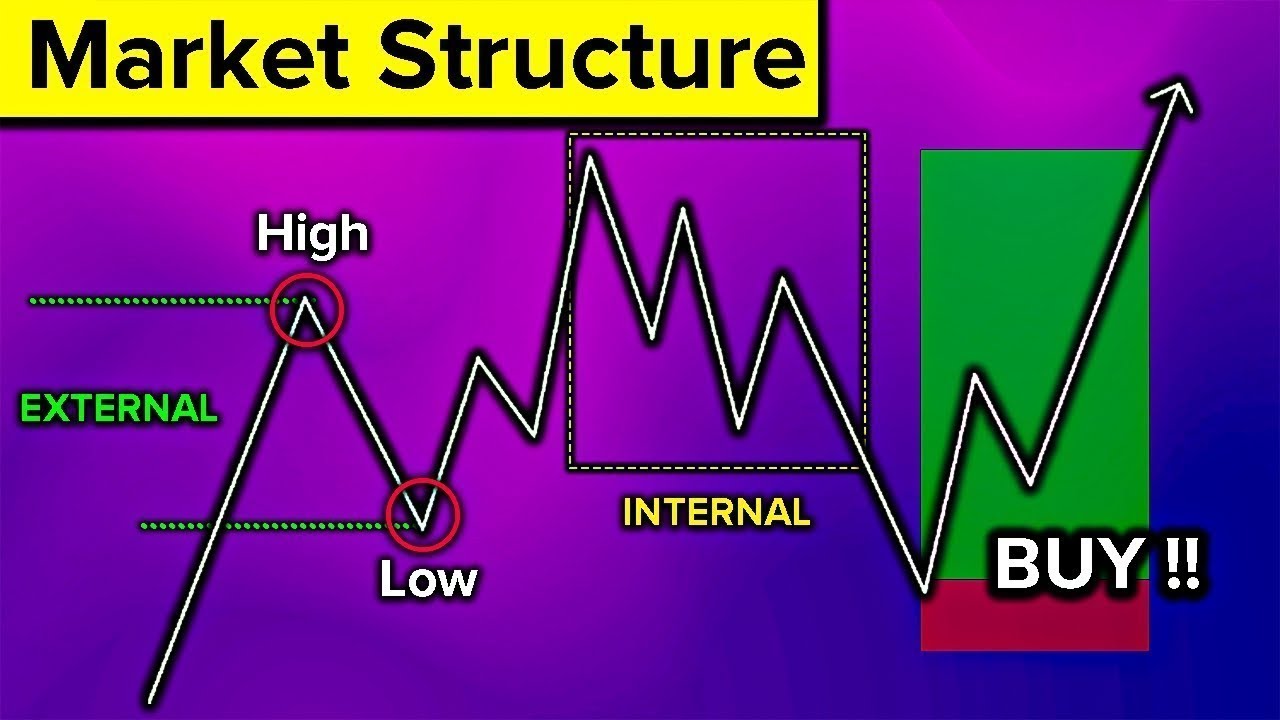

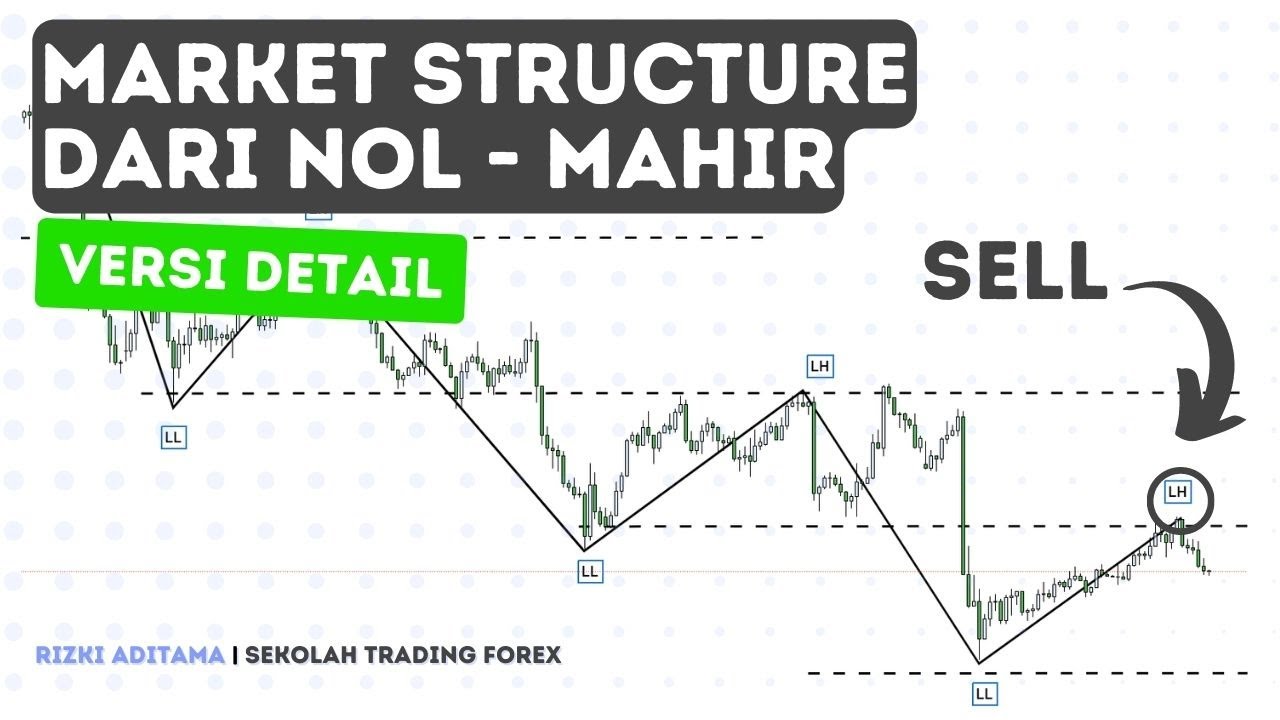

- 🔄 The 'M Effect' or trend following is presented as a preferred trading strategy that emphasizes proper market structure understanding.

- 🪨 The concept of 'rocks' symbolizes independent trading concepts, each representing a step in a trader's learning journey.

- 🤔 The challenge for traders is to resist the temptation of comfort and novelty, which can lead to a cycle of perpetual learning without mastery.

- 🚫 Many traders quit or get stuck in a loop of learning new strategies without fully mastering any, leading to a lack of profitability.

- 💡 The importance of understanding market movement through supply and demand dynamics is highlighted as a key to successful trading.

- 📚 Education in trading should be gradual, building upon foundational knowledge to develop a robust trading system.

- 🔑 Mastery of trading comes from sticking to a learning path and avoiding the trap of constantly seeking new strategies without applying them.

- 🧠 The learning process in trading is likened to academic education, where foundational concepts are built upon over time.

- 📉 The script emphasizes the importance of recognizing when not to trade, as part of a disciplined trading approach.

- 🌐 The concept of trading in harmony with market trends and understanding the larger supply and demand areas is crucial for entry and exit points.

Q & A

What is the main challenge that traders face according to the speaker?

-The main challenge traders face is the multitude of approaches to trading and the difficulty in mastering a single, consistent method, which leads to a perpetual cycle of switching between different strategies without achieving proficiency.

What does the speaker refer to as 'the M effect bubble'?

-The 'M effect bubble' is a term used by the speaker to describe a trend following or structure following approach to trading, which emphasizes proper understanding of market trends and structures as a foundation for successful trading.

Why does the speaker compare trading concepts to rocks?

-The speaker uses rocks as a metaphor to represent independent trading concepts. Climbing each rock symbolizes mastering a concept, and the difficulty of moving from one rock to another represents the challenge of learning new trading strategies.

What does the 'foam mattress with snacks and steak' represent in the script?

-The 'foam mattress with snacks and steak' symbolizes the comfort zone or the temptation to revert back to easier, less effective trading strategies after achieving some initial understanding or success.

What is the significance of the '90% of traders' statistic mentioned by the speaker?

-The statistic highlights that a large majority of traders never progress beyond the initial stages of learning and often quit or remain stuck in a cycle of switching between trading strategies without achieving mastery.

What does the speaker mean by 'trading true structure'?

-Trading true structure refers to understanding and following the natural patterns and trends of the market, rather than trying to predict or manipulate them, which is a key component of the speaker's preferred trading approach.

How does the speaker describe the process of learning to trade effectively?

-The speaker describes the learning process as gradual and building upon initial understandings, similar to constructing a house from the foundation up. It involves making incremental leaps in understanding and avoiding the temptation to jump between strategies.

What is the importance of understanding supply and demand in trading according to the script?

-Understanding supply and demand is crucial as it forms the basis of market movements. Recognizing how supply and demand validate price movements can lead to more accurate predictions and better trading decisions.

Why does the speaker emphasize sticking to a single trading approach?

-The speaker emphasizes sticking to a single approach to avoid the treacheries of falling back into a cycle of learning and forgetting. Consistency in learning and applying a single approach is key to achieving mastery and profitability.

What does the speaker suggest is the key to breaking out of the cycle of perpetual learning without progress?

-The key to breaking the cycle is to make a commitment to a single trading approach and to continue learning and applying it consistently. This gradual accumulation of knowledge leads to a deeper understanding and eventual mastery.

How does the speaker describe the difference between a novice trader and a proficient one?

-The difference lies in the depth of understanding and the ability to apply that understanding consistently. A proficient trader has a solid foundation and a clear template for entries, management, and exits, whereas a novice trader may lack this structure and understanding.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Market Structure Simplified (For Beginner to Advanced Traders)

just copy this, don't even think, this is how you trade

Trading Cepat dan Mudah dengan Market Structure (Detail)

Advanced Market Structure Course (step by step) SMC

Master SMC/ ICT Market Structure The Correct Way (very easy)

Intro to Market Structure Shifts, Fair Value Gaps, and Displacement - ICT Concepts

5.0 / 5 (0 votes)