Tutorial Pembayaran Pajak Menggunakan e-Billing

Summary

TLDRThis tutorial provides a simple two-step guide for tax payments using e-billing on the pajak.go.id website. First, users learn how to create a billing code by logging in with their Taxpayer Identification Number, password, and security code. The details are automatically filled in, and users can generate a billing code. In the second step, payments can be made using various channels, such as bank teller, ATM, internet banking, or mobile banking. For further assistance, users can visit the website or call the tax help center.

Takeaways

- 😀 Access the pajak.go.id website to begin the e-billing tax payment process.

- 😀 Log in using your Taxpayer Identification Number (NPWP), password, and security code.

- 😀 Once logged in, navigate to the djp-online homepage and click on the 'Pay' icon.

- 😀 Select the 'e-billing' option to start creating your billing code.

- 😀 Your NPWP data, name, and address will auto-fill in the e-billing form.

- 😀 Enter tax details such as type of tax, deposit type, tax period, tax year, deposit amount, and description.

- 😀 Click 'Create Billing Code' to generate your billing code.

- 😀 If there's an error or the validity period has expired, you can recreate the billing code.

- 😀 After generating the code, print or download it for payment.

- 😀 Payments can be made via various channels: bank teller, ATM, internet banking, mobile banking, mini ATM, or other methods.

- 😀 For further assistance, visit www.pajak.co.id or contact the tax ring at 1500 201.

Q & A

What is the first step in paying taxes using e-billing on the pajak.go.id site?

-The first step is to create a billing code by logging into the pajak.go.id website and filling in your Taxpayer Identification Number (NPWP), password, and security code.

What devices can be used to access the pajak.go.id site for tax payments?

-You can use a laptop, tablet, or smartphone connected to the internet to access the pajak.go.id site.

What should you do after logging in to the DJP Online homepage?

-After logging in, you need to click on the 'Pay' icon and then click 'e-billing' to proceed.

What information is automatically filled in when creating a billing code?

-The system automatically fills in your NPWP data, including your name and address.

What details do you need to fill in manually when creating a billing code?

-You need to fill in the type of tax, type of deposit, tax period, tax year, amount deposited, and a description of the payment.

What should you do if there is an error when creating the billing code?

-If there is an error or the validity period has expired, you can re-create the billing code.

What is the next step after creating the billing code?

-The second step is to pay using the billing code that has been printed or downloaded.

How can payments be made once the billing code is ready?

-Payments can be made through various channels, including bank tellers, ATMs, internet banking, mobile banking, mini ATMs, or editions.

Where can you go for help if you encounter issues during the payment process?

-You can visit the website www.pajak.go.id or call the tax helpline at 1500 201 for assistance.

What additional resource can help with understanding the e-billing process?

-You can visit the YouTube channel 'ditjenpajakri' for more information and tutorials about tax payment.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Lapor eBupot Unifikasi Full Lengkap

Tutorial Pelaporan SPT Tahunan 1770S | Bagi WP Orang Pribadi dengan e-Form

TUTORIAL PEMBUATAN E-BILLING DAN PELAPORAN PPH 25 DI CORETAX | KELOMPOK 2

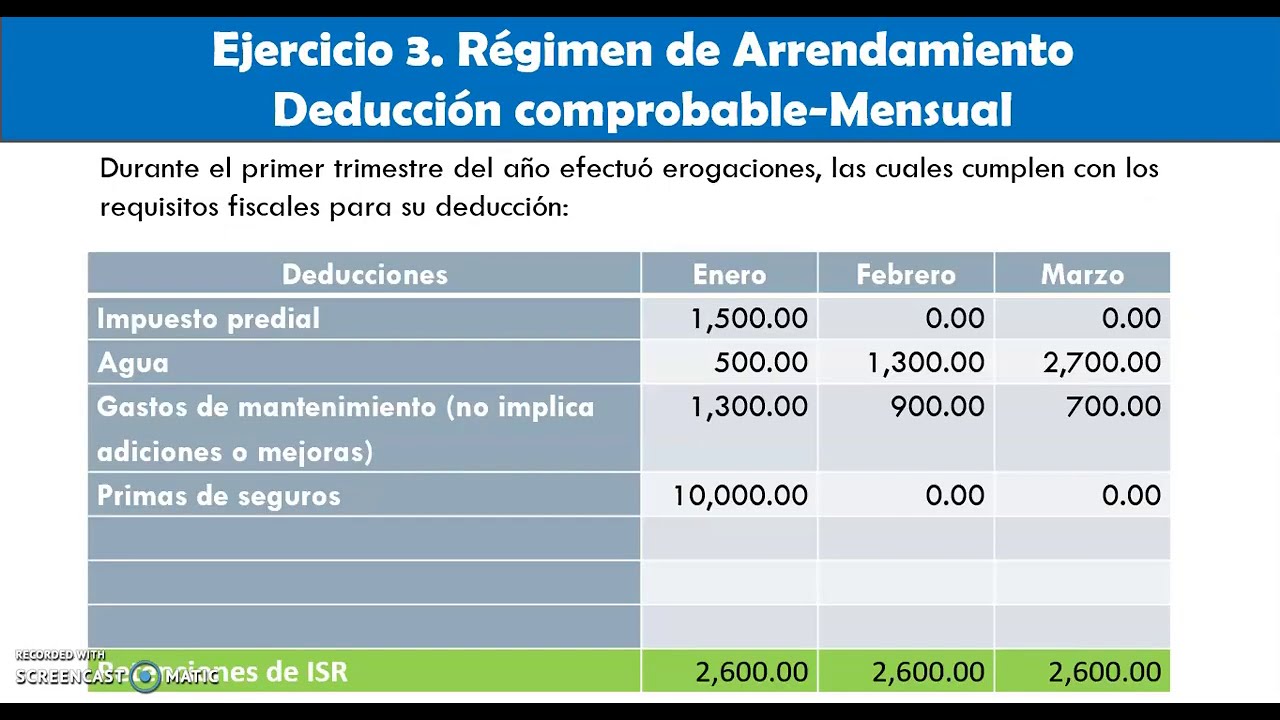

Pagos provisionales de ISR en Régimen de Arrendamiento parte 2

Seri Pengantar Akuntansi Pemerintahan Soal dan Pembahasan SIklus Akuntansi Pemerintahan (1)

Cara Membuat Bukti Potong PPh 21 Karyawan Tahun 2025 Coretax

5.0 / 5 (0 votes)