TUTORIAL PEMBUATAN E-BILLING DAN PELAPORAN PPH 25 DI CORETAX | KELOMPOK 2

Summary

TLDRThis video explains PPH25 tax, a monthly installment payment for businesses and individuals with taxable income. The goal of PPH25 is to ease the burden of paying a large tax sum at once by allowing monthly payments. The video covers who needs to pay, the process of creating an e-billing code through the Cortex system, and how to make payments via bank, ATM, or e-wallet. Additionally, it explains how to report PPH25 payments when filing the annual tax return, ensuring that businesses stay compliant and avoid future problems with taxes.

Takeaways

- 😀 PPH25 is a tax paid in installments to ease the burden on taxpayers, rather than being paid in one lump sum at the end of the year.

- 😀 PPH25 is applicable to individual taxpayers with businesses, as well as corporate taxpayers like PT and CV, who have taxable income.

- 😀 The main goal of PPH25 is to make paying taxes more manageable by splitting the payment into smaller amounts over the course of the year.

- 😀 Failure to deposit or report PPH25 payments may result in sanctions, according to applicable laws and regulations.

- 😀 Businesses can pay PPH25 monthly through a system called Cortex, without needing to visit the tax office in person.

- 😀 To pay PPH25 via Cortex, taxpayers need to create an e-billing code on the Cortex website (cortexdjp.pajak.go.id).

- 😀 After logging into Cortex, taxpayers select the 'company access roll' and generate the PPH25 e-billing code by filling in required information like the payment period and amount.

- 😀 PPH25 is paid monthly, but it does not need to be reported monthly. However, it must be reported at the end of the year when filing the annual tax return (SPT).

- 😀 Payments made under PPH25 are recorded as tax credits when completing the annual tax report, reducing the final tax burden.

- 😀 Always ensure that all PPH25 payments are correctly recorded and reported in the annual SPT to avoid any issues in the future.

Q & A

What is PPH25 tax?

-PPH25 is an installment tax, designed to ease the burden of paying the entire income tax at once. It allows taxpayers to pay a portion of their tax every month instead of in a lump sum at the end of the year.

Why is PPH25 important for business owners?

-PPH25 is important because it makes it easier for business owners to manage their tax payments. Instead of paying the full tax amount at once, business owners can pay smaller installments monthly, helping with cash flow management.

Who needs to pay PPH25 tax?

-PPH25 is required for individual taxpayers with businesses, and corporate taxpayers such as PT (Limited Companies) or CV (Partnerships). Anyone with taxable income who has filed an annual tax return must pay this tax.

How can PPH25 tax payments be made?

-PPH25 payments can be made online through the Cortex system. Taxpayers create an e-billing code and then pay through various channels such as a bank, ATM, or e-wallet.

What is the process for creating an e-billing code for PPH25?

-To create an e-billing code for PPH25, log into the Cortex system, navigate to the company access section, and select the option to create a billing code. Enter the KAP PPH Article 25 code, select the period (e.g., January 2025), enter the amount, and download the generated billing code.

Do taxpayers need to report PPH25 payments monthly?

-No, PPH25 payments do not need to be reported monthly. However, proof of payment must be reported annually when filing the SPT (annual tax return).

What should taxpayers do after paying PPH25 installments every month?

-After paying the PPH25 installments, taxpayers should ensure that the payment is recorded as a tax credit when filling out the annual SPT (tax return). This will reflect the monthly payments made throughout the year.

What happens if PPH25 payments are delayed?

-Delays in PPH25 payments or reporting may result in sanctions, as per the applicable regulations. It’s important to pay on time and report correctly to avoid penalties.

Can PPH25 payments be delegated to someone else?

-No, PPH25 payments must be made personally by the taxpayer. Delegation is not allowed for this type of tax payment.

What is the benefit of paying PPH25 in installments?

-The benefit of paying PPH25 in installments is that it spreads out the tax burden throughout the year. Instead of paying a large sum at the end of the year, taxpayers can pay smaller, more manageable amounts each month.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

PPh Pasal 25: Pengertian, Kategori Perhitungan, Perhitungan, Batas Waktu Pembayaran, dan Sanksi

Menghitung Pajak Penghasilan - PPh

KETENTUAN UMUM DAN TATA CARA PERPAJAKAN

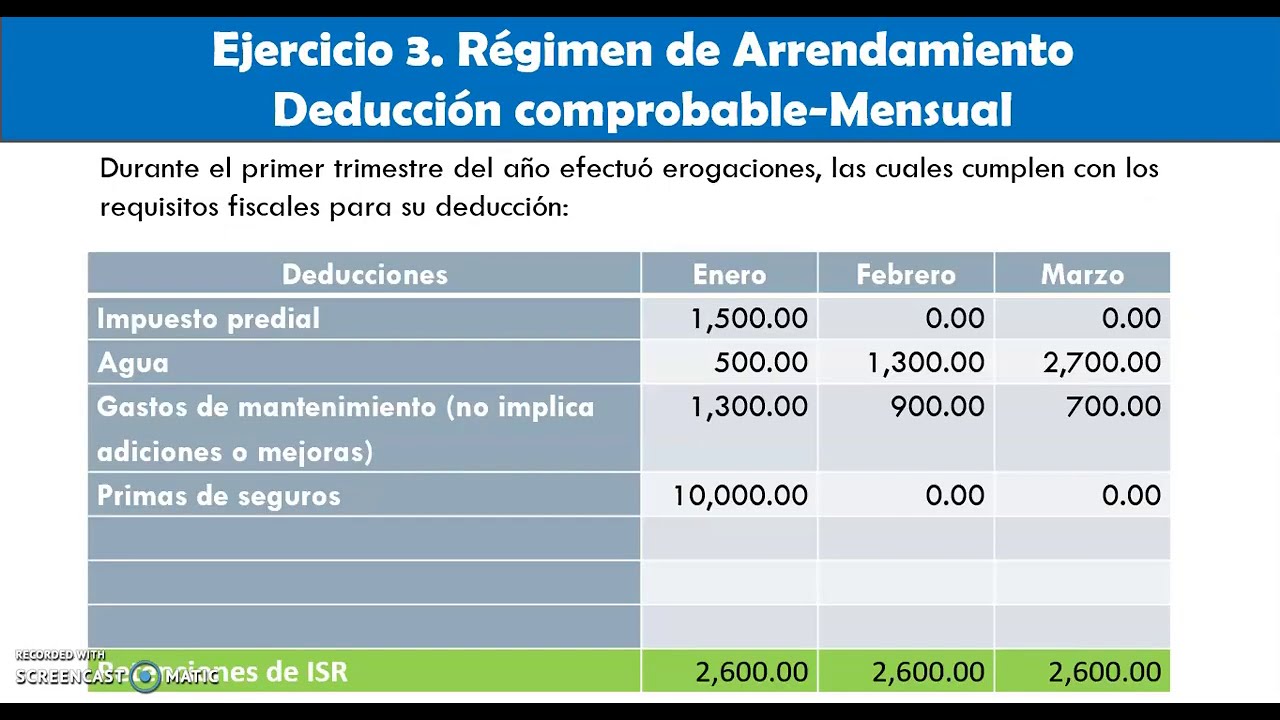

Pagos provisionales de ISR en Régimen de Arrendamiento parte 2

NEW IRS $600 Tax Rule On Payments from PayPal, Cash App, Venmo & More!

Administrasi Perpajakan - Pelunasan Pajak dalam Tahun Berjalan Pertemuan 12

5.0 / 5 (0 votes)