Massive News for United Health Stock Investors! | UNH Stock Analysis

Summary

TLDRUnited Health recently held a conference call revealing challenges facing the company, including a 53% decline in stock price due to higher-than-expected medical costs. Management now projects a 7.5% increase in costs for 2025, requiring price hikes and operational improvements through AI. Despite the potential loss of customers, the company is focused on restoring margins and achieving long-term earnings growth of 13-16%. United Health's strategy aims to recover profitability and provide value for investors, though higher healthcare costs may persist in the short term.

Takeaways

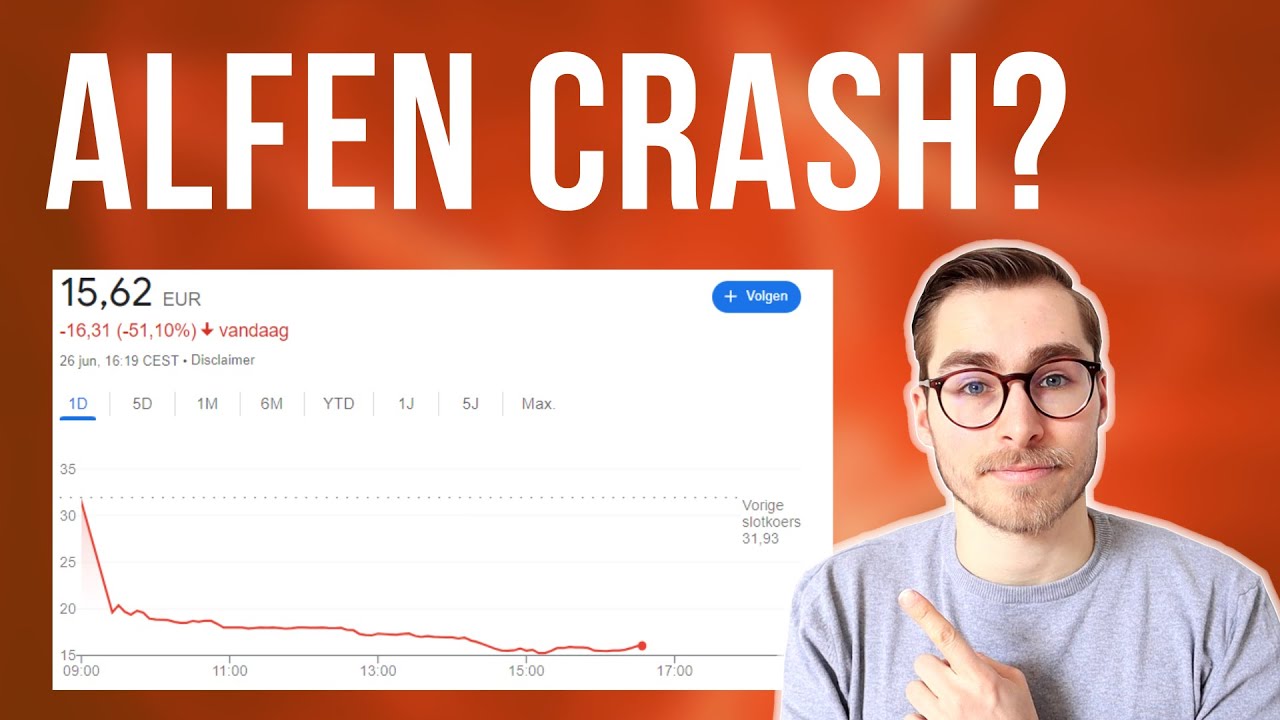

- 😀 United Health's stock is down over 53% in 2025, largely due to higher-than-expected service costs and increased doctor visits.

- 😀 The company miscalculated the cost increases for 2025, initially expecting a 5% increase but now predicting a 7.5% rise in Medicare Advantage medical costs.

- 😀 United Health's pricing policy is rigid, meaning they can’t adjust prices until next year to account for the accelerated costs in services.

- 😀 Health care costs in the U.S. have been rising faster than inflation for decades, with no immediate relief expected due to the disorganized system and ongoing legislative changes.

- 😀 The company plans to increase prices meaningfully in 2026, even if it results in losing customers, in order to protect profit margins.

- 😀 United Health is focusing on margin recovery and its long-term target is to grow earnings per share by 13%-16% annually.

- 😀 In response to operational difficulties, United Health is increasing its use of AI to improve efficiency and reduce costs, with a possible partnership with Palunteer being considered.

- 😀 The company is aiming for a 2%-4% profit margin range in the long term, with expectations to hit 2%-3% by 2026 and improve further by 2027.

- 😀 The changes in pricing and cost controls are designed to offset past challenges, ensuring the company doesn’t repeat the same mistakes in 2026.

- 😀 United Health hopes that its price increases and AI initiatives will lead to improved profit margins and a more sustainable business model for the future.

Q & A

What are the main reasons behind the decline in United Health's performance?

-United Health's performance declined mainly due to a significant miscalculation of the rising healthcare costs, especially for Medicare Advantage. The company had anticipated a 5% increase in medical costs for 2025, but it turned out to be 7.5%, a 50% higher increase than expected.

How has the increase in medical service costs affected United Health's stock price?

-The unexpected increase in medical service costs has led to a 53% drop in United Health's stock price year-to-date in 2025. This has been a major factor contributing to the company’s financial struggles.

What changes does United Health plan to make in response to rising costs?

-United Health plans to raise prices significantly in 2026 to recover its profit margins. They are also scaling up their AI efforts to improve operational efficiency and reduce costs.

What impact will the price hikes have on United Health's customer base?

-The company acknowledges that raising prices in 2026 might lead to a loss of customers. However, they are prioritizing profit margin recovery and believe that it is necessary for the company’s long-term sustainability.

What role does AI play in United Health's strategy for recovery?

-AI is being leveraged across health plan operations to improve patient and provider service experiences while driving cost savings. This is part of United Health’s broader strategy to increase operational efficiency and manage rising costs.

How does United Health plan to handle future cost projections and pricing flexibility?

-United Health's management has stated that since their pricing policy is not flexible, they cannot adjust their prices in 2025 to reflect the rising costs. They will only be able to adjust their pricing for 2026 and beyond.

What is United Health's long-term earnings growth target?

-United Health aims to grow its earnings per share between 13% and 16% annually over the long term. They plan to restore these growth targets in the coming years.

What are the projected profit margins for United Health in 2026?

-United Health expects to achieve a profit margin in the range of 2% to 3% in 2026, which is at the lower end of their targeted margin range of 2% to 4%. They aim to improve this margin further in 2027.

What are the key factors that might influence United Health's stock price in the coming years?

-The key factors influencing United Health's stock price will include their ability to achieve their earnings growth targets, improve profit margins through price hikes and cost reductions, and successfully implement AI initiatives to increase operational efficiency.

How does the Inflation Reduction Act affect United Health’s operations?

-The Inflation Reduction Act has resulted in higher revenue for United Health’s Part D program, but this increase was offset by higher costs, so it did not impact earnings significantly. The company is working to maintain its margins despite these changes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)