Statement of Financial Position (Balance Sheet)

Summary

TLDRThis video explains the concept of the statement of financial position (balance sheet), a snapshot of a company's equity, assets, and liabilities at a specific point in time. It emphasizes how assets and liabilities are balanced to determine the net worth or total equity of the business. The script details the components, such as share capital, retained profits, non-current assets, and current liabilities, and demonstrates how these are used to calculate total net assets. A practical example is provided to show how the balance sheet should balance and how it reflects the company's financial position.

Takeaways

- 😀 A Statement of Financial Position is a snapshot of a company's equity, assets, and liabilities at a specific point in time.

- 😀 The Statement of Financial Position is also called the Balance Sheet, as it balances total net assets with total equity.

- 😀 Total equity includes shareholder investments like share capital and retained profits (or retained earnings).

- 😀 Total net assets are calculated by adding non-current assets (e.g., property, machines) and current assets (e.g., cash, debtors, stock), then subtracting liabilities.

- 😀 Non-current assets are long-term assets like property or machines that the company holds for over a year.

- 😀 Current assets are short-term assets that the company owns, such as cash, money owed to the company, and inventory.

- 😀 Non-current liabilities are long-term debts, like bank loans, that the company owes for more than a year.

- 😀 Current liabilities are short-term debts, such as creditors or tax payments, that the company needs to pay soon.

- 😀 The total net assets are calculated by adding non-current assets and current assets, and then subtracting non-current and current liabilities.

- 😀 The total net assets must balance with the total equity, reflecting the company's net worth.

- 😀 The balance sheet gives a clear picture of where the company's resources (assets) are and what obligations (liabilities) it needs to settle.

Q & A

What is the purpose of a statement of financial position?

-A statement of financial position, also known as a balance sheet, provides a snapshot of a company's equity, assets, and liabilities at a single point in time. It shows what the business owns, what it owes, and its overall financial health.

Why is a statement of financial position sometimes called a balance sheet?

-It is referred to as a balance sheet because the total assets must balance with the total equity, meaning the value of what a company owns and owes must align.

What does 'total equity' refer to in a statement of financial position?

-Total equity represents everything that has been put into the business by its shareholders, including share capital (money raised by issuing shares) and retained profits (historical profits the business has accumulated).

How are total net assets calculated in the statement of financial position?

-Total net assets are calculated by adding non-current assets (long-term assets like property and machinery) and current assets (short-term assets like cash and stock), then subtracting both non-current liabilities (long-term debts) and current liabilities (short-term debts like taxes or creditors).

What are non-current assets?

-Non-current assets are long-term assets that a business owns and plans to hold for more than one year, such as property, machinery, or vehicles.

What are current assets?

-Current assets are short-term assets that a business owns, which are expected to be converted into cash or used up within one year, such as cash, debtors (money owed), and stock/inventory.

What are non-current liabilities?

-Non-current liabilities are long-term debts or obligations that a company must pay in more than one year, such as a bank loan taken to purchase property or machinery.

What are current liabilities?

-Current liabilities are short-term debts or obligations that a business needs to settle within one year, such as payments owed to creditors or taxes to be paid.

Why must total net assets equal total equity in a statement of financial position?

-Total net assets must equal total equity because the net worth of the business, calculated as the value of assets minus liabilities, must match the capital invested by shareholders, including retained earnings and share capital.

What is meant by the 'net worth' of a business?

-The 'net worth' of a business refers to its total equity, which is the difference between total assets and total liabilities. It essentially represents the value of the business as owned by its shareholders.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The KEY to Understanding Financial Statements

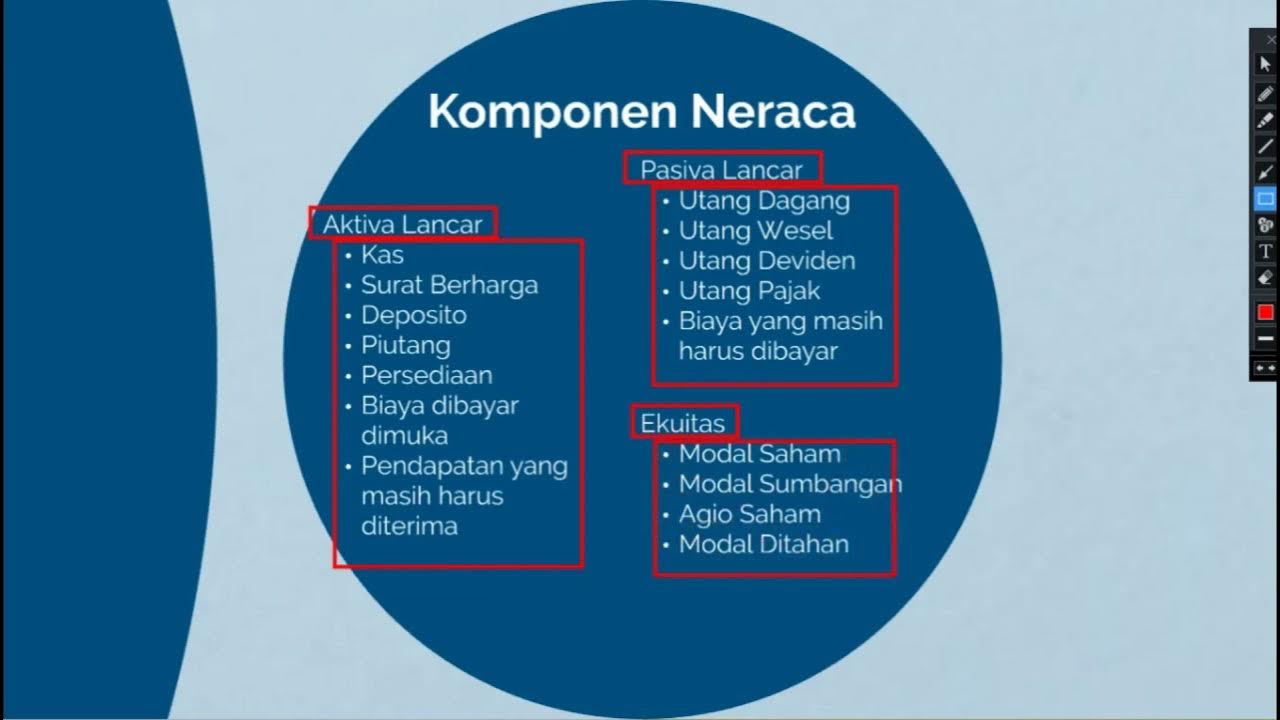

Video Pembelajaran Jenis Laporan keuangan

Statement of Financial Position (SOFP) | Laporan Posisi Keuangan | Akuntansi Keuangan Menengah

US GAAP Balance Sheet Presentation Guide | Financial Statement Format Explained

Balance Sheet Definition & How to Use It

The Financial Statements & their Relationship / Connection | Explained with Examples

5.0 / 5 (0 votes)