How To PREDICT Market Reversals - ICT Standard Deviations

Summary

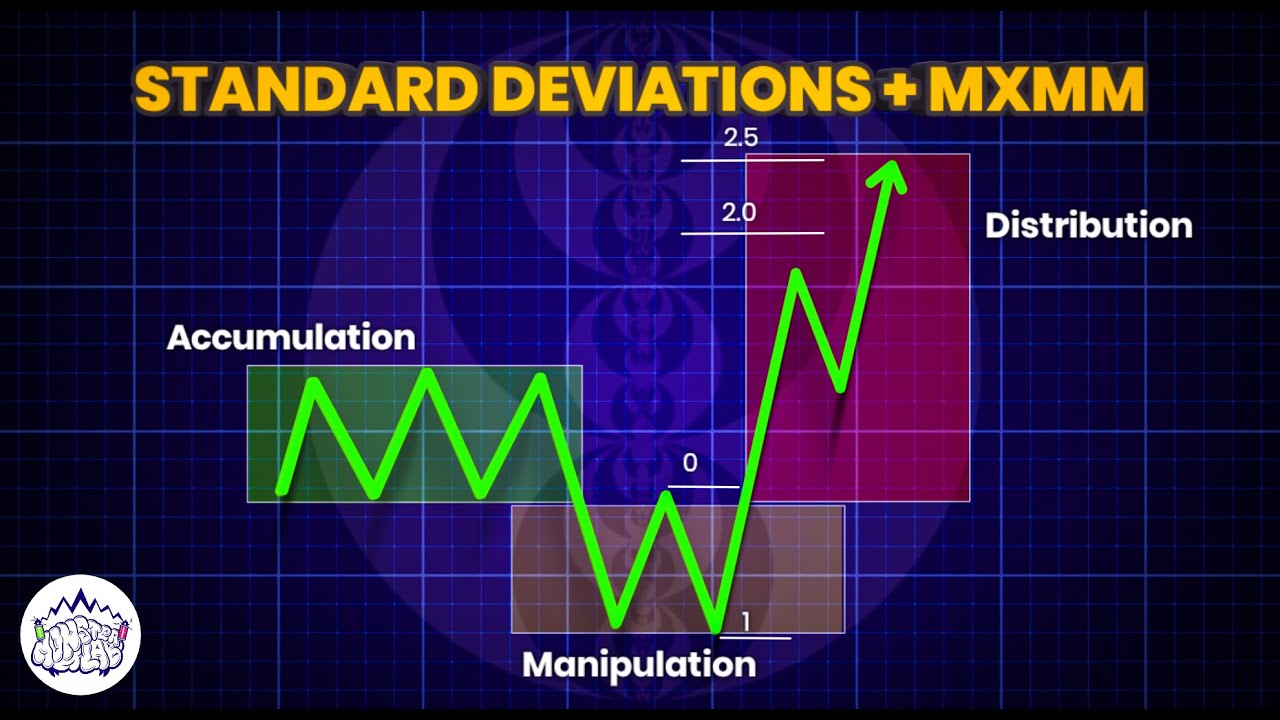

TLDRThis video explains how traders can use standard deviations to better anticipate market retracements and reversals, particularly when faced with multiple potential reversal zones. The technique involves anchoring standard deviations from manipulation legs (where liquidity is taken and market structure breaks occur) to refine entry and exit points. By focusing on the minus 2 to minus 2.5 standard deviation levels, traders can identify key zones where price is likely to react. This approach helps simplify decision-making and enhances the accuracy of predicting price movements across different timeframes, improving both execution and take-profit strategies.

Takeaways

- 😀 Standard deviations can be used to anticipate retracements or reversals in the market, helping traders refine their strategy.

- 😀 The standard deviation tool is helpful for identifying where the price is likely to react, based on key levels such as negative 2 and negative 2.5 deviations.

- 😀 To apply the standard deviation tool, traders need to anchor it to the manipulation leg that initiates a reversal, using key liquidity levels as reference points.

- 😀 Identifying the manipulation leg in price movement (whether it takes out buy-side or sell-side liquidity) is essential for drawing accurate standard deviation levels.

- 😀 On higher timeframes, standard deviations help determine potential reversal points, while lower timeframes assist with execution and take-profit placements.

- 😀 When dealing with multiple imbalances and order blocks, the standard deviation levels provide a way to filter out the most probable levels for price reversals.

- 😀 The tool helps traders refine entry and exit points by aligning standard deviations with key price structures such as market structure breaks and imbalances.

- 😀 In cases of ambiguity with multiple price levels, focusing on standard deviation ranges (between -2 and -2.5) significantly improves the odds of a correct prediction.

- 😀 The method described in the video uses a top-down approach, first analyzing higher timeframes to identify key price targets and then dropping to lower timeframes for execution.

- 😀 Using standard deviations in combination with other technical analysis tools, such as market structure breaks and imbalances, enhances trade precision and decision-making.

Q & A

What is the main challenge traders face when trying to anticipate market reversals or retracements?

-Traders struggle with determining where the market is likely to reverse or retrace, especially when multiple imbalances are present or when key higher time frame price levels, such as order blocks, are involved.

How does the standard deviation tool help traders anticipate market reversals or retracements?

-The standard deviation tool helps traders refine their analysis by pinpointing specific price levels (e.g., -2 and -2.5 standard deviations) where market reversals or retracements are more likely to occur, based on prior price manipulations and liquidity events.

What does a negative standard deviation value represent in the context of market analysis?

-A negative standard deviation value represents a deviation below the average price, with values like -2 and -2.5 signifying key levels where traders expect price to react or reverse after a manipulation leg.

When should a trader anchor their standard deviation for analysis?

-A trader should anchor their standard deviation at the point of manipulation that led to a reversal or market structure break, typically from the low to the high (or vice versa) of the leg responsible for taking out liquidity.

What is the importance of the -2 and -2.5 standard deviation levels?

-The -2 and -2.5 standard deviation levels are critical because they are the most reliable areas where price is likely to retrace or reverse after a significant market manipulation, often aligning with imbalances or liquidity zones.

Why is it challenging to determine the exact PD level for a retracement or reversal?

-It's difficult to pinpoint the exact PD level because multiple imbalances, order blocks, and liquidity zones can exist at different price levels, making it unclear which one will be the key level for a reversal or retracement.

How can standard deviations improve trade execution?

-By using standard deviations, traders can refine their entries by identifying areas where price is more likely to react significantly, allowing them to place more precise stop-loss orders and take profits based on the probability of a retracement or reversal.

What role does a market structure break play in standard deviation analysis?

-A market structure break, such as taking out a swing high or low, serves as a signal that the market may reverse direction, providing the point from which traders can anchor their standard deviation levels to predict potential price reactions.

Why is it recommended to use lower time frame standard deviations for take profit targets?

-Lower time frame standard deviations are recommended for take profit targets because they provide more immediate, actionable price levels, which are typically more reliable for short-term trades compared to larger higher time frame targets.

How does fractal behavior in price action influence standard deviation usage?

-Fractal behavior in price action means that price action patterns repeat on smaller time frames. This allows traders to use the same principles of standard deviation analysis on lower time frames (e.g., hourly to 15-minute) to refine their entries and take profits more effectively.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Standard Deviations + MMXM | ICT Concepts | DexterLab

Episode 9: Using Standard Deviations Day Trading - ICT Concepts

Standard Deviation – How to Enter from the Bottom | ICT Concepts 2025

Standard Deviation Projections & MMXM - (Simple Strategy)

The Simplest Way to Use & Trade Elliott Waves (Changes Everything...)

Unlocking The SMT Trading Sequence (Smart Money Secrets)

5.0 / 5 (0 votes)