Episode 9: Using Standard Deviations Day Trading - ICT Concepts

Summary

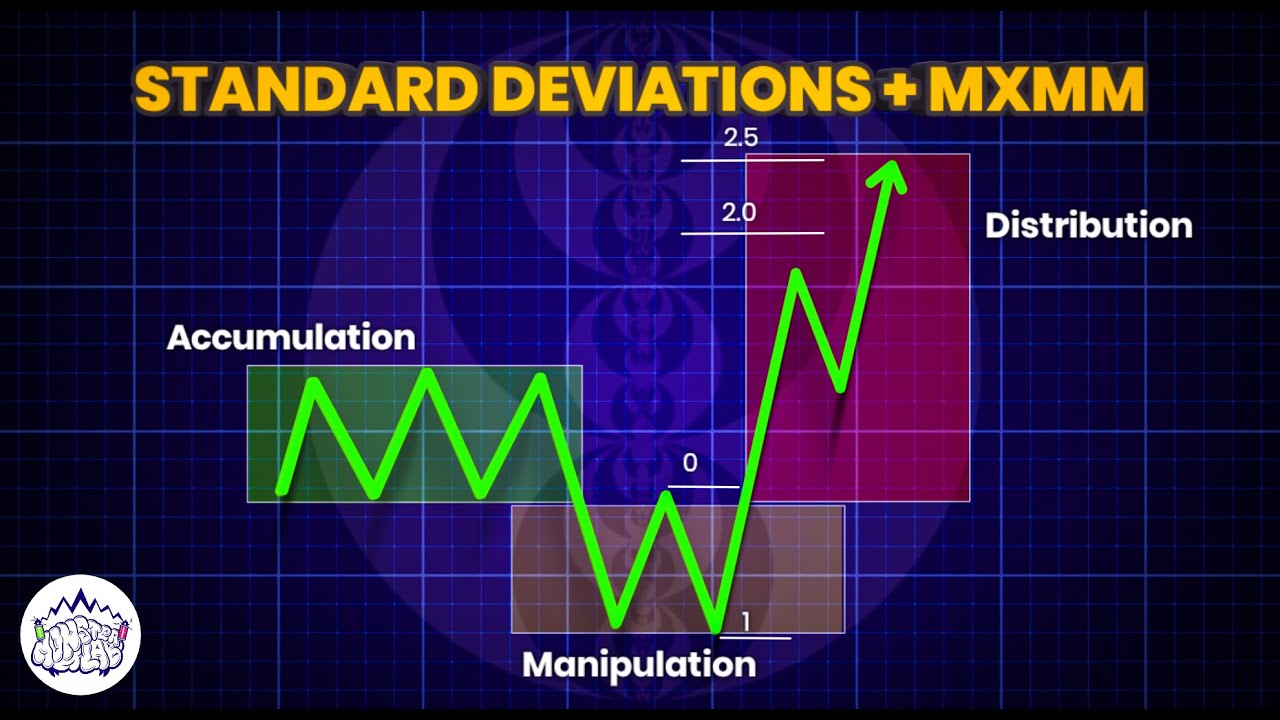

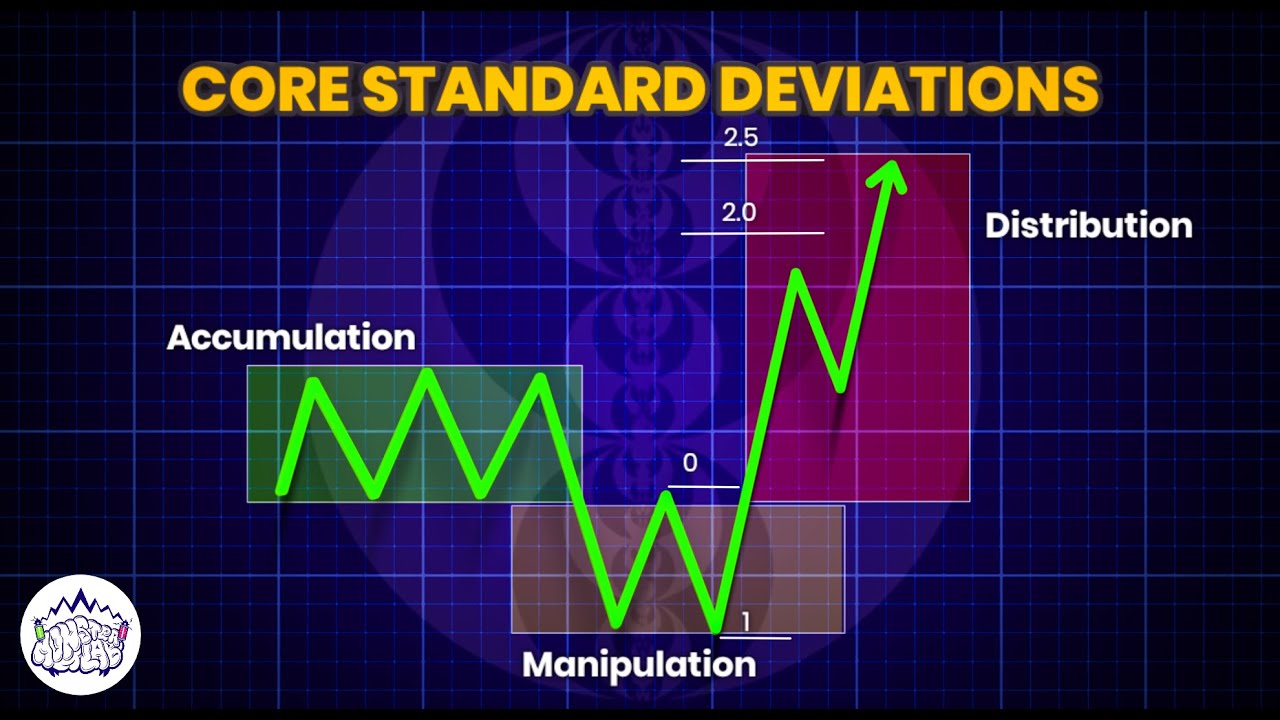

TLDRThis trading tutorial explores the use of standard deviations for setting price targets and identifying potential accumulation or reversal phases in the market. The video demonstrates how to apply these tools on various time frames, from intraday charts to daily charts, using specific settings and Fibonacci tools to measure market manipulation and project price movements. It provides practical examples on the NASDAQ charts, illustrating how to frame trades and anticipate reversals or continuations based on standard deviation levels.

Takeaways

- 📊 Standard Deviations are used in trading to determine price targets and to identify potential retracements or reversals in the market.

- 📈 Traders can take partial or full positions off at standard deviations, which can help in managing risk and profit-taking.

- 🔍 The script emphasizes the importance of identifying accumulation phases and manipulation legs in the market for better trade setups.

- 📐 The Fibonacci tool with standard deviation settings is used to measure market movements and project potential price levels.

- 🎛️ Accumulation phases are framed between 0.5 to -1 standard deviations, which can indicate a potential buying opportunity.

- 🔄 Retracements or reversals are often framed at -2 to -2.5 standard deviations, aligning with liquidity levels and potential price reactions.

- 📉 Expansions lower in the market can be measured from the low to the high of the standard deviation range, providing targets for short positions.

- 🚫 At -4 standard deviations, the market is more likely to experience a full reversal rather than a continuation, cautioning traders against continuation trades.

- 📝 The script provides practical examples on various time frames, from daily to minute charts, demonstrating the fractal nature of price action.

- 📉 The -2.5 standard deviation level is highlighted as a critical point where the market often respects this level before reversing or continuing lower.

- 📈 Equilibrium levels are identified as potential price targets for long positions, especially after a market has shown respect for certain standard deviation levels.

Q & A

What is the purpose of standard deviations in trading?

-Standard deviations are used for setting price targets in trading. They help traders to determine points at which they can take partial or full positions off and are used to frame retracements or reversals in the market.

How do standard deviations relate to accumulation and expansion phases in trading?

-When traders accumulate at a standard deviation level, they can expect an accumulation phase to follow, which may then lead into an expansion phase. This is a way to identify potential market movements based on standard deviation levels.

What settings does the speaker recommend for using standard deviations in trading?

-The speaker does not specify exact numerical settings for standard deviations, emphasizing that the numbers are not as important as the visual framing. However, they do mention that the visual indicators such as checks and numbers should be present and can be customized to any preferred color.

What is the significance of the manipulation leg in identifying standard deviations?

-The manipulation leg is significant because it represents a high to a new low, which traders use to measure the standard deviations. This measurement helps in identifying potential accumulation phases and subsequent market movements.

How are standard deviations used to identify accumulation phases on intraday charts?

-Standard deviations can be used to identify accumulation phases by measuring from the high to the low during a manipulation phase. The levels of 0.5 to -1 are often where traders can frame an accumulation phase from, as seen in the script with the example of a run on stops and continuation to -2 and -2.5.

What is the role of the -2.5 standard deviation level in framing reversals or retracements?

-The -2.5 standard deviation level is where the price often reverses or retraces because it typically aligns with sell-side or buy-side liquidity. It is a critical level to watch for potential market reversals.

How can the entire range of a standard deviation be measured for a potential price target?

-To measure the entire range for a potential price target, traders measure from the low that the standard deviation was measured from to the high that this low made. This range helps in identifying equilibrium, which can be a target for trades.

Why is the -4 standard deviation level significant for potential reversals?

-The -4 standard deviation level is significant because it is often where the price stops and either accumulates or has a full-on reversal. It is a level at which traders should be cautious about framing continuation trades, as reversals are most likely to happen here.

Can the principles of standard deviations be applied to different time frames?

-Yes, the principles of standard deviations can be applied to different time frames, as price action is fractal and works on all time frames, from intraday charts to daily charts.

What is the practical application of standard deviations in identifying entry and exit points for trades?

-Practically, standard deviations help traders identify entry and exit points by measuring from significant highs or lows during market manipulation phases. The levels of standard deviations project potential accumulation, distribution, and reversal points, which can be used to frame trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Episode 12: Using Standard Deviation Projections - ICT Concepts

How To Use ICT Standard Deviations

Standard Deviations + MMXM | ICT Concepts | DexterLab

Core Standard Deviations + PO3 | ICT Concepts | DexterLab

Standard Deviation – How to Enter from the Bottom | ICT Concepts 2025

Using Standard Deviation Projections - ICT Concepts

5.0 / 5 (0 votes)