Understanding Order Flow Using ICT Concepts

Summary

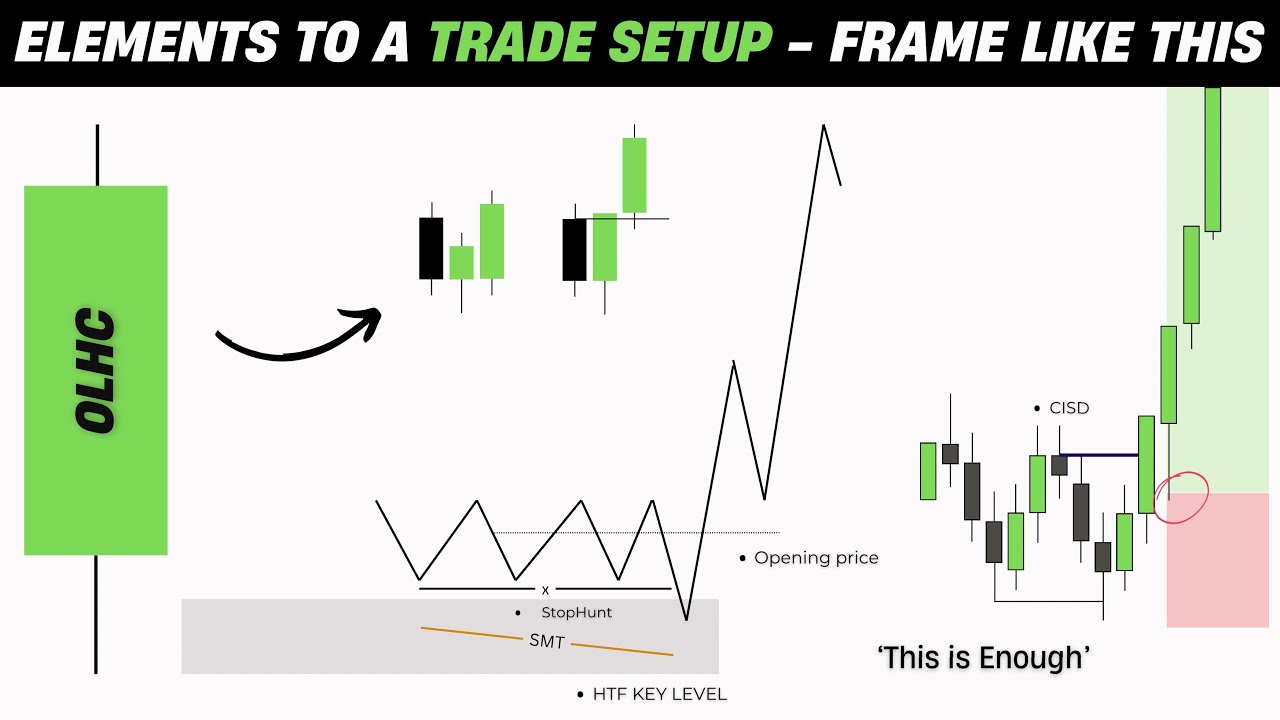

TLDRIn this video, the creator dives into the process of identifying higher time frame order flow, focusing on key price data arrays like order blocks, fair value gaps, and SMTs. By using different time frames (weekly, daily, hourly, 4-hour), the video teaches how to gauge market direction and pinpoint entry points for trades. With detailed examples, the video demonstrates how to align time frames and recognize key price actions, such as market displacement and the creation of imbalances. This approach provides traders with strategies to identify potential market movements and optimize their trades based on higher time frame order flow.

Takeaways

- 😀 Understanding higher time frame order flow is crucial for trading, using key concepts like order blocks, fair value gaps, displacement, and SMT.

- 😀 To identify order flow, use three primary PD arrays: order blocks, fair value gaps, and SMT (structural market techniques).

- 😀 When analyzing higher time frame order flow, start with a larger time frame (e.g., weekly or daily), then drill down to smaller time frames like the 4-hour or 1-hour to align with market price behavior.

- 😀 A fair value gap on a higher time frame (e.g., daily) can guide price movement; when the market enters this gap, further analysis on smaller time frames helps identify potential entry points.

- 😀 On the hourly time frame, after hitting a higher time frame fair value gap, look for displacement, fair value gaps, order blocks, and SMTs to confirm the next move in the market.

- 😀 SMT (Structural Market Technique) is a critical tool used to identify divergence between related markets (e.g., ES) and helps to predict price direction.

- 😀 A key strategy for finding high-probability trades involves waiting for market structure shifts (CISD), where price closes below or above certain levels, followed by a reaction (e.g., fair value gap).

- 😀 Trading on lower time frames (like the 5-minute or 1-minute) is essential for entering intraday trades after analyzing higher time frame order flow.

- 😀 If equal highs or lows are present on the chart, it's important to wait for those to be purged (taken out) before considering trade entries, as this confirms a clearer price direction.

- 😀 Using higher time frame key levels, order blocks, and fair value gaps, along with SMT and displacement, allows traders to gauge the market flow and make more informed trade decisions.

- 😀 Analyzing multiple examples, including both bullish and bearish setups, can help reinforce the approach to identifying higher time frame order flow and improves overall trading strategy.

Q & A

What is the primary focus of the video?

-The primary focus of the video is identifying higher time frame order flow using price delivery arrays (PD arrays), including order blocks, fair value gaps (FVGs), and smart money techniques (SMTs). The video explains how to use these concepts across multiple time frames for effective trading analysis.

How does the speaker approach identifying higher time frame order flow?

-The speaker identifies higher time frame order flow by using PD arrays like order blocks, fair value gaps, and SMTs. The approach involves analyzing key levels from a weekly or daily time frame and then zooming in on lower time frames, such as the 4-hour or 1-hour, to understand price action in greater detail.

What are the key PD arrays mentioned in the video?

-The key PD arrays mentioned are order blocks, fair value gaps (FVGs), and smart money techniques (SMTs). These tools are used to identify price displacement and predict future price movements.

What is the significance of using multiple time frames for analysis?

-Using multiple time frames allows traders to align shorter time frame price action with the broader, higher time frame trend. By analyzing the weekly, daily, and lower time frames (such as the 4-hour and 1-hour), traders can identify high-probability trade setups that are in harmony with the overall market direction.

What role does the fair value gap play in the trading strategy?

-The fair value gap (FVG) plays a crucial role in identifying price imbalances or areas where the market may return to 'fill' the gap. These gaps often act as key levels for price action, guiding traders on where price might reverse or continue its move.

What is an SMT (Smart Money Technique), and how is it used?

-SMT, or Smart Money Technique, refers to divergence between different instruments (like between futures and spot prices) that indicates potential shifts in market direction. It is used to identify areas where institutional money might be positioning itself, which helps traders anticipate market movements.

How can a trader determine whether a higher time frame order flow is bullish or bearish?

-A trader can determine the market’s order flow direction by looking for key signals like price respecting order blocks, filling fair value gaps, and forming SMTs or CISDs (Market Structure Shifts). If price action aligns with these signals in a way that suggests a continuation of a trend, the trader can confirm whether the order flow is bullish or bearish.

What does CISD (Change in Structure Delivery) refer to, and why is it important?

-CISD refers to a Change in Structure Delivery, which occurs when price moves past a significant level, indicating a shift in market structure. This is important because it signals that the market is transitioning, providing traders with a potential entry point for trades aligned with the new structure.

Why is the concept of liquidity important in higher time frame order flow analysis?

-Liquidity is important because price often moves toward areas of high liquidity, such as order blocks and fair value gaps. By understanding where liquidity is likely to be, traders can better predict where price might go and where potential reversals or continuations could occur.

What is the role of 'equal highs' or 'equal lows' in confirming order flow analysis?

-Equal highs or equal lows are used to spot potential reversal points in the market. If the market creates equal highs or lows and then breaks those levels, it can signal a shift in market sentiment, confirming the order flow analysis and providing opportunities for trading.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)